Here's How Pensioners Can Avail Personal Loan

Financial scarcities do not come after due warning. The uncertain nature of economic crisis calls for the availability of loans. A personal loan can be an immediate rescuer when one has been caught up in the dungeons of debt.Be it some unforeseen medical expenses or any other budgetary setbacks, personal loans can drag you out of financial troubles. Broadly, there are two types of personal loans which one can choose from:

- Secured personal loans

- Unsecured personal loans

Needless to say, the eligibility and documentation required for both of these vary in depth. However, personal loans commonly offered are generally unsecured.

Emergencies can arise irrespective of age. Therefore, many NFBCs and banks have introduced personal loans for pensioners to end their misery of surging debts and massive repayments. However, availing loans can be very challenging for pensioners due to old age.

Eligibility for a personal loan for pensioners

The retired employees of Central and State government can get a pension loan sanctioned from the very banks they withdraw their pension from. Although, the specific age criteria differs for various financial institutions. Family pension loan has been facilitated for those individuals who get a pension as an upshot for the demise of their spouse.

Documents required

1) Photo identity proof:. Any one of Passport, Aadhar card, PAN, Voter ID, driving

license would do.

2) Residence address proof

3) 2 color passport size photographs

4) A document for age proof

5) Income proof document

Collateral security terms

Since pension loans are generally unsecured, there are no constraints present regarding collateral demand. Typically, just a guarantee by the spouse or a third party is involved. This is because these loans are secured against the sole source of income, i.e., pension, which can be indisputably recovered. In case of family pension loan, only the guarantee by the spouse is needed. With the fulfilment of this desideratum, the loan gets secured against death as well.

Personal Loan

Repayment terms of the personal loan for pensioners

Depending on various factors, like bank's policy, age and the amount availed, the repayment period of personal loan can lie between 24 and 84 months. During this period, pensioners can repay the amount in the form of EMIs. The rate of interest levied on the loan will again differ with the policy of the bank. Customarily, this rate is lower in the case of pension loan in collation to personal loan.

CRITERIA FOR AVAILING PERSONAL LOAN BY PENSIONERS

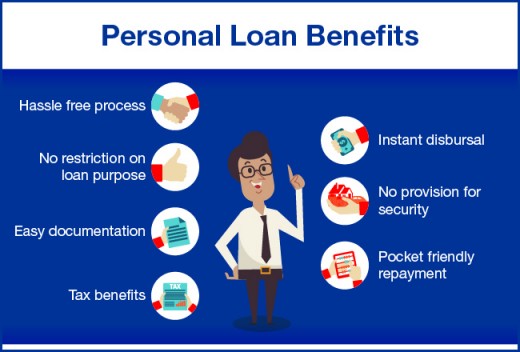

Personal loans are sanctioned quicker and with lesser hassle as compared to other types of loan. However, the following four conditions govern whether it will be beneficial for a pensioners to avail personal loan.

Eligibility

This differs from bank to bank. For instance, United Bank of India has made the scheme of personal loan accessible to pensioners of Central and State government, Defense Services, Educational Institutions, Central and State Government's undertakings are eligible to avail the loan, if and only if they are drawing their pension from UBI. The age of the pensioners wanting to avail the loan should be such that the loan should be entirely paid off before he/she attains 75 years of age.

The pensioners who collect their pensions at any branch of Central Bank of India are entitled to obtain a loan. The loan requirements are also fulfilled by the individuals whose pension gets disbursed in their CBI savings accounts through Treasury / DPDO. No age constraints are established.

In the case of State Bank of India, Pensioners below the age of 76 years lie within the purview of availing personal loan, conditioned that they are disbursed their pension at one of the SBI branches. The terms of approbation for family pension loan follows a different set of terms.

On the other hand, Punjab National Bank offers a personal loan to all pensioners who draw their pensions at one of their branches, regardless of any other terms. There is no existing age limit to qualify for the loan. However, the maximum amount granted varies with different age groups.

Amount and interest

With the United Bank of India, pensioners can get a loan of up to 10 lacs sanctioned. The rate of interest levied is 13.35%.

Pensioners below the age of 75 years can apply for a maximum limit of 5 lacs at CBI. Whereas, pensioners who have crossed 75 years of age are capacitated to avail a maximum loan of 2 lacs.

Following strict age criteria, the upper ceiling on the loan amount is set to be 14 lacs by SBI. The interests over the various loan amounts are spread over the range of 11.65%-14.65%.

On the grounds of helping pensioners meet their personal expenses, PNB offers a maximum loan amount of 10 lacs to pensioners who fall below the age limit of 70 years. This limit plummets down to 7.5 lacs for pensioners of the age group 70-75 years. Pensioners above the age of 75 years are provided with a maximum of 5 lacs loan amount. The rate of interest is set at BR+2.5%, irrespective of the loan amount sanctioned.

Repayment terms

This is again a very crucial factor which is required to be considered while selecting the appropriate source of loan. In the case of UBI, pensioners who are below the age of 70 years need to repay the amount through a maximum of 48 EMIs. This corresponds to a period of 4 years. For pensioners who are over the age of 70 years, 36 EMIs form the upper limit. This corresponds to a period of 3 years.

PNB allows a maximum of 60 EMIs for repayment in respect to pensioners who are aged below 70 years. This limit slumps down to 24 EMIs for the ones who are above 75 years of age. The amount of EMI has been stipulated such that 50% of the Net Monthly Pension is higher than the personal loan instalment after all deductions.

In addition to getting a personal loan sanctioned by the respective bank, pensioners can also consider getting a loan against shares and LIC policies. Regardless of the financial institution you go for, the loan is sanctioned after considering your credit history. Whatsoever, the availability of loans for pensioners does create a breathing space for all of us caught in a fluid financial state.