Master Your Credit Score Ratings

by Kathy Batesel

Why a Good Credit Rating Matters

Before I became a real estate agent, I had about the same idea of credit as the average person. I knew my scores would be good if I paid my bills on time, that I had to have a high enough score to get approved for a home loan, and that landlords examined my credit before renting to me, but I had a lot to learn!

When I became a Realtor, I was lucky. Two local lenders took time to educate me on important aspects of home lending, which enabled me to help my buyers find good loans. However, some buyers had blemishes on their credit records or had been victims of identity theft and struggled to get loans. I spent some time investigating how to help my buyers tackle some of the credit issues that came up again and again.

I'll talk about how to address credit blemishes in another article, but for now, I'll talk about something everyone should know how to do in order to protect themselves and their quality of life: How to check your credit report and credit score.

What Can Happen if You Don't Track Your Credit?

view quiz statisticsWhat Your Annual Credit Report Reveals

Your free annual report will show the names of companies that have extended you credit and your payment history with those companies. You will not see your credit score, however. Keep reading to learn how to get your credit score and tools to help you manage it without paying for a subscription service.

Your credit "score" is a number value that credit bureaus calculate using the Fair Isaac Corporation's algorithm. It may be called a FICO score because FICO is a trademarked name that belongs to Fair Isaac. Your score is not revealed on the free reports you're entitled to each year by federal law.

Your Experience

Have You Checked Your Credit Report Before?

Get Your Annual Credit Report for Free

The three credit bureaus sponsor an official website called Annual Credit Report as a free service to consumers in order to comply with federal laws. There are some copycat sites that try to charge consumers for something they aren't required to pay for, so only use this link to check your report!

On the landing page, you'll see that all three credit agencies sponsor the site, and there's a drop-down box to select your state. Use the state you live in now unless you've just moved in the last couple of months.

Once you've made your choice, you'll be asked which agency's report you want to view.

Experts say to check your credit report annually. Here is another option:

You can only select one agency at a time. Most people who follow the "once a year" plan get the first credit bureau report, then they go back and pull the second agency's report, and then the third. They usually contain very similar information. Once you've obtained the reports, you cannot check for updates until a full calendar year has passed.

Because credit changes and identity theft can appear suddenly, I encourage you to obtain just one report at a time, and to review another agency's report a few months later. This will let you keep better tabs on what happens with your credit.

The drawback to this method, if there is one, is that some lenders only subscribe to one of the credit bureaus. They may not report to all three. (This is also why you'll have three different FICO scores even though they all use identical algorithms to calculate your score.)

Let's pretend that I'm stealing your identity. I open a credit account in your name at ABC Furniture Rental, who subscribes and reports to just one of the credit bureaus. If you obtained your TransUnion report and ABC does business with Equifax, then you might not discover my theft of your identity without checking all three. However, if you reviewed all three of your reports in January, and I opened the account in February, you might not discover it until a year later. By then, I have opened several more accounts and wreaked havoc on your scores.

Instead, if you checked TransUnion in January and did not discover my theft until you got your Equifax report in April, you'll have been able to detect it in time to stop the problem from becoming as bad as it can be.

Either method - once a year, or one credit bureau at a time throughout the year - is better than not checking at all, so do whatever is easiest for you!

Look for anything that is incorrect. If you see an inaccurate birthdate, address, or accounts you never opened, take steps to correct them by clicking on the agency's "file a dispute" link or contacting them according to the directions you'll find at the end of your report.

Free Credit Score Check and Monitoring

Get Your Credit Score for Free

I've already described how your credit report will contain information about credit accounts you have now as well as closed accounts, but it will not reveal your FICO score. Each of the credit bureaus offers to let you see your score for a fee, or they have credit monitoring programs that allow ongoing access to your account reports and your scores. These programs can cost $30 per year or more, depending on which package you select.

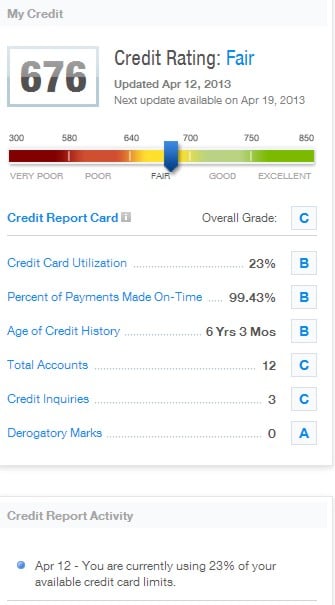

A new website will let you get your TransUnion score as often as daily, without it harming your credit in any way. Credit Karma enables its users to see their credit score now, plus figure out how their own actions could help or hurt their score. Credit Karma uses the same secure identity verification process as the credit bureaus.

