The Effects of Globalization and Taxation on the United States

Globalization has always played a pivotal role in the world we live in. It can be traced back thousands of years to when colonies would make simple trades with one another. However, over the last few decades we have seen an enormous increase in globalization as technology has evolved. Globalization101, a website that conducts extensive research on globalization, defines the term as “a process of interaction and integration among the people, companies, and governments of different nations, driven by international trade and investment and aided by information technology” (“What is Globalization?”). What sticks out most about this is when they say globalization is aided by technology. The development in technology over the years has had a direct impact on the growth of globalization.

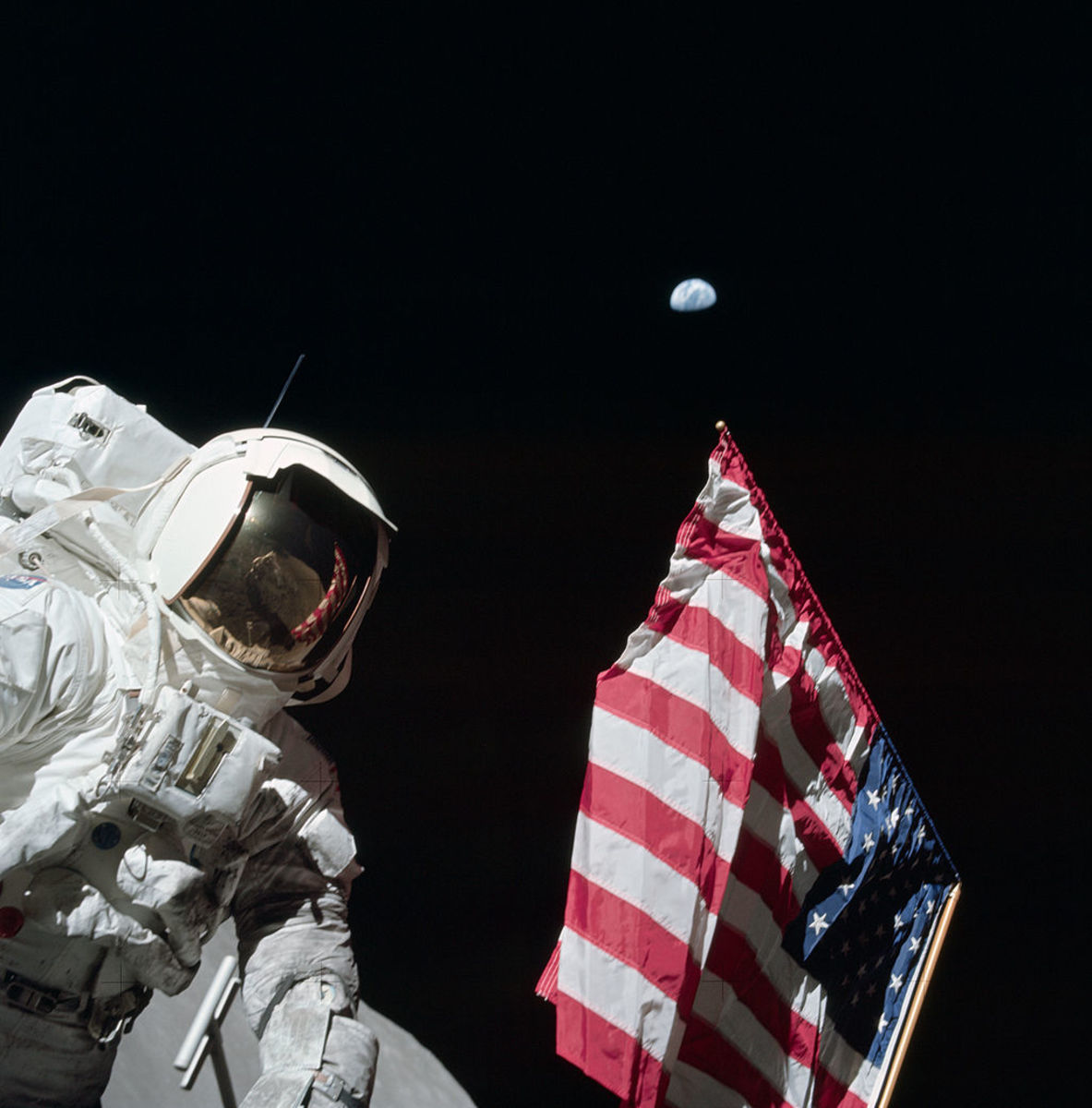

The two main growths in technology that have affected globalization the most are the internet and travel. The internet has played such a big role in the growth process of globalization. It makes it much easier for companies to communicate with each other from different locations around the world. Along with our ability to communicate, our ability to travel has also improved. In today’s world one can travel from New York to Europe in about seven hours. A century ago the only way to travel across the Atlantic Ocean was a four weeklong voyage on a boat. The evolution of transportation has opened the door for companies to grow their businesses internationally. We have seen so many companies start small and evolve into huge international corporations, and it is because of the development of technology. Just as the growth of technology has had an impact on globalization, the growth of globalization has had a great impact on taxation. The laws of taxation are different in every country and companies try to take advantage of this. One country that has seen these effects first hand is the United States.

