Budgeting and Money Management using Mint.com

In times of such financial hardships (don’t want to say the R-word) it is very important to maintain a strict financial discipline. How many of us have a budget and follow it up at the end of every month? I hear you say “It is so time consuming to monitor all the bank accounts and my spending and keep a tab on them, but I so badly want to do it”. Have you heard about the free online tool called Mint.com? That might be your answer.

Mint.com is a free money management/ budgeting tool. There have been quiet a few in the last couple of years, but this is my favourite.

Where do I start?

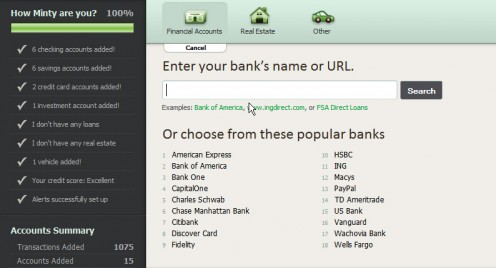

You register your self at http://www.mint.com and then add your bank account by using user name and password of your bank's online account. I hear critics saying, “How can I give them my bank details?” Well Mint.com only uses them to get your transaction details and since you cannot transact money on Mint.com to me it is not an issue. The benefits of Mint.com are far more and their security is the best that can be on the internet.

How does it work?

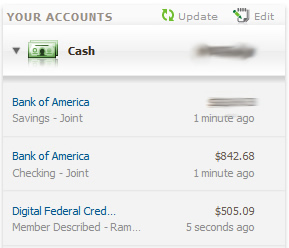

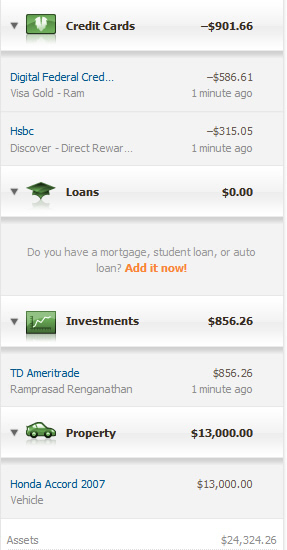

Once you add all your bank accounts including credit cards, car loans and mortgages, Mint.com will take a few minutes and load all the transaction from all these accounts.

Tip: Add every single account like savings, checking, auto loans, credit cards, mortgages, investment accounts, etc. When Mint.com organizes every thing, it will give you a complete picture of your finances.

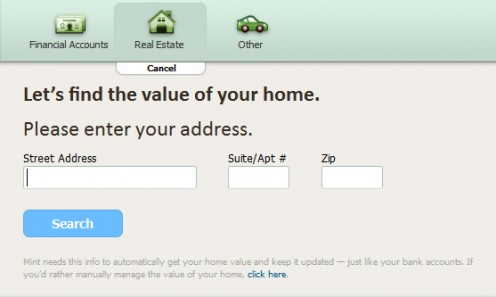

One of the things I most like about Mint.com is the ease of use. Almost all functionalities are very simple to use. If you add the street address of your house, Mint.com will calculate the current net worth of the house. The same for a car, if you add make, model and year it calculates the net worth.

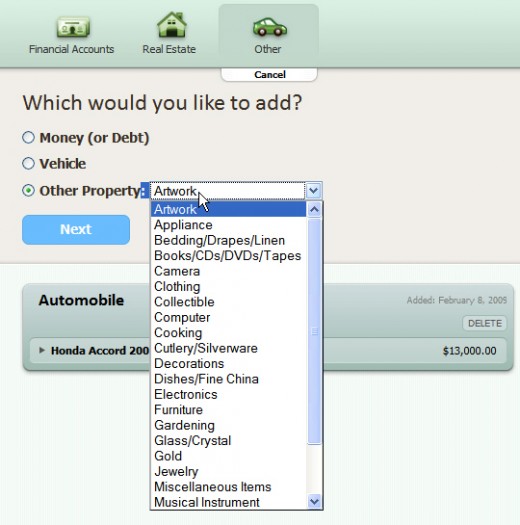

In fact you can add any asset you own. Like electronics or special art pieces or may be your grand ma's antiques jewelry.

You can

also add your investment accounts and Mint.com will monitor your stock prices

every day and update your net worth automatically.

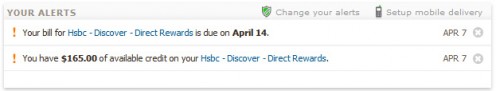

Mint.com also gives you a nice feature to send alerts through email or text, when ever

there is a large withdrawal or deposit or when a credit card payment is due.

I can go on and on for several pages talking about the features in Mint.com but let me get to the point, how does this helps me budget and save money?