The photo here shows a bit of my Credit Karma profile. I discovered an error in the age of credit history that is lowering my score slightly, and some credit inquiries I did not make. I can now contact the credit agencies to have this evaluated when I file a dispute. I also see that the number of accounts I have open is 12, and that this is rated as a "C" score. I can consider whether closing one or more account will help me. To figure out which account(s) to close, I can use other tools on the Credit Karma website that will reveal an estimate of what my credit score would look like if I changed this account or that one. Because age of open accounts, payment history, and other factors influence our scores, the tools on this website are invaluable for predicting the impact of your actions before you make a mistake!

How the Information on Your Report Affects Your Scores

Sample Account (Closed)

This is a sample of a closed account on my credit report that shows the type of information you'll see. Open accounts report the same information. Both types of accounts may show a charted payment history as well.

Lender Name: (DELETED)

Lender Address (DELETED)

Account Number: 20159XXXX

Current Status: PAYS AS AGREED

Account Owner: Joint Account

High Credit: $ 90,500

Type of Account : Mortgage

Credit Limit:

Term Duration: 30 Years

Terms Frequency: Monthly (due every month)

Date Opened: 12/1998

Balance: $ 0

Date Reported: 11/2004

Amount Past Due:

Date of Last Payment: 11/2004

Actual Payment Amount: $ 765

Scheduled Payment Amount: $ 648

Date of Last Activity: 11/2004

Date Major Delinquency

First Reported:

Months Reviewed: 38

Creditor Classification:

Activity Description:

Paid and Closed

Charge Off Amount:

Deferred Payment Start Date:

Balloon Payment Amount:

Balloon Payment Date:

Date Closed: 11/2004

Type of Loan: VA Real Estate Mortgage (Veteran's Administration)

Date of First Delinquency: N/A

When and Why to Check Your Credit Report

Consumers are often told to check their credit report each year to look for unexpected changes. I think the reason for this common wisdom is because the United States government requires credit reporting companies to provide you with one free copy per year of your report.

It wasn't always that way. It used to be that you were only entitled to a copy of your report if you'd been turned down for credit.

Today, with identity theft becoming a growing problem, it's absolutely critical to keep an eye on what is happening to your credit! You can save years of problems without spending a small fortune repairing your good name.

Identity theft can occur without your awareness. When the thief creates thousands of dollars of debt using your personal data, those unpaid debts can appear on your credit report for as long as they remain unpaid, especially if the police are unable to locate the culprit. Imagine discovering that a thief purchased a new car or a house, only to abandon it a few months later without having paid a single month's payment! When you try to buy your own new car, the lender is likely to see you as a bad credit risk.

Nipping identity theft in the bud is important to preserving your credit rating. My husband first got held responsible for a few thousand dollars of debt right around the time we met. His soon-to-be-ex wife had opened a credit card without his awareness. She used a different mailing address, and he didn't know about the account until a collection agency started threatening him.

He closed the account, paid the bill, and just two weeks ago, discovered that two more credit accounts had been opened in his name. We don't know if his ex or someone else targeted him. Fortunately, we caught it before any charges had been made and were able to take protective action.

I recommending reviewing one credit bureau report every four months or so, especially if you have a specific reason:

- Receiving credit cards you did not request.

- Suddenly receiving mail with your address, but an unfamiliar name or with the name of someone who has not lived at your address for a few years.

- If you've been notified that a company you do business with may have had their customers' personal data stolen.

- If you anticipate buying a house or car in the next few months.

- If you discover unusual charges on your credit card bill, even if they're for just a few cents.

Benefits of Maintaining Good Credit

By ensuring that your credit score stays good, you will get lower interest rates on loans. For major purchases, like a house, this can add up to many thousands of dollars over the life of the loan.

Utility companies will waive deposits if they know you're a good customer. Wouldn't you rather have that hundred bucks in your wallet than "on hold" at your electric company for a year?

You can make smaller down payments for large purchases. Home buyers with good credit can qualify for Federal Housing Authority FHA-insured loans. That means they have to come up with about 3 1/2% of the home's purchase price for a down payment. If a buyer's blemished credit makes them ineligible for FHA loans, they may be forced to produce as much as 20% of the home's purchase price to be able to buy it.

Your credit report can even affect whether or not you land that great job!

Poor credit costs consumers millions of dollars each year, even if they were victimized. Simply checking your credit report regularly can help you make sure you're not one of them.