How to Save Money Every Month

How Much Would You Like to Save Each Month?

How to Set a Monthly Money Saving Goal: Budgeting Your Money

If you want to effectively save money every month you need to set a goal and have obtainable ways to do so. Setting goals really helps motivate us toward reaching a goal and everyone has something they could save for. So ask yourself some questions: Why are you wanting to save money? To buy a new car? To have something to fall back on in your savings account? Let's say you want to buy a new, $12,000 vehicle and you want to buy it within six months. That means you will need to put $2,000 aside every month in order to reach your goals.

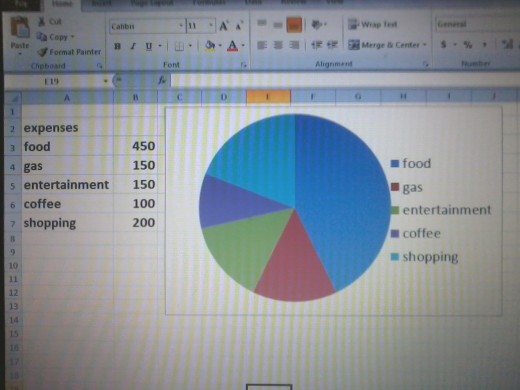

The first step to take when creating a money saving goal is to analyze your expenses and look at where you are spending your money. Doing this will help you see where you can make cuts on your spending. If you have Microsoft Excel, it is very easy to set up a pie chart to get a great visual of your spending every month. I have created an example (see the photo below) to show you some categories that you can add to your chart. As you can see, I just used to columns to write down what I spend my money on and how much I spend each month. All you have to do after that is highlight those two columns and click the pie chart.

Using the pie chart as a visual you can see in which areas you need to cut your spending down. For example, my food expenses are pretty high because I eat out a lot. This is something I can change.

Once you have set your goal, you need to figure out how much money you have coming in each month and how much you will have to set aside from that amount. Your budget is the money you have to spend during that month.

Pie Chart of Your Monthly Expenses

Save Your Change

Use Cash Instead of Your Card to Save

Many of us have quit using cash because it is so much easier to just slide your card to pay for things. Yes it is easier but, when you only use your card as a payment method you don't see the actual money you are spending.

I recommend only paying your bills with your debit/credit card. Some places actually give you a discount for going paperless and using your card to pay. After the bills are paid take the rest of your budget out in cash and put your card away. Using cash will enable you to actually see the money you are spending and might make you more conscious to how you use it and will help you stick to your budget.

Another great thing about using cash to pay is that you get change back! I know, I know, not everyone is as excited about change as I am but, it really adds up! Every time I get change back from a transaction I bring it home and put it right in my change bag. Before you know it, you will have enough change saved up to fill your tank with gas or splurge on those shoes that didn't fit into your budget. You can also get some change rolls from your bank and add them to your savings account. It takes time but it really does add up and will help you reach your savings goal faster.

How to Start Cutting Down on Your Expenses

Now that you have figured out where your money is going it's time to start cutting back. Stopping at the local coffee drive-thru has become a part of so many people's morning routine. That's about $4 a day and $80 a month if you only go on weekdays. So it might be time for you to break out the old coffee maker that is way back in your kitchen cabinet and start brewing your own every morning. It costs about $10 for a can of coffee and about $5 for creamer. Those items should last you a month, maybe an extra $5 if you are a creamer lover, so about $20 a month. That's about a $60 savings already!

Tobacco users can do the same thing with their chew/cigarettes. You can't exactly brew your own tobacco but you can roll your own cigarettes and cut down and possible quit in order to reach your monthly savings goal. You would not only be getting healthier but also saving money at the same time!

Plan Some Home-Cooked Meals

Another category many of us are spending too much money on per month is food. So quit eating out so much! Not only is it usually healthier to cook at home, you can make the same things you get in the restaurant for a much lower price and have leftover ingredients for another meal.

Another great thing about buying your groceries instead of eating out is that you can plan ahead and buy things like chicken, cheese, and eggs in bulk and save more money. If you sit down at the beginning of each week and plan some meals ahead that use the same ingredients you can buy only what you need and in bulk which are both money savers.

Cut Down on Entertainment Expenses

It's almost unbelievable how many people still go out to the movies when it costs about $12-$15 per person and then an extra $10 for popcorn and a drink at the concessions. If this is something you do a lot you can really cut down on this entertainment expense buy going to a dvd kiosk or investing $10 a month in Netflix or a similar movie program. Going out doesn't have to be obsolete, however, it's worth it to cut back in the name of saving some money to do something more meaningful than seeing the latest films.

Another large entertainment expense, especially for younger people, is going out to the bar to socialize. When did partying at home become lame? It doesn't have to be. Instead of paying $5 or more for a single drink at the bar plus a tip, pitch in to make a batch of a favorite drink and hang out at home. You can still meet new people if everyone brings someone they know and it will definitely help your wallet. If you do decide to go out, you can have some drinks at home first and split a cab both ways with a couple of friends.

More Ideas to Save Money

There are so many ways to save up during the month and the different ways really depend on your lifestyle and what you do in your spare time. Here are some ideas that may apply to you:

- When the weather is nice, bike or walk to work or school. Even if it's only once or twice a week it still saves some gas.

- See if your local bus route works into your routine and ride the bus every once in a while.

- Split entertainment costs with your date. Sure it's nice to be able to buy something for someone but if you do it constantly it can add up to a lot of wasted money.

- Color your hair at home. This is a pretty simple process if you are doing all-over color or streaks using a cap.

- Start couponing. Subscribe to some local stores' newsletters and save the coupons for things you usually buy.

- If you are not in a contract with your gym drop the membership and pick up biking, hiking, or walking.

- Save energy. This will cut down on your utility bills and put more money in your pocket.

- Learn how to change your own oil and more DIY projects that can cost you.

- Drop your cable service and invest in Netflix or reading.

- Only buy food that is on your list at the grocery store. Some impulse buys just rot in the fridge.

- Assess your car insurance and phone bills. See if switching to a different company can help you save.

- Put your savings into a bank account that will give you some interest each month.

Finding a Second Job to Save Money

- How to Find and Work a Second Job While Maintaining Your Life

Thinking about taking up a second job? Here are some important things to consider when taking that step and making more money. How to work around your schedule and manage your life with two jobs.