Managing your Money

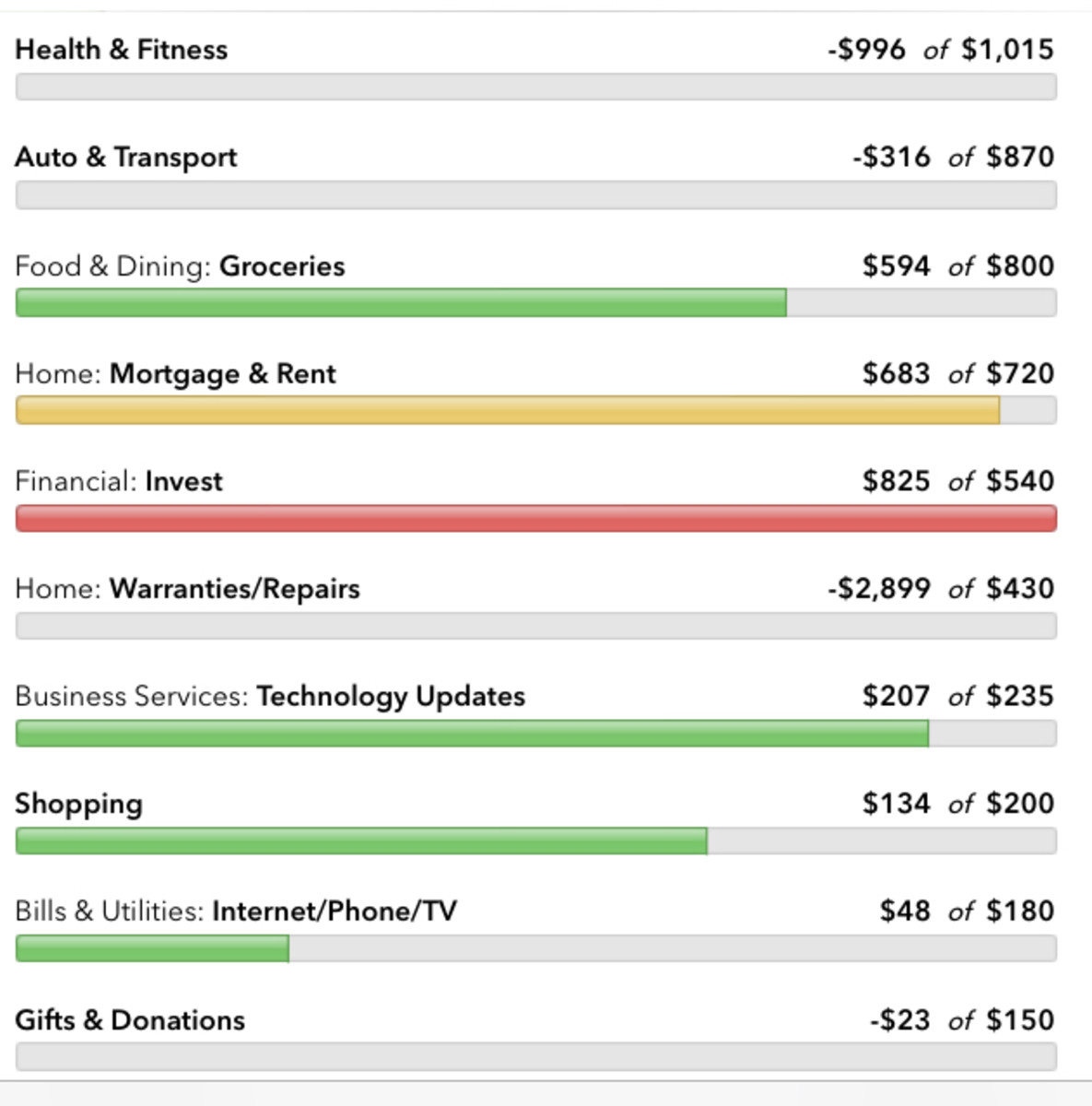

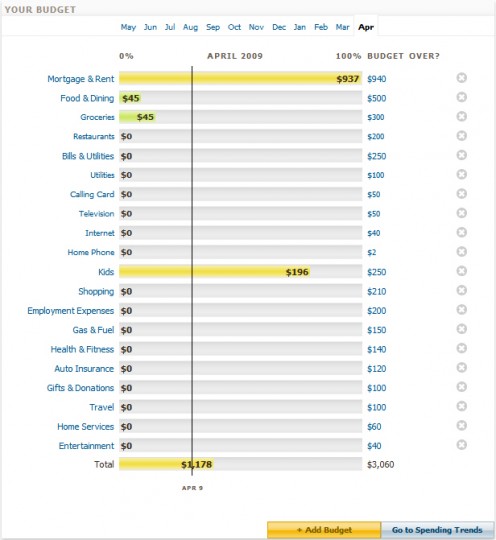

The first step would be to build a comprehensive budget. Think about it where do you spend money every month? Some things that come to mind quickly are the regular stuff like Groceries, Gas, Utilities – mobile, internet, home phone, electricity, rent/mortgage, etc. What slips through are the coffee we have at Starbucks and office lunches on Friday afternoon. It’s no big deal, start with a basic budget, see for a month if you still over spend your budget then find out what you missed and add them to your budget. With this constant feedback loop you can have a very good budget in 3-4 months, if you don’t you are not paying attention. Every single penny should be accounted for! Every time there is a changes in spending add that into your budget.

The one in figure 4 is my very own budget; it is for a family of 2 with a small baby. It took me a couple of months to build this, some of them might be a bit too much but I would over budget, spend less and feel happy rather than the other way around.

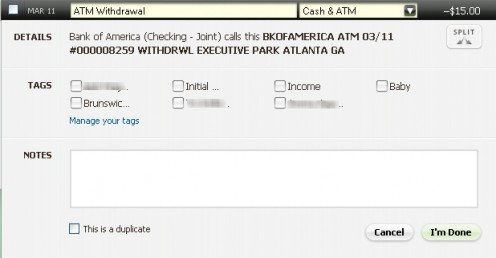

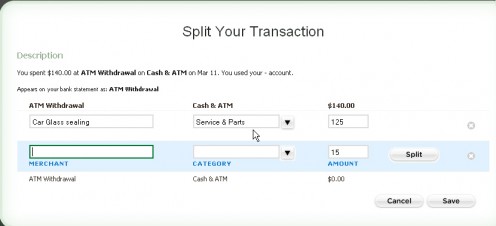

Once you are done with the budget, Mint.com automatically categorizes your bank transactions into the items we have on our budget each month. If Mint.com screws up you can always change the item under which the transaction has to go, but 80% of the time Mint.com is spot on.

Beyond all this Mint.com also suggests you credit cards with the best rate based on your spending habits. Your credit card company might be ripping you off right now as you are reading this. If you do not know the interest rates and fees on your card find it out and compare it to the ones in Mint.com.

