Home Mortgage Interest - What Impact Does One Percent Have?

Buying a home and taking out a home loan is probably the biggest finance and money decision any of us make. Making such a large purchase usually necessitates getting a mortgage or home loan to make up the shortfall between the deposit we have available and the price of the property.

During the process of obtaining a mortgage, there is a raft of new information purchasers need to become aware of, especially if it’s a first home and first mortgage.

The technical terms, interest rate options, life insurance requirements and lawyers can be bewildering.

Here is some information on the rate of interest and the impact of one percent over the term of the loan.

One percent doesn’t sound much does it?

Yet this 1% can, over the life of the mortgage make the difference between slaving over work for years longer than necessary to pay the interest cost or paying off your mortgage and enjoying several holidays.

Judicious selection and monitoring of your mortgage can mean the difference between paying off your mortgage earlier so you are wandering around Sydney's great markets or taking that dream trip to cruise the world heritage site Halong Bay.

Mortgage Repayments and Home Mortgage Interest Rates

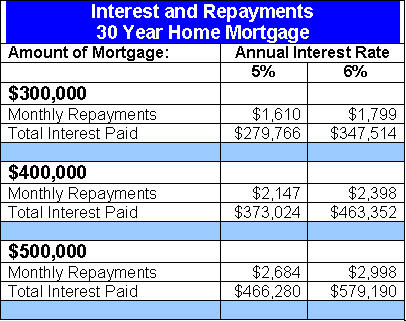

The following table shows the impact of the difference in home mortgage repayments when you pay 5% interest per annum versus 6% per annum.

- For a $300,000 loan your monthly repayments will be $1,699 for a 5% mortgage rate.

- If the rate is 6%, then the repayments are an extra $189 each month or over $2,000 annually.

Over the term of the loan is where the impact is the most dramatic. This table shows the amount of interest paid over 30 years. The extra one percent paid in interest alone on a $300,000 home loan amounts to a whopping $67,748. Now I imagine you could have a few nice holidays on that amount of money!

The above information is a guide.

When The Interest Paid is More than the Initial Purchase

The impact of the additional one percent home mortgage repayments is most dramatic if a mortgage of $500,000 at 6% is taken out. Over thirty years the purchaser is likely to pay for the cost of the home more than twice - once for the bricks and mortar and once to the bank!

The reality is that few of us stay in our homes for over 30 years and so mortgages are changed. Interest rates change too. Sometimes they are lower that those shown in the table and sometimes higher - even considerably higher. What's important is to take out the minimum mortgage you need, shop around for a good deal and pay it off as quickly as you can.

Even changing your repayments from monthly to fortnightly will have a noticeable impact on the time taken to repay the debt and the total amount of interest paid. So too will paying more than the minimum amount.

That's financially smart.

And finally......

This hub is copyright Travelespresso. Please do not copy.

Writers love feedback so please leave a comment, rate my article and/or pass it on. Thanks!