Budget Planning for Newlyweds

A budget tells us what we can't afford, but it doesn't keep us from buying it.

William Feather

Balanced budget requirements seem more likely to produce accounting ingenuity than genuinely balanced budgets.

Thomas Sowell

It's clearly a budget. It's got a lot of numbers in it.

George W. Bush

Exchange of vows

A couple exchanges their vows amidst their family and friends. Share little laughter with them and go on to their honeymoon to discover each other. Discovering period comes to an end when they are back to reality. The real challenge starts now.

Challenges after marriage

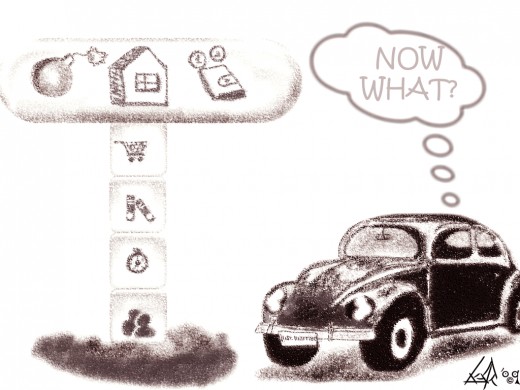

They ought to make their house a home where peace shall prevail and stress is invisible. Finances need to be sought out since; earlier they were single and now being a couple, everything will mount up if not prioritized and planned.

Financial planning and Money management

Financial planning is not only important to build a strong foundation for a long lasting trust and cooperation in a marriage, but it also helps the couple face any financial distress in the future.

Money management done on time also helps to decide who gets what if the marriage does not work.

The husband and wife has a couple of rules to abide by, when planning out their finances.

Use the CPR method.

Correspond

1. Be Honest to each other

- Open up your balance sheets and show each other your monthly dues such as credit card debts or student loans, if you have any.

- Disclose your 401(k) s, stock or bond investments or other valuable collectibles.

- Decide on whether to have a joint account or keep it separate.

- Decide on who pays the bills and whose paycheck goes into the bank for savings.

- Disclose all your expensive hobbies such as shopping only brand names, traveling to exotic places, dining and lodging only in five stars, skydiving, mountain expeditions etc.

Correspond

| Plot

| Rethink

|

|---|---|---|

Plot

1. Redefine your financial goals such as home ownership or early retirement by planning a realistic budget where savings can be made. Try to save at least 10-15% of the gross salary for the emergency fund/retirement.

2. Play turns to splurge in your expensive hobby month to month. This will enable you to save and enjoy at the same time.

3. Meet up with a financial planner on investment options like CDs and money market accounts. The couple should update their 401 (k) and IRA retirement and life insurance accounts.

Rethink

1. When looking for a house, the couple’s monthly mortgage payment should not exceed half of their monthly take home salary.

2. The couple should update their 401 (k), IRA retirement and life insurance accounts.

3. The couple should not be making minimum payment on their credit cards, since that will eventually carry too much credit card debt for them and they will feel the pinch especially when they have a family.

4. A couple should make a living will of their assets and keep updating it as they accumulate them. Having a health power of attorney also matters especially when one of them is on life support and the document gives the other the right to pull the plug, if required.

Conclusion

- Marriage makes a couple share a bond between each other and they should not falter when they come across an economic turmoil. If they can withstand that, their bond will be stronger.

- CPR is the best way to abide by each other.

- Amidst handling the finances, the couple should not forget romance even if it is a simple form of having a candle lit dinner and soft music. Romance will keep the marriage alive.

- Research indicates that a married couple has a better and secure financial future with long lives, good health and personal happiness than divorcing your partner over some reason. Think twice before taking that step.