How to Deal With Your Debt and Still Have a Life

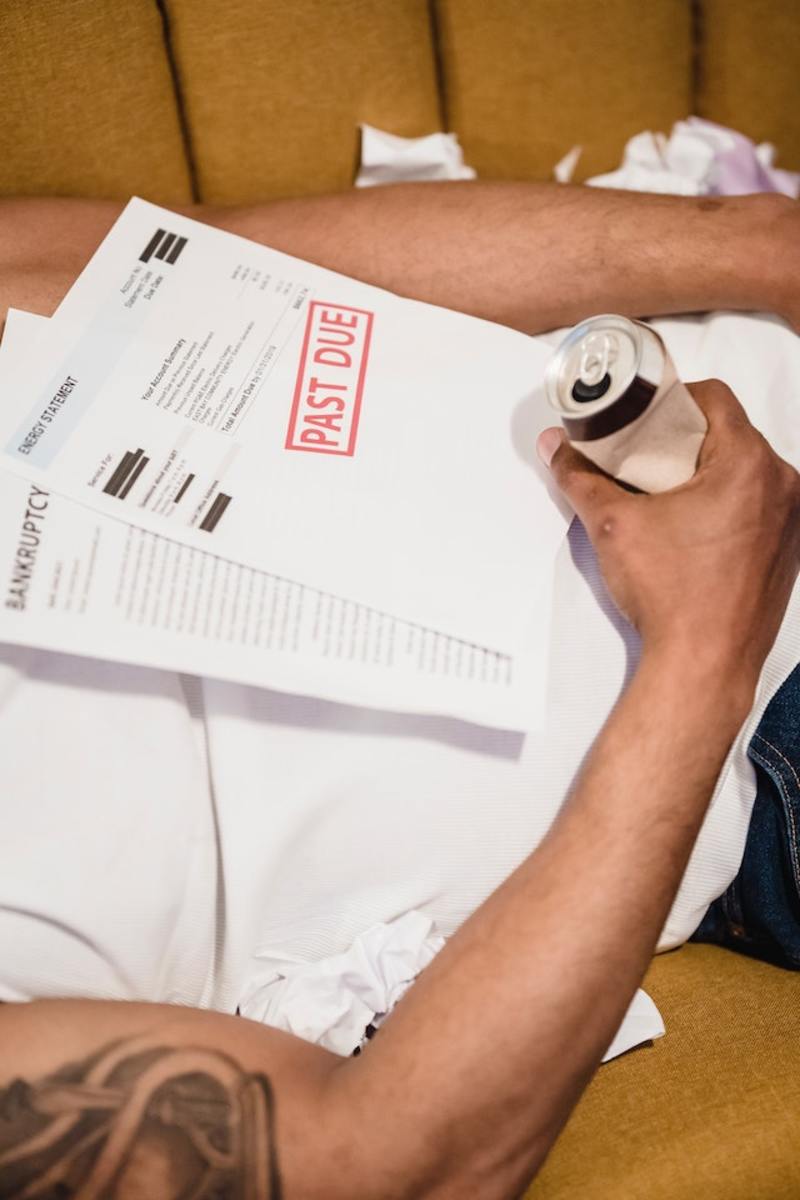

Debt can be overwhelming, causing sleepless nights, even panic. It can feel like a mountain of worry, huge and immovable. Regardless of how deeply in debt you are, there are ways to manage your debt and to still have a life along the way. This brief article describes some tools that may be used to help alleviate debt and live a happier life.

In order to manage your debt, you need to stop ignoring it. Get to know it. Know why and how you got into debt. Understand what causes you stress and emotional pain about it. Is it the high interest rate that causes you stress, or the total amount owed that is so stressful? Is it the telephone calls that you receive from creditors that causes you stress? Is it that you feel badly about owing so much? Is it that you feel uncertain about your ability to pay it off? Is it that the debt itself, or the lack of money makes you feel poor? Whatever the situation, it is time to stop ignoring it. Get to know your feelings about it.

Handling your debt will involve taking a good look at your spending patterns, as well as the emotions that drive them. It will require that you confront those patterns and change them. It is not an easy task, but with discipline, it can be done. Then it is important to look realistically at what you can to do to pay it off and become debt free.

The rules to halting the hemorrhage are simple, the execution, more difficult.

First, and foremost: stop incurring debt, with the possible exceptions of a home and/or cars. No more charging anything. If you don’t have the cash, do not buy it. Sounds simple, but in this plasticized monetary economy, it can be difficult to do.

Second: determine a budget that allows you to live below your means. This may mean that means must increase, costs decrease, or some combination of both.

Third: apply the difference to your debt, in a systematic and disciplined fashion.

Write down all your debt. List the debt, the amount owed, the interest rate, and the minimum payment owed each month. Add up the total minimum amount owed each month for all your debt. Write down the amount you pay each month.

If your debt exceeds your means, consider calling your creditors and negotiating either a lower interest rate, or a lower total amount. People often fail to do this, primarily because they believe that creditors will not negotiate. Most creditors will however, especially once they realize that the debtor is in earnest.

We all hate to budget, but a good working budget is essential. There are online tools that you can use for free such as Mint.com, or YNAB (You need a budget). Once you set these up, they can be handy to use and the graphics make it easy to tell whether you are on target or overspending.

Or keep track of your finances the old-fashioned way—with a notebook or ledger. Track every expenditure: debt, savings, fixed costs and variable costs. However you choose to do it, it must be done.

Even though your focus may be on the elimination of debt, it is important to save money. At the very least, you must have an emergency fund that you contribute to so that unexpected financial obligations do not necessitate incurring further debt. In addition, you may decide to allocate savings to retirement vehicles and/or other goals. You may consider keeping an envelope system for smaller goals such as new shoes or a new computer. For larger goals, like vacations and such, consider using a separate account in which money is automatically deposited each month. Small, but steady use of savings tools helps enormously. Again, a systematic approach is best. Save consistently, even if you have little to no extra money.

Once you have these tools in place, decide how you want to order your debt for payoff. Some prefer to pay off the debt with the highest interest first. Others prefer to pay off the debt with the smallest balances first. Whichever method you choose, be consistent, be on time, and be aggressive. Once a debt is paid, apply that money to the next debt in order. And cheer yourself on a job well done each time a debt is paid.

Finally, continue to have a life in the face of debt. Debt is a factor in your life right now, but it need not be so in the future. Develop a hobby outside of work if you can. Hobbies can make life more fulfilling, and often lead to passions that can become income generating tools later. Discover your local library, join a book club, exercise. Whatever you choose, choose something or a set of things that make you feel good about yourself and your life. Life is short.

Copyright/All rights reserved Audrey Howitt 2012. Do not use or copy without the express written permission of the author.