This gives a very good idea what you can do with Mint.com. With Mint.com your spending habit is hitting you in your face. If you are like me when I was younger, you will never know where all the money went. With Mint.com, it gives you tools to analyze, find out where the money is being spent and if you are really disciplined, will help you cut a lot of existing cost or may be save you some extra cash.

You can also look at other online money managers likes,

https://www.geezeo.com/

http://quicken.intuit.com/

If you saved some money because of this article, or have another useful Tip or Suggestion on this article drop me a line, BundleBoy@aroah.com.

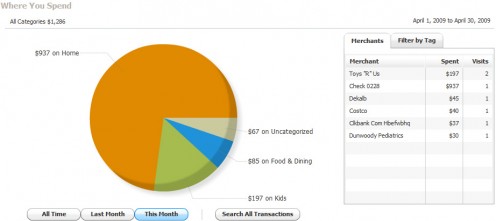

This gives you an idea if you are over spending by eating out too much or shopping out a lot. If you were like me you would feel guilty that you are spending too much money eating out (higher than your cities average spending pattern). Well to me that’s a good thing.

Tip: This is also a very good indicator of how bad the economy is doing. Compare the eating out habit of people for the last one year and you will see a drastic reduction.

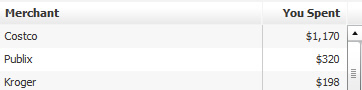

The merchant table will also give you an idea of how much you spend with each of them. On further investigation you will find what you buy there at these merchants, let’s say you buy veggies at Publix and they are a little expensive. It would be cheaper if you go to the local farmer market on a weekend and buy it from them. I saved almost 50-100 $ a month on this.

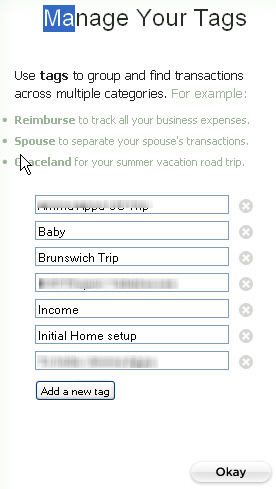

You can also tag your transactions. At the end of a Vegas trip you can tag all transactions for this trip. Later on when you click on the tag, you have a total for the trip.

The next

step is to use the tools in Mint.com; there are several tools they provide. I

have listed some of them that I extensively use,

In the

Trends Tab, “Where you spend” tool is a great start,