Choosing a Low Interest Credit Card Over High Rewards Credit Cards

Choosing a Low Interest Credit Card Over High Rewards Credit Cards

There is a lot of options when it comes to choosing your credit cards. You would know this by now if you surf the web for credit card choices. There are credit cards that provides you the lowest interest rates, the excellent repayment terms and cash rebates. How does one choose the best credit card among the many credit card options that is suitable for him/herself? The card that you choose should reflect your lifestyle and spending levels. Is a credit card with low interest rates or APR the most important factor when you choose a credit card? yes!

But I start answering myself, the first thing you will need to decide when selecting a credit card is why do you even need one in the first place? Is cash not king? Some people apply for a credit card to manage monthly cash flow issues, while others are attracted by the incentives and rebates that are given to the loyal customers who uses the credit cards regularly. With a credit card, you are able to make purchases and buy goods without cash, until the end of the month. In this way, not only can you let your cash gain interest in the bank account, you can also increase the flexibilty and freedom in your spending, as long as you pay your credit card bills at the end of the month, before any interests get billed to you.

Getting Easy Cash from Low Interest Credit Card

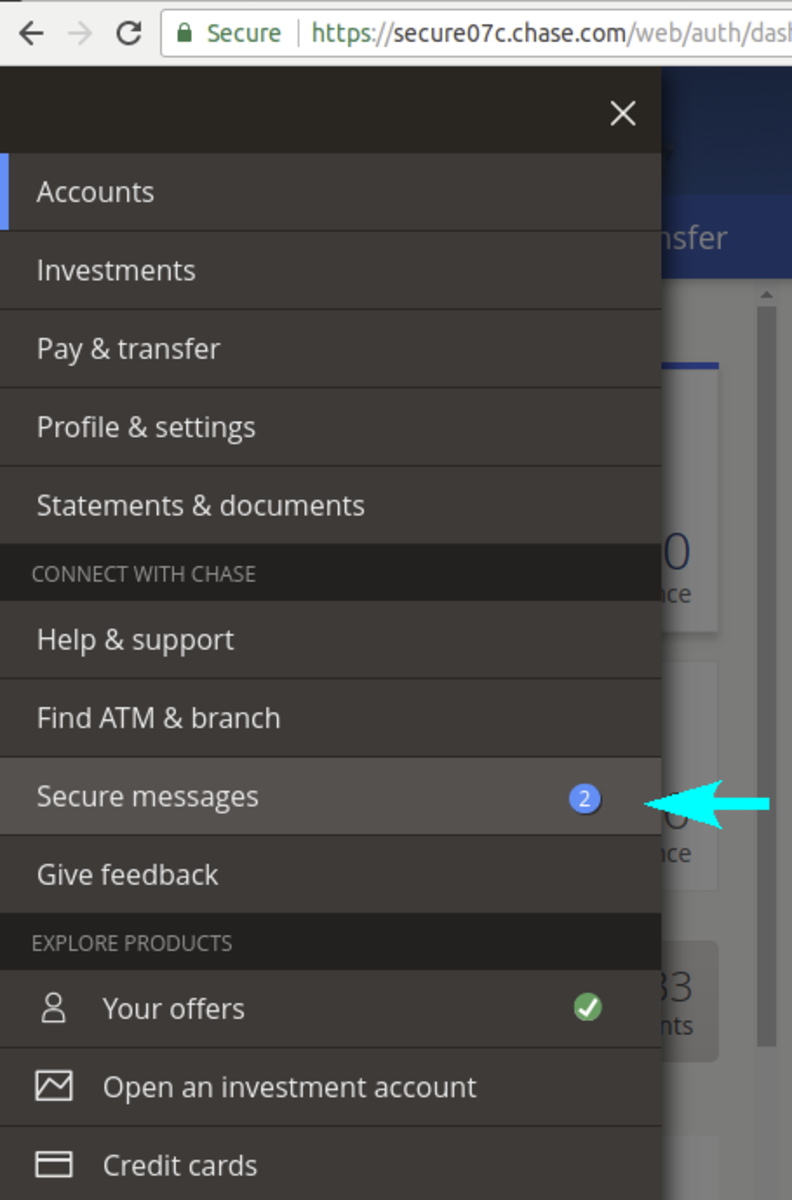

There are others who will choose to apply for a credit card for instant cash purposes. In these cases, credit cards with low interest rates will be attractive. Such needs are for people who want to use their credit card at the ATM and get instant cash for travel expecially before they go to places without credit facilities. If this is your reason for looking for a credit card, a credit card with low interest rates will be especially important for your consideration.

Other Than low Interest, There are Rewards and Incentives

After you get a credit card, you will also need to consider the payments. You need to decide if you want to pay the balance in full at the end of the month or just the minimum required amount. With a low interest credit card, you will have the option of defering payments with minimum interest. Hence when you compare credit cards, you should look at the introductory rates, balance transfer rates, and other offers that apply to new credit cards applicants. Some will offer you amazing deals and even zero interest rates, especially if you have good credit.

Another important area to look at when comparing credit cards is the incentives. There are many cards out there that will give you attractive incentives, such as reward points and even cash back with purchases that can be used towards paying the balance. There are several common incentives out there with credit cards, all you have to do is look around and compare.

Ultimately It is Still Most Important to be Paying Less Interest

The key area that you should look at and compare is the interest rates and APR (Annual Percentage Rate). The interest rate on the credit card or the APR is what you will have to pay on what you buy when the incentive period expires. APR rates varies among credit cards, so it is always in your best interest to shop around. The lower the interest rates or APR rate you get, the better off you will be.

One more area to look out for is the minimum payment amount. Typical minimum payment balances starts around 3%. There are some exceptional ones that can be lower while others tend to be higher, hence it pays to look around. The interest free period is a concern too, as you will naturally want to choose the longest period that you can keep the payments down.

After comparing and choosing the credit card suitable for your lifestyle and needs, you should always make sure that you know exactly what you are getting. Whether be it low interest rates or attractive incentives, credit cards are double edge swords. They are great to have, but they can be troublesome when the interest on that low interest 8.8% credit card starts accumulating. Put some time to research the various credit cards available to you, you will definitely find one suitable for you. A credit card with low interest rate is a important criteria, but consider the other incentives and options. Sometimes the rebates can outweigh the low interest. And dun forget to pay your bills on time.

Jared L

Blend That High Interest Credit Card.

Destroy Your Credit Card that is causing too much hurt to your financial health. Blend it like how the video does it!

Will it Blend? Credit Cards

- Low Interest Credit Cards

Low Interest Credit Cards can offer interest rates or APR below 7%. There are many credit cards but most credit cards do not offer rewards or interest rates better than average credit cards. Compare all at your own risk!