Debt Dictionary: Understanding Financial Basics in your 20s

Understanding finances is essential to anyone in their 20s because this is an important time - first job, maybe your first car purchase or house payment - to start budgeting, spending and saving wisely.

Most kids in their 20s can't handle the responsibility of a paycheck, or they want to keep up with their friends who have better paying jobs so they spend money on temporary indulgences like going out to eat and shopping. I have a personal friend who is almost $50,000 in debt just because of shopping! Financial mistakes are a huge epidemic these days and, I think, it's all because these kids never got a good financial education at a young age.

Take retirement for example. The difference of delaying your retirement contributions even 5 or 10 years can mean hundreds of thousands of dollars that you will never earn because you didn't understand the important of saving early!

Let's look at some important, basic financial concepts that will hopefully help you understand the importance of financial education in your 20s.

Side note: Please remember that I am not a tax professional and this is not expert advice. Nor, is this a comprehensive guide to your finances. These are just important concepts I think every 20-something should know when they are facing a complicated financial world!

APR (Annual Percentage Rate)

The concept of annual percentage rate (or APR) is super important, especially when you are looking at different options for credit cards and loans. Basically, the APR is the interest rate that you will pay over the course of a year, and the higher the APR, the more money you will pay over the course of your loan. You want to make sure you should for a car with a low APR, meaning that you won't have to pay a huge amount of interest on top of the money you initially owed (see below for principle and interest definitions!)

Make sure if you want to compare loans that you are looking at the same time period in order to compare APRs. Because the amount of your payments and interest depends on the number of months of your loan, the APR for a 15-year mortgage will look different from that of a 30-year mortgage.

Remember that you have every right to know exactly what the APR is on a loan or credit card before you finalize any agreements with the companies that are lending you money. Staying informed and asking the right questions can save you a lot of money on interest in the long run!

Get Your Free Report!

- Annual Credit Report

By law, the three major credit bureaus need to give you access to your credit report (not score) once a year. This is the official site to access those reports.

Credit Report and Credit Score

A credit report is simply a recorded history of all your debts and repayments. Whenever you are applying for something like a loan or credit card, that company will confer with one or more of the three major credit bureaus that keep that information (Experian, Equifax and TransUnion) which includes your good history as well as the bad (e.g. late payments, etc.)

You can obtain your credit report for free from each of the three major bureaus to make sure that the information reported there is accurate - if there is something incorrect, potentially from an identity theft situation, then you can contact the credit bureaus immediately to dispute the inconsistencies. Any negative information will have an effect on your credit score, which will then affect your ability to get a good interest rate on a loan or even get a loan at all.

You can get all three at the same time to make sure they are all correct, but I like to space them out and get one every few months just to monitor my report throughout the year in case anything pops up!

While you can get your credit report for free, you will have to pay a nominal fee to get your actual credit score, which is a single number that represents an analysis of your credit report. The higher the number, the better you look to potential lenders who want to make sure you will make your payments on time! The credit score depends on many factors like length of credit history, late payments or other negative payments information and the amount and type of your debt.

Compounding

Compounding is the reason why it is important to invest early when it comes to retirement or other long-term goals. Compounding means that the earnings off your original investment are reinvested so you essentially have more money earning interest and so on.

Let's look at this concept in terms of an investment. Let's say you invest $100 into an account and, over the course of a year, the value of that investment rises to $150, essentially gaining 50%. Now, you have an investment of $150 because your extra money goes back into your investment. And if your investment gets another 50% return in year 2 (great investment choice if it does!) then you will earn an additional $75 this year from your $150!

You can see how even this small example shows how compounding can make you a lot of money without having to invest any additional money from your own pocket.

Do Your Research!

- Morningstar Stock, Mutual Fund, Hedge Fund, ETF Investment Research

This is my favorite website to research all things investment from stocks to mutual funds.

Mutual Funds

When I was just starting out investing, I was scared and intimidated by the stock market. There were a million different companies to choose from and I didn't know where to begin. So, I started looking at mutual funds.

Mutual funds are investments that are managed by professionals who take a lot of stocks and package them up together so you can invest in all of them without having to do the extensive research on each one.

You can invest in a specific sector, like medical or transportation or whatever, or you can put your money into a target date mutual fund, which says it will adjust your investments to make them less risky as you get older and closer to retirement. Always take time to do your own research and see what funds are performing well and what will work best for you and your investment needs.

Mutual funds typically have less risk than buying individual stocks because they are made up of many stocks and, if one of them does poorly, there are still many other ones in the package to make up for it.

Pre-Qualification or Pre-Approval

When you are looking for a home, in my opinion, it is essential to have a pre-approval or pre-qualification letter from your lender. It used to give you an advantage over other potential buyers, but in this economic time, I think it is an absolute necessity.

A pre-approval letter tells a seller and/or real estate agent that a potential lender has looked at your credit history, verified your employment, income and assets, and considers you a good buyer at a certain price. While this is not an actual loan document and doesn't technically approve you for any loans, the seller will feel safer knowing that all your credentials have been checked out before they enter into a contract with you.

Principal and Interest

When we are looking at loans, the principal is the initial borrowed amount that you have to pay back - i.e. if you get a loan for $20,000 for a new car (not recommend, by the way!) then the principal on your loan is $20,000.

As we all know, you won't just get to pay back the $20,000 that you owe because there is a little thing called interest. This is just a fee that your lender charges you in order to let you borrow money from them - and it's a good reason to save up and pay cash for smaller purchases, or even larger ones, like a house, if you have enough discipline!

Roth IRA

An IRA (or individual retirement account) is a great way to start saving now for your retirement because they are plans that have tax advantages for most people. But, there is one major choice you have to make when you are deciding where to put your money: Roth or traditional IRA?

Unlike some other retirement plans, a Roth IRA does not give you a tax break for the money that you put into the account. But, what it does is allow you to do is take out the money when you are retired tax-free. You are allowed to put $5,000 a year into a Roth IRA account, but you can't contribute the maximum if you are making over $105,000 a year.

Traditional IRA

A traditional IRA is a little different from a Roth IRA because your contributions to this type of retirement account are tax deductible when you put the money into the account, which gives you a short-term advantage.

When you do withdraw the money at your retirement age, the money will be taxed at whatever tax rate you are subjected to at that time.

Which IRA is Right for You?

Withholding Tax

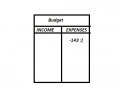

Every one knows the feeling of getting their first payment and wondering where all their money went - what a bummer! The withholdings from your paycheck are basically payments to the government and your employer will take them out for you with each paycheck.

Some withholdings, like Social Security, wouldn't get paid back to you except in the form of Social Security payment when you are eligible, but some of them you can get back in your tax return if the IRS has determined that you paid too much based on your income, deductions and other factors.

If you would rather get more money in each paycheck instead of getting a big return every year, you can adjust how much the government actually withholds based on several factors. Check out the video below to determine how much you should get taken out, or talk to your HR department to discuss your options.