Current US Treasury Bonds to Fund Future Social Security Benefits

Should taxes be increased now to fix future Social Security deficits?

Should the Federal Government seek to capitalize on Treasury Bonds to sustain Social Security benefits?

Which method from below do you believe will best resolve the current issue of dwindling Social Security?

According to the Congressional Budget Office (CBO), Social Security will become null and void 19 years from now – at maximum the year 2033. Depletion is set to begin as ealy as 2017. This means that by the time modern-day 21-year-olds retire, their children will probably not have a clue of how Social Security benefits functioned in the past. Descriptions of Social Security will become fodder for history books. The elderly and senior citizens of 2033 will reminisce of past options for Social Security.

The fact is that the lack in Social Security for a nation that a living longer and growing in size will inevitably cause an exponential surge in poverty levels throughout the country in the future – unless citizens really begin to work until they die. It is unfathomable to perceive disabled people put their health and well-being at risk for the purpose of making ends meet. It will be difficult to witness a society of three or four generations within the same workforce. Although this type of workforce may already be a reality for some people today, most individuals expect that by the time their children enter the workforce, their parents will be exiting. Unfortunately because of the dwindling Social Security benefits, the cycle of life will be disrupted by 2033. More and more individuals will find their parents working, in some cases, for their children.

Social Security benefits, a government-sponsored financial perpetuity, is in decline. The CBO forecasts that in order to prevent insufficient levels of Social Security for at least 75 years after 2033, taxation on employees today must increase by almost 4%. Presently, increasing levels of employment around the country today has helped abate sooner detrimental levels of Social Security insurance and disability as initially predicted approximately 10 years ago. Yet still, the depletion of Social Security is still on-course and individuals today remain torn on the topic of resolving the Social Security issue. “In a study released last month, the Pew Research Center asked 10,000 adults to choose between two statements: Social Security benefits should not be reduced in any way, or some future reductions need to be considered. Sixty-seven percent endorsed the first, 31% the second.”1 The reality is that most individuals do not prefer to see taxes increased for any reason. Usually when the government cannot increase tax rates to increase government revenues, there is a motion for option 2: Treasury Bonds.

