Economic Depression - Tips on spending, saving and investing wisely

How I Became a Better Shopper, Saver, investor

I have given up listening to the commentators on CNBC. I don’t know what they are drinking but these people see “green shoots” indicating economic recovery everywhere. Nobody has told them green shoots come from fungus as well as healthy plants. The bottom line is the housing crisis is getting worse as prime, not sub-prime mortgages are going belly up. Why? Houses are valued at less than the mortgage. Joblessness is hitting all sectors, all income levels, at the same time property taxes remain high and the value of real estate in entire neighborhoods is taking a nosedive. So the message to banks is: “Here are the keys. It’s your headache now. Credit card defaults are going up, as are defaults on all the businesses that are failing. Banks scrambling to hold on to capital are either not lending or want large down payments on property; credit card holders are facing annual fees, higher interest rates, and lower credit limits. Those optimists who are looking for economic recovery coming from a return to higher consumer spending are in for a huge disappointment. We have years of a bear market, not a bull market ahead of us.

Like many of you, I am looking at our lifestyle, our shopping habits and our priorities in a new light. I am now saving money or at least the little I can with grocery prices going sky high. All those “green shoot” folks who are looking for signs of an economic recovery probably haven’t gone grocery shopping. If they did, they would know the reason we are not spending on clothing, cars, and vacations is that we are contending with huge bills for the necessities like groceries.

So what do we do? Here is what I am doing.

1. I am paying cash and I am shopping at dollar stores. If you haven’t visited one lately or ever I suggest you do. You’ll find many packaged goods grocery for a dollar each, less than a dollar for some little more for others but half of what even Wal-Mart charges. Potato chips, crackers, tuna, rice. Manwich, Hamburger Helper. You get the idea! Also I have bought men’s and women’s shorts there, gardening supplies, all kinds of cleaners from laundry detergent to carpet cleaner as well as paper products. Now when I go to the grocery stores I am buying produce, meat and dairy.

2. I have discovered a couple of Mom and Pop grocery stores that have items much cheaper than traditional grocery stores. Some of them are ethnic; others are discount grocery stores like Save a Lot.

