Retire Wealthy Great Dividend Stocks and ETF's

Safe Dividend Investment Stocks

As the market is falling I look at it as a great time to buy. I am in retirement so I like to look at stocks that are safe and will still provide me with the upside of a dividend payment to live off of. My hope would be at a time soon I could use only my dividends to spend for my expenses.

I have a broker but I still like do some investing on my own as it keeps ,e hip to date on what is going on in the market and gives me some hands on control of my financial income. It is my money after all. I like Sharebuilder and Scottrade. Sharebuilder invests one day every week for a small fixed fee. You set up what you would like to invest in.

It goes without saying you should use your own criteria and due diligence when picking stocks. The stock market is notorious for jumping all over the place. I purchased Netflix several years ago and sold it just before it took off. OUCH!!!!

Steve Forbes discusses why we need dividends

Good income stocks

The following stocks some you have heard some maybe not but they are solid stocks and are paying a good dividend that they will continue to grow. Nothing is a sure thing.

Proctor and Gamble PG

Reynolds America RAI

Deago DEO

Realtiy Trust O

Conoco Philips COP

Lockeed Marting LMT

Pfizer PRE

China Mobil CHL

Cisco C

Shaw SJR

Pepsi PEP

A T &T T

Dominion Resources D

Lowes L

Coca-Cola KO

Vodaphone VOD

Consolidated Edison ED

General Mills GM

You can purchase many of these stocks directly through the company with no fee at all.

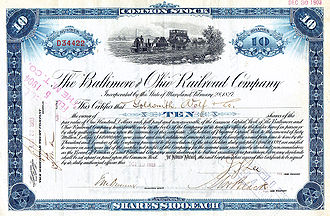

Here is a link to give you an idea of what a direct stock purchase plant looks like DSPP

How to Invest for Beginners

As Your Family Grows So should Your Stock Portfolio

Great ETF'S

Many people like to invest in ETFs .They are a group of stocks with a much smaller expense than a mutual fund would cost although they are made up of stocks they are not as closely monitored as a mutual fund. ETF's are actually a group of stocks that follow a group of assets and trade like a stock with low expenses. They can be be bought and traded like a stock although, as with any investment you will want to hold onto it and watch it closely

I ran a screen and found some low cost highly rated but highly recommended ETF's to buy.

They are QQQ It is a Morningstar 5 star fund made up of many notable tech knowledgeable stocks and also one of the most actively traded EtFs on the market It follows the stocks on the Nasdaq 100 list.

Next is XPH a highly respected medical ETF available. It too is a 5 star etf as ranked by Morningstar. This ETF follows a group of pharmaceutical stocks.This is a particular good time to purchase as the price has dropped.

Next us RHS an equity weighted consumer staple dtf also 5 star ranked by morningstar and it's price has dropped some. It follows the S&P Consumer Staples stocks.

finally i like DTN and DON both 5 star morningstar, DTN is set to follow the price and yield performance of the WisdomTree Dividend Top 100 Index It follow the Wisdom Tree Large Cap Dividend Stocks . DON follows midcap dividend stocks. These ETF's high returns with lower than average risk.

You can find more information on these and many more treat investments on Forbes, Yahoo Finance, Smart Money, Motley Fool, etc.

Where to look

Many of the sites listed above offer free one month free trials. Motley fool has information free of charge also as it is a public information sharing site. Investors share their insights and even vote on what they think a particular site is going to do. It has a total open information policy so you know what the owners and writers are investing in themselves.

Some great magazines to invest in are Smart Money and Forbes as well as Kiplinger. They all have online sites with lots of free information

Investopedia is a great investing learning website.