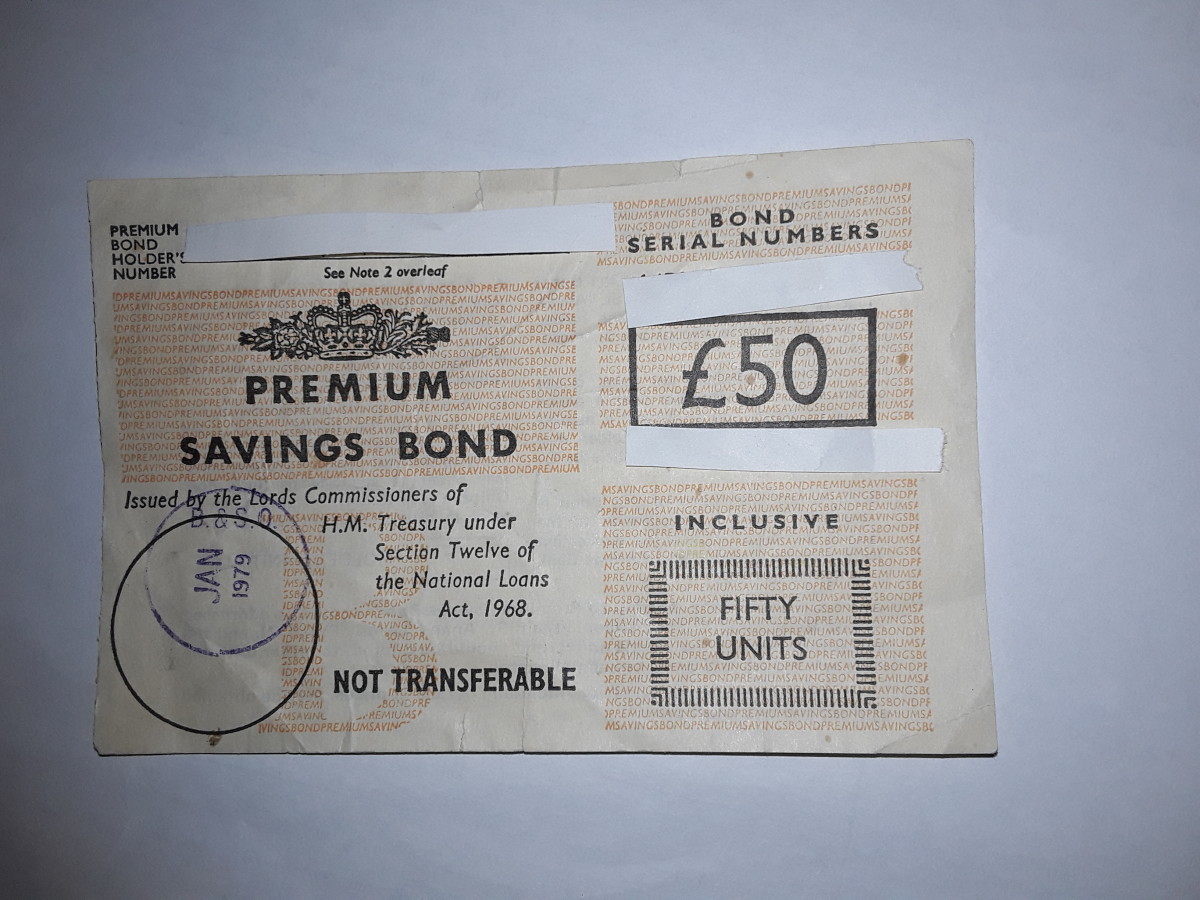

Treasury Bonds have historically funded the government in times of war, economic decline and budget deficits. The government capitalizes on these investments in multiple ways (i.e. investment in special projects, property development, business development, technologies, etc.) before repayment is necessary. Since Social Security is a mandated government responsibility via the Social Security Act of President Roosevelt’s 1936 New Deal, the government can choose to issue T-Bonds for financing future Social Security deficits. T-Bonds facilitate the time lines needed to manage Social Security long-term. The CBO has already computed and forecasted out the government's financial need to sustain Social Security benefits in the future. Although it is uncertain if any specific mandates or regulations prohibit the use of Treasury Bonds for this purpose, using the common government financing activity can satisfy the present need for future funds.

Maximizing Social Security Benefits ... before they are possibly gone forever.

The US Government can issue Treasury Bonds today for a period of time towards increasing available funds for Social Security in the future. Treasury Bonds provide investors interest income on debt offered by the US Department of Treasury for thirty years. Investors receive fixed interest income from Treasury Bonds, but may also choose to sell the debt on a second (or demand) market for proceeds from the sale. The government uses these investments from individuals to cover necessary costs in the management of the country’s maintenance, while providing interest income (from investment profits) to investors. The government’s recent issuance of Treasury Bonds to cover Afghanistan and Iraq war-related costs has proven to be successful. Since State and local taxes on Treasury Bonds are withheld, these financial instruments are of high demand by US citizens.

There are four different types of marketable US Treasury securities: Treasury Bonds, Treasury Notes, Treasury Bills and Treasury Inflation Protection Securities (TIPS). The difference between these types of securities is their varying maturity dates. Treasury Bonds carry the longest maturation period of 30 years. Treasury Notes last for a range of 5 – 10 years, while Treasury Bills last for only one year. T-Bonds, Bills and Notes offer fixed interest payments to investors based on their associate interest rates. TIPS, on the other hand, provide variable interest rate payments in accordance with the Consumer Price Index (CPI) . TIPS currently offer 5-year, 10-year or 30-year durations for maturity.

The market for these government-backed financial securities is available. The US Government must become much more proactive in resolving the impending collapse of Social Security benefits. All of the debt securities discussed above can be used now by the US Government to finance Social Security payments into the future. Will the US Government make the right decision?

Read more of my financial blogs at: http://missinfo.hubpages.com.