How to invest in Masala Bonds? Everything you wanted to know about Masala bonds

Masala Bonds - An introduction

What are Masala Bonds?

Masala Bonds refer to rupee denominated borrowings by Indian entities overseas. There is always demand for long term capital in India to build infrastructure and the government is exploring various ways to tap the same. In November 2014, the International finance corporation (IFC) issued a Rs. 1000 crore bond to fund infrastructure projects in India. The bonds were listed on the London Stock Exchange and were named Masala Bonds to attract attention of investors. Already, the Japanese and Chinese have named their Bond instruments after food stuffs

Through Masala bonds, corporates in India could issue rupee bonds in overseas markets. This will lower their borrowing costs as well. They also eliminate exchange risks often connected with External commercial borrowings (ECB). Masala Bonds are also seen as a step towards full rupee convertibility. It will internationalise the Rupee.

Maximum amount

Maximum Amount: According to RBI's norms, an eligible borrower can raise upto INR 50 billion through these bonds in a financial year under the automatic route FDI. The funds raised cannot be used for real estate activities and other areas restricted for FDI.

What does it mean for investors?

As Masala Bonds are denominated in rupees, foreign investors will be taking the currency risk. As time goes on, more investments will strengthen the rupee. However the investors will gradually benefit as more and more infrastructure projects take off in India and the yield from the bonds will also rise

The IFC bonds carry a yield of 6.3% which is far higher than what the US treasury bills yield. Further, the IFC bonds are priced below comparable maturity government yields worldwide as they are AAA-rated. With inflation generally kept under control by RBI (Reserve Bank of India) in India, the rupee is expected to remain stable and hence India offers an exciting avenue than most emerging markets

The Masala Bonds offer an opportunity for foreign investors who are otherwise not registered in India, to have an exposure to Indian debt markets.

Masala Bonds

Interest Payments

As per government norms, interest payments for rupee dominated bonds should not be more than 500 basis points above the yield of G-secs (government securities) of corresponding maturity. For example, if the yield on a G-sec is 8% the interest rate for rupee denominated bonds cannot be more than 13%

Competition with Domestic Bonds

Already, there are Rupee bonds that are issued for foreign investors in India and listed on the local stock exchanges. The IFC has earlier issued Maharaja Bonds, its onshore bond programme in India. Masala Bonds will compete with these bonds as well.

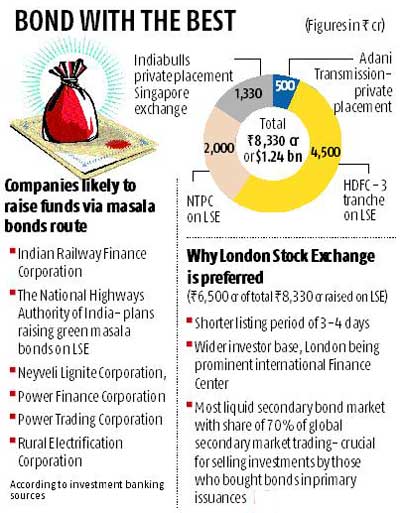

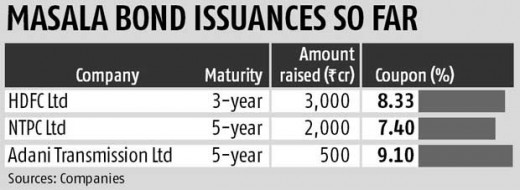

Who are issuing Masala Bonds in India?:

Indian Railway finance corporation, NTPC Ltd , HDFC and India Infrastructure Finance Co Ltd (IIFCL) are in the process of floating these instruments soon.

For Further details and guidelines on masala bonds, visit RBI.org.in