The Flat Tax: Deflating our U.S. Tax Code

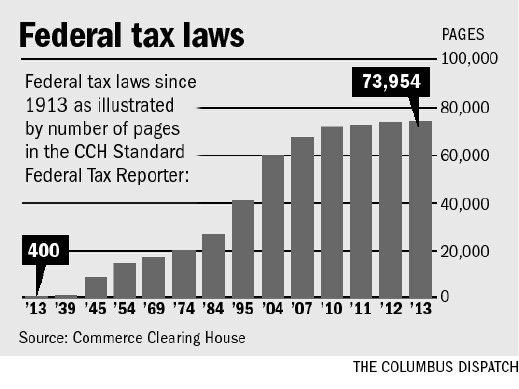

As of 2013, nearly 148 million of us filed a U.S. Income Tax Return with about half, 77 million filers, seeking the help of a professional tax preparer - a statistic that has been growing. And it’s no wonder when you consider the U.S. Tax code as of 2014 contains an astounding 73,954 pages. At its current pace, it will double in length every 24 years. What’s causing this trend?

According to the Tax Policy Center, the 1980s and 1990s were extraordinarily turbulent times for federal income tax policy. The income tax was significantly altered seven times: in 1981, 1982, 1984, 1986, 1990, 1993 and 1997, with additional changes made in others years as well such as the tax reform act of 2010. Those changes have modified numerous features of the tax law, including the base, the level and structure of tax rates, the existence and generosity of deductions, exemptions, credits, and other tax expenditures, the indexing provisions for inflation, and other factors.

Burdened with the responsibility of complying with each change in the law, It’s become an inside joke among CPA’s and accountants that their industry gains even more job security with each successive act passed by Congress intended to make their job less required. It with little wonder then why serious tax reform debate has begun to take hold in our political system once again. And the idea that seems to be getting everyone’s attention this time is the “flat tax” - one tax rate charged to individuals and corporations no matter how much you make.

Political Debate

Just prior to the Tax Reform Act of 1986, serious inquiry was made into the impact a flat tax would have on U.S. tax revenue with the Reagan administration finally opting instead for a revision of the tax code to lower rates. What followed was a period of the greatest economic prosperity in America. An important point of reference for future flat tax debates. In 1996 and 2000, the idea of a flat tax system was brought to national attention again when then presidential candidate and CEO, Steve Forbes, ran on a flat tax proposal of 17%. The idea apparently took hold in the Republican party. Rick Perry and Newt Gingrich ran on an optional flat tax in 2012. Their rival Herman Cain proposed a flat-ish tax called 9-9-9. And If Rand Paul - the Libertarian-leaning, conservative senator from Kentucky - chooses to run for president in 2016, expect to hear a lot about a single-rate flat tax system. Ben Carson unveiled his idea for a 10% flat tax plan in a 2014 republication convention and may also be a contender in 2016.

Many believe not much will happen to overhaul the tax code until the next president takes office in 2017 if at all. It’s not clear when Congress will take up the issue of tax reform seriously, or if a flat tax of some kind would ever garner sufficient support.

Flat Tax Plan Comparisons

Perry

| Forbes

| Cain

| Gingrich

| |

|---|---|---|---|---|

Flat Tax Filing Optional

| Yes

| No

| No

| Yes

|

Individual Tax Rate

| 20%

| 17%

| 9%+9%

| 15%

|

Corporate Tax Rate

| 20%

| 17%

| 9%

| 12.5%

|

Exemption Adult

| 12500

| 13000

| 0

| 12500

|

Exemption Child

| 12500

| 5000

| 0

| 1000

|

Charitable Donations

| yes

| No

| No

| Yes

|

Home Interest

| yes

| No

| No

| Yes

|

Corp investment deduction

| Yes

| Yes

| No

| Yes

|

Remove Payroll Tax

| No

| No

| Yes

| No

|

All plans exempt estates and Social Security from taxation as well as passive income on savings such as capital gains, dividends and interest.

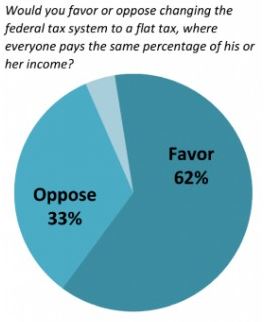

Americans in Favor of a Flat Tax

According to polling conducted in March of 2014 by Reason-Rupe, 62% of Americans favor changing the federal tax system to a flat tax. “Simplification" is an argument that will likely resonate with taxpayers. Plus, a weak economy could better the chances of reform if it's seen as a necessary step to create jobs. Perhaps the biggest driving force behind Americans favoring the flat tax is the concept of fairness. There is a growing trend in the middle class that the wealthy actual pay less tax than they do. The reason for this was the constant class war rhetoric presented to Americans during the 2008 and 2012 presidential elections. Anyone making $250K or more, they claimed, had made enough and needed to pay their fair share - in fact, more than their fair share. In the mind of politicians, a flat tax would resonate well with voters as it would ensure that everyone pays the same rate. No more special tax breaks, loop holes and special allowances for the rich.

