FINANCIAL ANALYSIS TECHNIQUES - Solvency Ratios

Introduction to Solvency Ratios

After looking at how efficient the management is able to manage the company assets, activity ratios and liquidity ratio which measure the sustainability of the company for a short term. As a value investor we also must make sure the company we invested in are sustainable for long term.

Solvency ratios measure the ability of a company able to pay off its long term debt in the other words sustainable for long term. There are many type of solvency ratio in this hubpage we focus on two main types of solvency ratio, debt ratios and coverage ratios.

Debt ratios focus on item listed in the balance sheet and measure the amount of debt capital relative to equity capital. On the other hand, coverage ratios focus on income statement and measure its ability to cover its debt payment, interest payment.

The solvency ratios discussed here are as follows:

Debt Ratios

- Debt to asset ratio (Total debt ratio)

- Debt to capital ratio

- Debt to equity ratio

- Financial leverage ratio

Coverage Ratios

- Interest coverage

- Fixed charge coverage

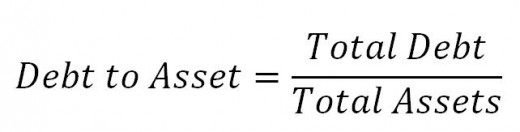

Debt to Asset

Some analysts named this ratio as total debt ratio. Basically this ratio measures the percentage of a company’s total assets finance by its debt. A debt to asset ratio of 0.1 indicates that 10% of the company total assets is finance by its debt. As for basic accounting Asset = Liability + Equity, the remaining asset which does not finance by debt is finance by equity either the money from shareholder or the retain earning from the previous earning.

An analyst should look into company which low debt to asset ratio because this means that most of the company asset is finance by equity, which is the market capitalisation of the company. A company with low debt to asset ratio is more sustainable in long term.

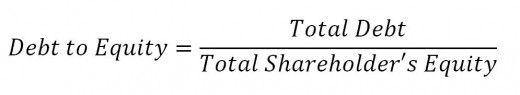

Debt to Equity

The debt to equity ratio measures the amount of debt relative to its shareholder’s equity. A debt to equity ratio of 1 indicated that the total amount of debt is equal to its shareholder’s equity.

As a value investor we shall look for a company with the debt to equity ratio of more than 1. This means that the company consists of more equity compare to debt. However some people might argued that the management shall borrow more money compared to the shareholder equity to expand the company but these is not always true. If the cost of capital (borrowing interest) is more than the return of investment (ROI) which the management intended to invest then the addition borrowing will reduce the company earning instead.

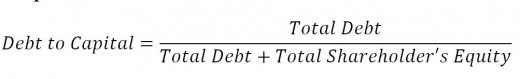

Debt to Capital

The debt to equity ratio measures the amount of debt relative to its capital (total debt + shareholder’s equity). Debt to capital ratio is the other ways to measure the debt to equity ratio. A debt to capital ratio of 0.5 indicates that the total debt is half of the company’s capital which also means that the company debt is similar to its shareholder’s equity (debt to equity =1). Debt to capital ratio has the range from 0 to 1. A debt to capital ratio of 0 means the company has no debt while a debt to capital ratio of 1 mean the company has no equity which is impossible unless it is bankrupt.

Hence as a value investor we shall look for a company with < 0.5. These is because the debt to capital ratio < 0.5 shows that the company has more shareholder’s equity compared to the company debt. A debt to capital of 0 is also not a good indication for a good company these means that the management unable to utilize the company asset fully or cannot find a suitable investment for the company.

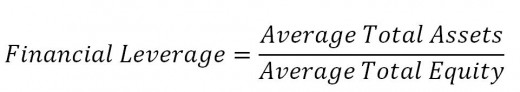

Financial Leverage

This ratio is also known as leverage ratios. This ratio measures the amount of company’s total assets support for each unit of equity. In the other word how much asset you owned when you have $1 of the company’s equity. Financial Leverage ratio of 2 means that for every $1 of the company equity there are $2 of the company asset. Since every asset is required to be finance through equity or liability hence the higher the financial ratio the higher the liability to finance the asset. The financial leverage ratio is also an importance element in the DuPont formulae when calculating the return of equity.

Interest Coverage

This ratio measure how many number of time the company earnings before interest and taxes (EBIT) is able to pay the interest payment. It also measure the number of year the company able to pay the debt interest without having any addition earning. (EBIT =0)

As value investor, we would look for a company with the interest coverage more than one. High the interest coverage ratio indicates that the company has strong solvency. A high interest coverage value also indicated that the management able to utilize the loan fully and use the loan to earn extra earning which higher that the interest payment.

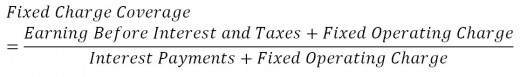

Fixed Charge Coverage

Most of the company has fixed operating charge (such as rental) that required to be paid each month regardless of the sales. Fixed charge coverage ratio take into account the fixed charged. High fixed operating charge will reduce this ratio compare to interest coverage ratio. Fixed charge ratio is meaningful when the company operate at high fixed operating cost.

Similar to interest coverage ratio, a higher fixed charge ratio indicates the company has strong solvency.

Solvency Ratio Criteria

Solvency Ratio

| Criteria

|

|---|---|

Debt to Asset

| < industrial norm

|

Debt to Equity

| < industrial norm

|

Debt to Capital

| < industrial norm

|

Financial Leverage

| < industrial norm

|

Interest Coverage

| > industrial norm

|

Fixed Charge Coverage

| > industrial norm

|