How to Get More of Your Money Back: Overlooked Tax Deductions, Bigger Returns

Overlooked Tax Deductions Cost You Money

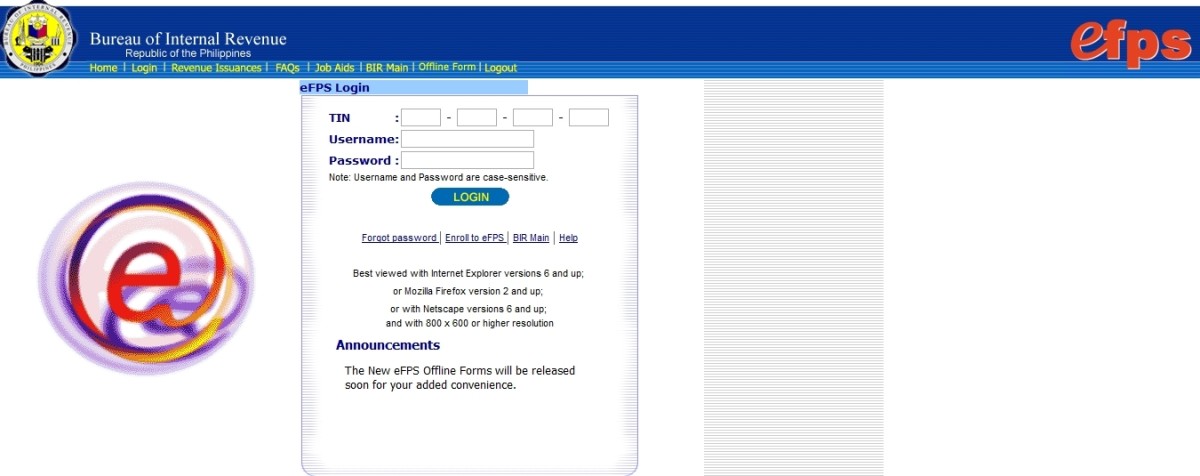

Are You Paying Too Much on Your Tax Return?

More money could be coming your way in the form of a larger tax refund if you don't pass up some of the most overlooked tax deductions. It's easy to fill out the 1040EZ and just forget about all the hassle of filling out that long form. But if you do that, you're likely missing out on some pretty serious cash back on your tax refund this year.

Here's a serious number for you - about 48 million Americans itemize on the 1040 tax form and claim more than $1,000,000,000,000 - that's one trillion dollars - every year. There is a lot of room for mistakes with that many people filing and itemizing deductions. Some of the more serious mistakes in overlooking deductions can cost you hundreds, even thousands of dollars. Here are some of the most commonly overlooked tax deductions.

First-time Homebuyer Credit - $8,000

That's right - $8,000. Do not miss out on this tax credit. If you are a first-time home buyer who closed a home sale by April 30, 2010, or got a contract to buy a home by that same date and closed on the contract by September 30, 2010, you qualify for this huge tax credit. Those who have owned a home for 5 of the 8 years before buying a new home qualify for a big $6,500 tax credit. There are a lot of limitations and rules for this overlooked tax deduction so be sure and check with your tax professional for more details.

Interest Paid by Parents on Student Loans - $2,500

As a rule, interest on student loans is deductible only if you are legally bound to repay this debt. However, the IRS considers money paid by parents toward repayment of a student loan to be money given to the child, who then takes that money and puts it into repaying the loan. If you are a child who is not claimed as a dependent on your parents tax return, you may qualify to deduct as much as $2500 of the loan interest that was paid by your parents. The parents do not get this deduction because they are not liable for the student loan payments.

Costs of Looking for a Job are Deductible

This is a big one this year because so many people have looked for a job in the past year. Just to be clear, we're talking about expenses incurred looking for another job - not your first job. First, keep track of all your job-hunting expenses including food, hotels, transportation, cab fares, air fares, employment agency fees, printing business cards, resumes, even postage and advertising. All of these are overlooked tax deductions that can be costing you big.

Moving expenses are also deductible for your first job or your next job. The best thing about this tax deduction is you don't even have to itemize. Your new job has to be more than 50 miles from your home. This most overlooked tax deduction includes expenses and costs to get you and your household to another location. It even allows 16.5 cents per mile for driving your own car along with the move. Tolls and parking fees along the way are also deductible.

Don't Miss Out on the Childcare Credit

Sometimes this one gets overlooked, especially if your employer is paying or reimbursing you for your childcare costs. If you have two or more kids in childcare, up to $6,000 can qualify for this tax credit. Tax credits are even better than deductions because they will reduce your overall tax bill by crediting you for every dollar you spend. This one overlooked tax deduction can add hundreds to your tax refund.

Be sure and contact your CPA or professional tax preparer for the specific details regarding deductions. There are many other overlooked tax deductions like charitable contributions, state sales tax, reinvested dividends, health insurance deductions, estate taxes, jury duty, energy saving credits, and more.

Overlooked Tax Deductions: How to Get Your Refund Check Faster

How much do you know about overlooked tax deductions?

What is the most common mistake made on IRS tax return forms every year?

Links to more info on Overlooked Tax Deductions

- Money Matters

Some good information on how to save money and the best way to handle your personal finances - The 5 Best Ways to Save Money: $17,000 in Your Savings Account for 2011

So you've decided it's time to start saving money. Even if you do just a few of the things listed here, you can cut a great deal of spending from your budget. Every dollar you save is one more dollar you'll be...