Fixed Rate Mortgages Explained– and Calculate Fixed Rate Mortgages (FRM) Using Excel

Interest Rate on the Loan Remains the Same

Fixed rate mortgage (FRM) is a very common mortgage loan where the interest rate on the loan remains the same throughout the term of the loan. This is different from adjustable rate mortgage where the interest rate is adjusted based on market forces prevailing at any one given time. Fixed-rate mortgages have been used by many homeowners for several decades. Fixed-rate mortgages offers security from the risks of escalating interest rates in the unknown future. Fixed rate mortgages are normally packaged in such a way that monthly rates that are not paid for in time are charged a compounding interest.

Reducing Interest Amounts

In a Fixed rate mortgage (FRM), you are given a fixed monthly payment of the borrowed money plus the accrued interest for the month. Initially when the principal balance is high, the interest amount is equally high but as you progresses towards the end, the principal balances reduces and interest amount is correspondingly small.

Example of a Fixed Rate Mortgage Payment

Let’s take an example: You borrow a fixed interest mortgage loan of $150,000 to be paid in a term of 15 years at a fixed interest rate of 6% per year. The fixed monthly payment of the principal is $150,000 divided by number of months in 15 years which is equal to 150,000/180 equals to $833.30 per month. Then there is the fixed monthly interest which is 6% divided by number of months per years which is equal to 6/12% equals to 0.5% per month. The value 0.5% can be expressed as a factor by dividing by 100 which is equal to 0.005. This means the interest payable for the first month on the principal balance of $150,000 is 150,000 x 0.005 equals to $750.

Total Monthly Payment Reduces With Time

In the second month, the principal balance will be 150,000 minus 833.30 equals to $149,167.3. The fixed monthly payment of the principal will remain the same as $833.30 but the interest will be $149,167.3 x 0.005 equals to $745.84. As you can see, the total monthly payment for the first month is 833.30 + 750 = 1583.30. The total monthly payment for the second month is 833.30 + 745.84 = 1579.14. This shows that the total monthly payment reduces with time due to reducing monthly interest amounts.

You should be able to see that the fixed monthly payment on a fixed interest mortgage depends upon the amount of money borrowed, the interest rate charged, and the length of time over which the fixed interest mortgage loan is repaid.

Many Borrowers Interested In Fixed-Rate Mortgages

Why we have many borrowers interested in fixed-rate mortgages in comparison to adjustable-rate mortgages is because many people like the security of knowing in advance exactly how much they will pay per month for the fixed rate mortgages. This seems to be very valuable in planning their budgets. In the real sense, in a stable economy, fixed-rate mortgages are more expensive than adjustable rate mortgages in the long run. They are expensive because it’s the lender who is taking the risk of the future fluctuation of interest rates. The price the lender charges you when they take that risk on your behalf in the case of fixed interest rate mortgages is a lot of money. But the question is: would you mind paying for car insurance so that you can drive a car with insurance or not? Since the amount of money involved in a mortgage is a lot of money, then it’s only good you have insurance on the fluctuation of interest rates. This would therefore make us conclude that fixed-rate mortgages are better than adjustable-rate mortgages.

Calculate Fixed Rate Mortgages (FRM) Using Excel

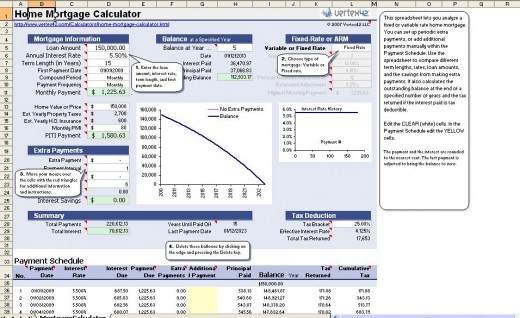

To calculate Fixed Rate Mortgages (FRM) Using Excel, you will need to have an excel template that will help you. You will need to download this Free MS Excel spreadsheet which is a Home Mortgage Calculator and it’s a small file (350 KB). Once you load this file, it should look like the spreadsheet shown below.

Create Different Scenarios for Your Case

Create different scenarios for your case and play around with figures until you believe you are able to answer the following questions:

1. If you were to have a fixed rate mortgage, how much would you save by making extra payments apart from your standard monthly payments?

2. If you were to have a fixed rate mortgage, how would you explain tax deduction changes as you pay interest change over time?

3. If you were to have a fixed rate mortgage, how much might your monthly payment be worst of over time than if you had borrowed a variable-rate mortgage?

4. If you were to have a fixed rate mortgage, how soon can you off your fixed rate mortgage if I make extra payments?

5. If you were to have a fixed rate mortgage, how will your fixed rate mortgage loan balance be at the end of 2, 3, 10, or 14 years from the date you took the mortgage?

Best Mortgage Fixed Rate

Create this kind of scenarios for your case and play around with figures until you believe you fully understand the fixed rate mortgages. After that, you are now free to go out shopping for the most competitive fixed rate mortgage loan in the market. Ask FRM lenders as many questions as you can so that you can be able to compare the right fixed rate mortgage loan for you.

Analyze Fixed Rate Home Mortgages and Analyze Variable Rate Home Mortgages

This Free MS Excel spreadsheet that you have downloaded will help you to quickly analyze a fixed or a variable rate home mortgage. Be creative and set up periodic extra payments as well as adding additional payments manually within the Payment Schedule to see what happens. Go ahead and compare the different term lengths, rates, loan amounts, and the savings from making extra payments. Use this excel spreadsheet to answer any question that you may think of including calculating the outstanding balance of your mortgage at the end of a specified number of years, the tax returned if the interest paid is tax deductible, etc, etc. If you find some terminologies that you do not understand, hover your mouse over the cells with red triangles and you will be given additional information and instructions which should be very helpful. With this information, you can now go ahead and buy your house or a home. Good luck.

If you have liked this article, and you would want this page to keep up and improved, you can help by purchasing some great items from Amazon by following Amazon links and widgets on this page. A free way to help would be to link back to this webpage from your web page, blog, or discussion forums.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.