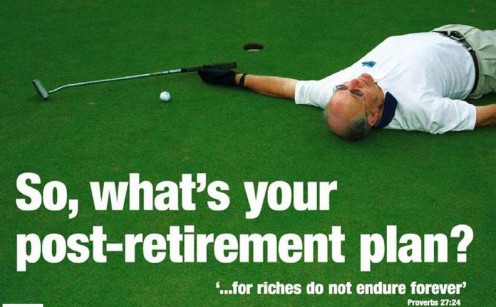

Financial Planning tips for Retirees. How much can I spend each year without running out of money?

" The pride of dying rich raises the loudest laugh in hell " - John Foster

After years of working and saving, retirement is at hand. Through choice or chance, you are facing life without employment. You now need to establish a spending plan that will last you and your spouse (if any) as long as either of you is living. There are two basic ways you can go wrong when it comes to spending down your nest egg. First ,you can live it up, overspend in the early years of retirement, and potentially run out of money later on. Spending too much too soon is a mistake you simply can't afford to make. Few, if any of us want to spend our final years living as a ward of the state or a burden to others.

The second mistake is to underspend it, driven by an irrational fear of running out of money - even when your sources of income are sufficient to sustain your desired standard of living. Underspending can be a difficult problem for people in the habit of saving and investing to overcome.

A real story of Jacob Leeder

In June 1997, 'The Baltimore Sun' reported a story about Jacob Leeder, a retired Army Scientist who died in February 1997. He drove a 1984 Oldsmobile stationwagon and lived in a modest, one-story brick home. He had a girl friend, Ann Holdorf. He had no children or pets. He didn't have a cable TV. He spent most of the time in his girl friend's house watching stock-market reports in her TV and using her phone to call his brokers.

They rarely went out to eat, and when they did, it was to a cafeteria or a cheap restaurant. Most evening she cooked food for him. For her birthday, Leeder give her a $100 check. They never took vacations. When she brought up the subject, he would say, "Not now, the market is bad".

Leeder died in 1997. He left an estate valued at approximately $36 million. His girlfriend for 24 years Ann Holdorf, had no clue about this estate. However, he did leave her $150,000. Most of his fortune went to estate taxes, with the remainder earmarked for two nieces, animal right groups and veterinary schools.

Be flexible

If Boy Scout's motto is to "Be Prepared", the retiree's motto is to "Be flexible".

What most of us want is a plan that ensures we do not outlive our money while enjoying it as much possible. Your early withdrawal rate must be adjusted as years go by. Stock Market returns go through long periods of feast and famine. High inflation rate may come along and diminish purchasing power. Unexpected things may happen in life that can raise or lower living expenses in ways you never anticipated.

Best ways to insure income for life

1. Keep your fixed living expenses as low as possible.

Retirement is not the time to have an enormous mortgage, expensive car payments and credit card debts. You need to have the flexibility of spending less during bear markets and more during bull markets. When market has a great year, spend some of your profits, buy a new car or take a round-the-world-cruise. When the market is down, if your budget is tight, you put those purchases on hold for an year or two.

In Search Of Retirement Security

2. Have a viable way to earn income if needed

Technology makes it possible to do many paid tasks from the comfort of our home, working as much or as little as we want. For instance, you can write articles in Hubpages and get paid. You can share your experiences in life with the younger generations. Every extra dollar that comes in is one that doesn't have to be withdrawn from your savings. There's a psychological benefit too. Working part-time keep you productive, makes you feel like you are a contributing member of the society, and keeps you mentally sharp.

3. Delaying retirement

Delaying retirement, waiting until full retirement age to draw Social Security, and purchasing an immediate annuity is another way to increase the odds of solvency. Every year you delay retirement is one more year to add to your savings, one more year for your savings to compound, and one year less tat you will be depending on your savings/investments for income.

As of this article, the earliest retirement age when you can collect Social Security benefits is 62. However, delaying payments until full retirement age will provide a larger, inflation-adjusted pension. For example, someone whose full retirement age is 66 will receive a pension that's 33 percent larger than he or she would at age 62. However, it is best to begin drawing social security at age 62, if you need the money, are not expecting to live a long time, and are not earning over $12,000 a year.

4. Purchase an immediate annuity that guarantees a fixed monthly income

An annuity can be a good option for those ages 75 or older, but not a good option for young retirees.

The retirement challenge

How much can I withdraw each year?

Finally, here is the answer to the big question. If you want to make inflation-adjusted withdrawal each year, increasing the amount withdrawn each year in accordance with increase in cost of living. Begin by withdrawing no more than 4% of the portfolio's (savings) beginning value. If by contrast, you want to simply withdraw a fixed percent of the current value of the portfolio, withdraw a maximum of 5% a year. Keep in mind that the value of portfolio may go down in some years, so if you withdraw a fixed percentage, be prepared to take a pay cut or plan to earn extra income. The good news is, the value of your portfolio will go up in some years, allowing you to withdraw a bit more. Also, as we age, it should be possible to increase our withdrawals because of the shorter time left to withdraw.

How to Calculate Retirement Income?

Like to read more on retirement planning ?