Although globalization is so great for our world, the United States economy has been affected negatively over the last few decades. Big companies are increasingly moving abroad to other countries where taxes and labor is much cheaper. Companies can make much more money developing and constructing their products abroad and shipping them into the United States. One of the main reasons companies do this is because income taxes in the United States are much higher than that of other countries. James Hines, an economic professor from The University of California Berkley, has done research on the impact globalization has on taxation in various countries. He states, “governments of small countries instead rely on consumption-type taxes, including taxes on sales of goods and services and import tariffs, much more heavily than do larger countries. Since the rapid pace of globalization implies that all countries are becoming small open economies, this evidence suggests that the use of expenditure taxes is likely to increase, posing challenges to governments concerned about recent changes in income distribution” (Hines). In this excerpt, Hines discusses the different obstacles that countries like the United States face. Since the United States is such a big and powerful country, generally large companies find it beneficial to take advantage of smaller countries’ taxes. If the United States wants to prevent companies from moving abroad they must lower income and other taxes for large corporations. The U.S. government should also increase tariffs on goods shipped into our country as smaller countries do. If they make tariffs high enough it will make companies want to keep their production in the United States and it could possibly make companies that have previously moved abroad, move back to the United States.

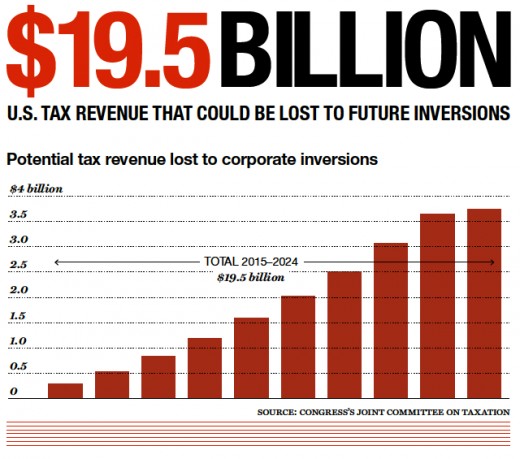

Another reason U.S. companies are moving out of the country is their ability to hide revenue. Although this seems dishonest, many companies move abroad for this reason. United States companies also look into buying foreign companies so they can allocate their earnings abroad and pay much less in taxes. A website called the Economist explains this situation very clearly. They state, “for more than 30 years, companies, especially American ones, have been merging with foreign firms or acquiring them outright in order to shift their tax bases abroad. It started in 1982, when McDermott, a construction company, outsmarted America’s Internal Revenue Service by moving its base from New Orleans to Panama, where it had a subsidiary. Ever since, this kind of move, called a ‘corporate inversion,’ has been an attractive way for American companies with overseas earnings to reduce their tax bills” ("What's Driving American Firms Overseas”). Just like McDermott Construction Company, many companies have followed suit. When companies move abroad they are able to shift their income and report it in the country with the lower tax rates. The only reason companies are able to do this is because of globalization. Without the increase in technology and globalization, these situations would not be possible. Globalization has played a huge role on taxation, especially in the United States.

References:

- Hines, James R., Jr. "How Globalization Affects Tax Design." NBER. N.p., Jan. 209. Web. 14 Oct. 2016.

- Leviner, Sagit. "The Intricacies of Tax and Globalization." Columbia Journal of Tax Law. N.p., n.d. Web. 14 Oct. 2016.

- "What's Driving American Firms Overseas." The Economist. The Economist Newspaper, 16 Aug. 2015. Web. 10 Nov. 2016.

- "What Is Globalization? | Globalization101." Globalization101. The Levin Institute, 2015. Web. 10 Nov. 2016.

- Wibbels, Erik, and Moisés Arce. "Globalization, Taxation, and Burden-Shifting in Latin America." International Organization, vol. 57, no. 1, 2003, pp. 111-136. doi:10.1017/S0020818303571041.