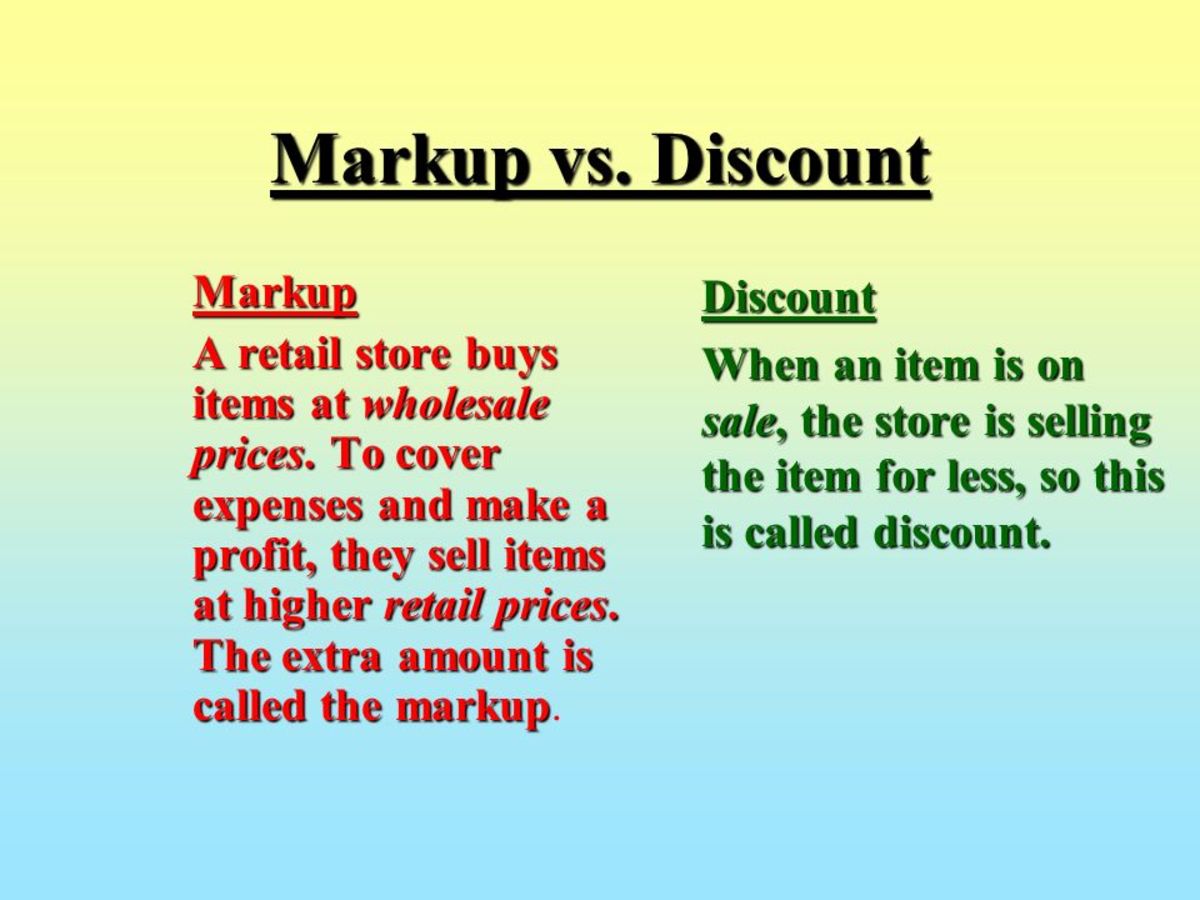

3. I am more disciplined about shopping sales. When I go to the stores for advertised specials I buy only those items.

4. I buy cosmetics, hair coloring and office supplies at discounters like Big Lots. The same brands that the pharmacies and grocery stores carry are dollars cheaper.

5. I always cut coupons but I am more selective now and go to more sources. I don’t bother with the 25 cent ones but I do clip from the Sunday paper. Even the discounters will accept coupons, which make already discounted prices even lower. I also have a list of great sites for on line coupons. I recently used one to get a 16-ounce package of Velveeta cheese free.

6. I hold swap parties. Each woman brings 5-10 items of clothing (also jewelry, accessories, shoes) and each woman winds up with items while parting with others. Another party is household small appliances, gadgets, and knick-knacks. You can find some that are just right for you without spending a dime and it cuts down closet and household clutter.

- Silver Investor - Silver, Gold & Precious Metals Investment, Silver Mining, Stocks, z Report &am

You have come to the right website for the most comprehensive collection of information on the silver market, mining & stocks. Get expert advice on silver coin, gold & precious metals investment. Contact us on 509-464-1651 & SIGN UP FOR T - Whiskey and Gunpowder features articles on gold, oil, currencies, energy, emerging markets, profits

The independent investor's guide to commodities, gold, energy, profits and freedom. Featuring articles and commentary on currencies, emerging markets, energy and more. - Stock Market Analysis, Research Stocks, Market News, Stock Picks

The Growth Stock Wire daily investment newsletter provides unparalleled pre-market stock analysis to help predict market reactions and highlight daily investment opportunities

7. Now the biggie. All of the above are done to be thriftier and save money. If inflation lies ahead (and I truly believe it does) then that saved money loses value sitting in a low interest account or stuffed under the mattress. I do a lot of homework on investments. That means I subscribe to newsletters, read newspapers on line and listen to business reports on NPR and CNBC, The guests on CNBC have valuable insights. Don’t be distracted by commentators who try to put a good spin on every move and almost beg guests for “signs of a recovery”. That research has led me to invest in gold and silver mining and emerging market funds. Don’t take my word for it. Today you can’t afford to be a passive investor. One of my favorite newsletters is Silver-Investor because it does not just try to sell you something. It contains a wealth of information about precious metals and why they will become more valuable. I don’t have money for much of the actual metals but have become a big believer in the mining stocks. Do your own research. I also subscribe to Whiskey and Gunpowder, The Growth Stock Wire, Money and Markets, Agora Financial and Gold World. Do some digging and find some on-line newsletters you like and read the business and economy sections of a variety of newspapers on-line. Bypass any that are simply trying to sell you something. First you need to be informed. For Instance, Silver-Investor has The Morgan Report, a paid newsletter with individual recommendations and videos. However, you can spend hours reading articles, listening to audio and watching video interviews on Silver-Investor before you even consider a paid subscription. We all have to be educated with varying views of what is happening in the economy world-wide

8. Finally, I have dragged out old cookbooks that contain create casserole recipes, as well as ways of cooking the least expensive cuts of meat. Sauerbraten with red cabbage! My friend gave me a Wolfgang Puck rice cooker in which I throw in the ingredients push the on-button and wind up with macaroni and cheese, rice pudding or a chocolate raspberry cake.

9. I bought a bread machine at a thrift store and have been making my own bread. The machine did not come with a manual but I found one on the Internet. It makes great bread and considering the current cost of a loaf of bread saves money. Sweet potato bread is a favorite using a jar of sweet potato baby food,

10. In conclusion, this is no time for slackers. We all should be saving money, shopping wisely and reorganizing our priorities. A great night at home is a one-dollar new release movie, a bag of popcorn from the dollar store and made from scratch lemonade. But don’t forget now is not the time to say, “Things are just too depressing. I prefer not to know what is going on in the world. This is how bills pile up, 401’k and IRA’s shrink and our world changes without our changing a thing. Proactive is the operative word these days. See you at the dollar store!