Internet Bank Accounts Are The Way Of The Future!

Shopping Online For Banks

Back in the day, I remember when I used to write checks out by hand and mail them out. Of course, today that's a thing of the past. The scariest part is that I went with my current online bank without knowing what I do now ... and I was very fortunate, as I chose a good one on the first shot. However, with many more options available today, it's far easier to find a bad one, which is why we will do a little research together to determine how to find the good ones.

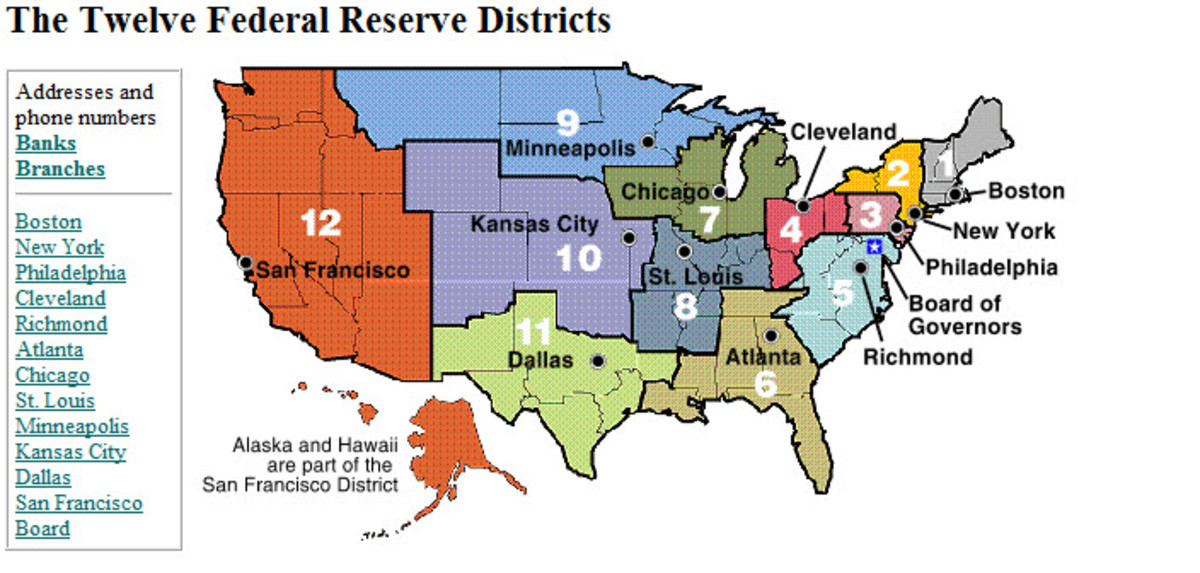

First off, back when I was looking around I only had local options as online banking was still in its infancy. Of course, much has changed since then, allowing one to live in Los Angeles and do all of their banking in New York City. The question you may be asking is ... why bother? After all, is is having an online checking account really that great of a deal? In many respects ... yes.

Look Out For The Vultures

Wherever there is money you will find hands out waiting to receive it. So, how do you avoid the vultures? By learning how they operate. First thing you need to know ... avoid the hype! If something seems too good to be true, it typically isn't. That's why you need to keep your eyes open as you look for a great online checking account. Be on the lookout for any hidden fees or rules that could affect your account.

Remember, this article is all about educating you so you won't be picked apart by the buzzards, so at no time will I recommend a bank to you. This is all about educating you so you can find a great deal, and given enough information you will do just that.

And so ... let's look how the vultures operate so we can fly past them, eh?

Free Online Checking

Free? Really? Better be certain about that. Some online banks charge a monthly fee - I know mine does. Other banks charge a fee per check written, and this is where we need to think ... which deal works the best for us?

I've seen where some banks charge $7 a month for online checking. Now, when you write about 12 checks a month like I do you save on each stamp that you don't use. Currently, a stamp costs 44¢, which comes out to $5.28 I save each month on stamps. Doing the math, you find that I spend $1.72 a month for my online checking. Not bad! And if I write a few extra checks I break even. Of course, there are some banks that charge extra if you write beyond a certain amount of checks each month and you need to know if this fee exists and how much it is.

And there are banks that charge for each check written. If you're being charged $1 a check - and yes, I have seen fees this high - then you need to find a different bank. Any fee beyond 60¢ a check should tell you to search elsewhere, as you don't want to rack up high monthly fees in check charges.

A Low Minimum Balance

Most banks want a minimal deposit to remain in the bank. Now, this isn't such a bad thing. After all, for a bank to remain solvent they need to have money to lend. There's no better way to insure that than to make it so each client has a minimal balance in the bank.

