How A Rename To Speck In 2007 Might Have Saved Nadine Antoniazzi's Life

With the recent lifting of a Canadian publication ban, a public discussion of the life and death of Nadine Antoniazzi, the deceased sister-in-law of the mayor of Kirkland Lake, Ontario, Tony Antoniazzi, is once again taking place. Over the past three years, this writer has conducted an exhaustive study into the nature of stocks issued by companies that trade the TSX Venture Exchange.

Comparisons have been made between the distribution techniques employed by firms involved in private placements with companies on which Paul Antoniazzi, Nadine's husband, served as chief executive officer and board member, and those employed by convicted U.S. swindler Jordan Belfort; those employed by characters in the 1973 film, The Sting; and those described in the 1923 series, Reminiscences of a Stock Operator, by Edwin Lefevre.

If Paul Antoniazzi had knowledge that the shares of Opawica Explorations, RT Minerals, or Affinity Gold were going to lose value, and as each has lost over 90 percent of its value, there is reason to at least suspect that he did, and his wife somehow learned this information, Paul, and others, such as his brother Wayne, could be seen with motive to attempt to keep his wife from sharing that information with others.

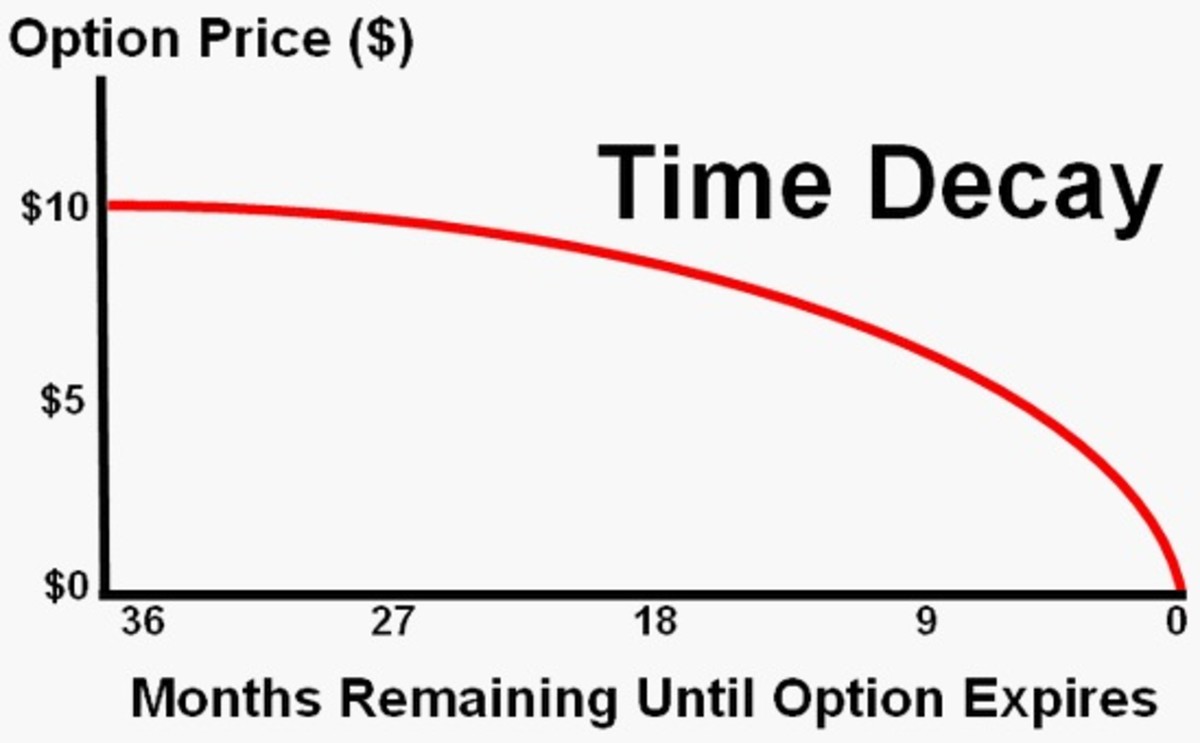

An option is a product that is defined as the right but not the obligation to take delivery of some defined quantity of an underlying asset, for a set price, the strike price, for a set period of time. Speculators sometimes buy out-of-the-money options with the hope that the price of the underlying asset rises above their strike price, going into the money, and offering a big payout. These speculators understand that when they buy an out-of-the-money option that if the price of the underlying asset doesn't rise above their strike price that the value of the option contract will go to zero. This is demonstrated in the following chart, which all option traders know and understand:

Option time-value decay

Penny stock time-value decay

Stocks sold by Paul Antoniazzi trade like options

The problem with the stocks sold by Paul Antoniazzi's companies is that they lose most of their value. If, instead of stocks, Mr. Antoniazzi's companies sold investors options, the situation would be different. Then, investors would understand that they are purchasing a highly speculative investment that is likely going to lose almost all of its value, something that does not appear to be currently understood by all participants on the TSX Venture Exchange. However, there are problems with using the term option to describe the shares of companies like Opawica Explorations and RT Minerals.

Others terms, which serve exactly the same purpose, are speck, shyre, speculity, speculation, and inspeculation. For example RT Minerals Corporation could be referred to as RT Minerals Speculation, and its shares as shyres, and stock as speck. Before being allowed to trade in speck, investors could be required to be shown a chart comparable with the Opawica Explorations time-decay chart above, similar to how options investors must be shown the option time-decay chart above. In this way, a higher level of "full, true and plain disclosure," as described by the Ontario Securities Commission, would clearly be achieved.

My January 20, 2017 report to Canadian Safety Minister Ralph Goodale outlines the need to enter precise definitions for stock, share, corporation, and speck, shyre, and speculity, into federal and provincial legislation. I have proposed that only companies with more than zero revenues be permitted to issue stock, and to refer to their equity as such, and that companies with zero revenues only be permitted to issue speck, and refer to their equity as speculity.

This change would remove the ability of stock distributors to deceive and an unknowable amount of motive from Canadian society. This writer has previously asked how many deaths comparable to Nadine Antoniazz's have taken place in Canada, where police appear to be completely oblivious to this source of motive. The rename of the equity of revenue-less companies from stock to speck solves the problem of having legions of Canadian police understand what is a somewhat complex issue, possibly not always apparent at the time of a death. A rename to speck simply removes this motive from Canadian society and would save an unknowable number of lives.

If this rename had occurred in 2007, and Nadine Antoniazzi's death is related to seeming deception surrounding her husband's stocks, she might still be alive now. How many other Canadians, and individuals around the world, have lost their lives in the name of deception related to the stock market?

© 2017 Stephen Sinclair