These are all great emotionally based reasons to support the flat tax. The only problem is – it won’t actually work that way.

Examining the Facts: 7 Common Misconceptions

Below are some common arguments in favor of a flat tax system:

- Everyone will pay one flat rate - True -. At least for Federal income tax on earned income. The flat tax ignores payroll taxes such as Social Security, Medicare, or federal excise taxes. This means, for example, that the 12.4% Social Security payroll tax (split between employer and employee) would remain in place. Currently, once you make over $90,000 a year, you no longer have to pay the Social Security tax. It also leaves in place all state and local taxes.

- A flat tax will eliminate special deductions and loopholes and increase taxes for the rich - False -. Our current tax code is a progressive tax meaning the more you make the more your tax rate increases. Under a flat tax proposal, this progressive feature would go away resulting in less tax on the wealthy. The estate tax and the Alternative Minimum tax would be done away with. In addition, any income that is saved or invested is tax exempt. That means no taxes on capital gains, Social Security benefits, interest, or dividends. Corporations could expense all investments, doing away with depreciation schedules. These are all things that benefit the wealthy.

- A flat tax will dispense with complicated returns making filing as easy as sending a postcard - True.- In its current form, a tax return would be the size of a postcard. While it would greatly simplify the preparation of your tax return, what you may get in exchange is – more tax. As proposed, flat tax plans that would keep intact a standard deduction and exemptions but little else. Itemized deductions like the home mortgage interest, property/sales tax, job expenses, medical expenses, etc. would all go away. And keep in mind, the home mortgage interest deduction that then makes it possible to itemize currently strongly encourages the housing market, a strong driving force behind our economy.

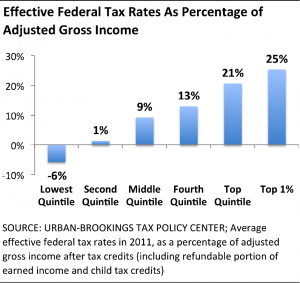

- A flat tax will “broaden the base” to include more taxpayers keeping tax rates low.- False - Broadening the base means tax increase. Presumably, the idea is to reach those wealthy taxpayers that somehow manage to accumulate vast amounts of money and pay very little tax at everyone’s expense. In reality however, only lower income individuals fall below the threshold of paying tax and, under the flat tax plan, A family of four would pay no taxes if they made less than $46,000 a year. What data indicates however is that the public really doesn’t know how much the rich pay, and often likely make policy judgments based off of the political rhetoric of the politicians and pundits they trust. The more Americans are led to believe that there is widespread cheating among the nation’s wealthy, the greater the support for raising their taxes. Upon examining the facts however, the top 1% of the wealthiest of Americans pay 25% with the top 5% paying a whopping 60% of all tax revenue collected in the US. A statistic only 20% of Americans know (see chart below).

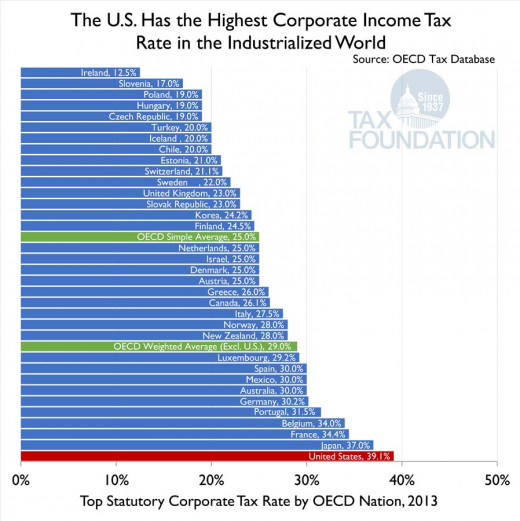

- A flat tax would unleash economic growth - False - This is actually an argument for lowering the corporate tax rate as that is what is actually stifling economic growth for business. The U.S. has the highest corporate tax rate in the industrialized world. (See Chart Below).No one is going to argue that the tax code isn't complicated and large. I think what's important to remember however is that internal revenue tax code is law passed by Congress. We also have common, constitutional, statutory and regulatory law as well that is large, cumbersome and complicated yet no one is recommending we dispose of these laws. And rightly so, as in the case of common law including contract law, precedent has been established over some 200 plus years. The laws have been fine tuned in our courts to dispense justice equally and fairly. And it's this assurance of fair play that encourages venture capitalism and investment leading to economic growth and business prosperity in America. Junking our current tax code law and starting from scratch will inevitability impact tax payers and businesses in ways not fully appreciated inviting new challenges that will burden our court systems for years to come.