Of course, some minimal balances are way too high. Anything over a $300 minimum should be walked away from unless you have a comfortable cushion in your current checking account. Bad times fall upon us all, which is why it's nice to know we can have access to our money when we need it the most.

Of course, most banks will allow you to drain your account down to $0, but the penalty is often very high to do so - taking money away from you when you need it the most. As such, we look for a bank that has no minimal balance, right?

Wrong! As said earlier, a bank that charges no minimal balance isn't very solvent. As such, to stay in business they need to achieve that solvency somewhere, which means a lot of hidden fees. It's far better to go with a bank that requires a minimal fee of about $100, as these banks have less reason to look elsewhere to insure their profit line.

If the bank you are looking at requires a minimal balance, know what the fees are for going below that balance and how it's calculated.

Overdraft Protection

This is one of the best benefits a bank can offer and is often overlooked. How many of us can say we have never overdrawn their checking account? I know I can't. Sometimes people hold onto the checks you write and forget to cash them ... until months later when you have forgotten all about them. That one hidden check can prove to be a catastrophe. That's why having overdraft protection 'can be' ideal.

Of course, the operative words are *can be*. What most people are unaware of is the fact that once one check overdrafts you the other ones that follow count as overdrafts too, until you get your balance back out of the black hole. So, if you bounce one check for $20 and then bounce three more for $30, $8, and $43, then you are $101 in the hole. And on top of that, you are charged an overdraft fee for each check, which is typically about $35 per check. This adds $140 to your debt which is also drafted against your account. That's a negative balance of $241 and a strong argument *against* overdraft protection.

So, what's the argument *for* overdraft protection? Well ... without overdraft protection the bank bounces the check and you are typically charged a $20 bounced check fee. A $15 savings per check, right? Not exactly. You still have creditors that haven't been paid and they typically have late fees or punishments of their own, which offset any savings. Also, these bounced checks can have a sever impact on your credit, so overdraft protection is an ideal thing to have - just be aware of the overdraft fees. Most banks offer $200-$300 in overdraft protection, but a few offer up to $500, which is ideal, as it makes room for the bounced check and the fees that arrive afterwards.

No matter how you look at it, overdraft protection is a good ting and a bad thing ... and something you want, but never want to take advantage of unless you *really* must. It's not free money, and should be treated as a very high interest loan used only for emergency situations. In other words, you should plan your overdrafts if they are going to occur and plan on how you will pay the bank back ... never let yourself fall into an overdraft by ignoring your account!

Watch This Carefully!

A Free MAC Card

We all love and hate the MAC card. This little card has supplanted cash for many of this, allowing us to make purchases everywhere without carrying any money with us. Of course, there is a charge for each transaction, but there is an added bonus most of us don't see ... by not having cash in our pockets we do consider each purchase a little bit more.

Many internet checking accounts include a MAC card, so those that don't should be considered as arcane and not as valuable. After all, if you can pay your bills 24 hours a day (which we will get to), then why not be able to have access to your money 24 hours per day?

Fees are bad, but convenience is good!

24 Hour Banking

It makes sense that a bank offering an internet checking account will also offer online banking. These go hand-in-hand, but is it really a benefit?

I'll forget that you asked that question and go into all of the benefits:

- You can check your account balance 24/7

- You can write checks online 24/7 - no more paper and no more stamps

- You can reconcile your account online 24/7

- You can review your past expenses 24/7

Look Out For Hidden Fees

Before signing up with any bank, look over every fee they charge. After all, that online bank will be there tomorrow, and for some reason it wouldn't be, you would then be glad you didn't do business with them.

Read over everything and understand what each bank has to offer and ask yourself ... does this benefit me or does it work against me? Write down the pros and the cons for each bank down on a piece of paper and then weigh it out before making your final choice.

Again, I'm not here to make one for you. For if I did, regardless of my good heart or intent, I could be seen as one of the vultures with their hand out, sifting through your pockets for change. This is about empowering you to make a great choice, and that involves giving you the information needed to do so.

So, What Are You Waiting For?

You should be looking up banks and finding the one that will work for you. Did I forget something?

Wait! I did!

Sorry about that one folks, but I got so busy jabbering away that I forgot the most important part ... how to get your money into an online bank. After all, one can't walk from Los Angeles to New York City to make a deposit, and I don't think any of us would feel safe mailing our check cross country.

This creates a problem. How do we safely get our money into the bank? Thankfully, there's a simple solution ... direct deposit. You simply talk to your employer and tell him you want your checks deposited into your online account, which they are often happy to do as they have an online banking account of their own and by giving your check to you by direct deposit they save themselves from writing a check to you. Everyone wins!

So ... I ask again ... What are you waiting for? Start looking through your options and find the online checking account that will work for you. :)