- A flat tax is so simple, a transition from our current system would be straight forward.- False - Current proponents have not explained fully how a flat tax would work in conjunction with the Affordable Health Care Act. Keep in mind that the Health Care Act enforces its regulations through the existing tax code with a penalty based on your adjusted gross income. And the current tax code sometimes disallows losses, deductions and credits to insure Americans pay a minimum amount of tax. These subtractions from income are not lost completely. Many are suspended until a future year. One example is the capital loss deduction limit of $3,000. If you have a $30,000 loss in one year, you deduct a $3,000 capital loss (assuming no offsetting gains) each year for the next 10 years. And there are others such as passive losses, net operating losses, alternative minimum tax credits, and scheduling of depreciation of equipment to name a handful. What would happen to these suspended losses and schedule of deductions in the year a flat tax was implemented? We don't know.

- The flat tax has worked with attractive results wherever its been implemented - False Throughout the 1990s and early 2000s, 6 former Soviet republics and three other Eastern European countries flattened their income-tax rates. Estonia adopted a 26 percent tax on personal and corporate income in 1994. The country had gross domestic product growth of 11.7 percent in 1997, and continuously grew between 7 and 10 percent throughout the early 2000s, U.S. GDP growth was 2 to 4 percent over that period. In 2001, Russia switched from a system of 12, 20 and 30 percent tax rates to a 13 percent flat income tax. Adjusted for inflation, revenue from Russia’s personal income tax increased by 26 percent in the year after a flat tax was implemented, and by nearly one-fifth as a percentage of GDP. Russia also saw strong GDP growth throughout the 2000s, ranging from 6 to 8 percent from 2003-07. So far so good. But what's driving this growth?For one thing, those reforms came at a time of massive economic change as former Soviet republics transitioned from command economies to the free market, and Eastern European countries made other systemic changes. Tax compliance was an important issue for people not used to having to file an income tax. Estonia, which introduced a flat tax in 1994, had just started transitioning to a capitalist system three years earlier. So it's hard to isolate the real cause and place the credit on a flat tax. What is becoming evident however is that The flat rate tax results in a quick increase in the inequality between the rich and poor, as can be seen in countries like Estonia and Latvia.

So in conclusion, what do we find?

- The flat tax doesn't tax the wealthy more, it taxes them less.

- It isn't really flat when taken in conjunction with the payroll tax rates and state and local tax rates.

- It isn't more fair because the middle class will see an erosion of their disposable income while the rich are hardly affected.

- A conversion to a flat tax would not be simple and leaves many uneasy questions eliminating many important tax deductions that encourage the housing market.

- There is no evidence that it will boost economic growth by itself rather than simply lowering the corporate and individual tax rates.

Taxing the Rich

Urban Institute data reports that in fact, the wealthy do pay a higher tax rate than the middle class. Average effective federal tax rates in 2011, as a percentage of adjusted gross income find the following (after tax credits):

Lowest Income Quintile: -5.8%

Second Quintile: 1.3%

Middle Quintile: 9.2%

Fourth Quintile: 12.9%

Top Quintile: 20.6%

The “1 Percent” pay 25.3%”

Reason-Rupe also found that only about 20 percent of Americans knew the actual share of federal income tax dollars paid by the top 5 percent of households, which is roughly 60 percent of all tax receipts. Without knowing these facts, 57 percent of Americans say they think the top 5 percent should contribute no more than 40 percent of all the tax revenue collected.

Taxing Corporate America

The US has one of the highest tax rates in the industrialized world. So high in fact that a popular growing trend in America is the performance of an off-shore merger, referred to as a tax inversion, to repatriate earnings in a country with a much lower tax rate. A recent example is Burger King merging with a large fast food chain, Tim Hortons, in Canada. Not only are they able to pay a lower tax rate, accounting strategies such as lending money from an off-shore company to its US counterpart would allow even more shifting of incomee as these US companies can claim interest payment deductions on large notes. The Obama administration has put regulations in place to stop such maneuvers.