How to Free Yourself from Debt!

In our modern world, it's common for just about everyone to have debts hanging over them. It can be hard to save money, be financially stable, and afford to reach for your dreams when all of your income is being sucked away by debt. Getting out of debt is one of the best things I ever did for my life, and you can do it too. Here are some helpful steps to be on the way to fulfilling your debt-free dreams!

Stop Spending

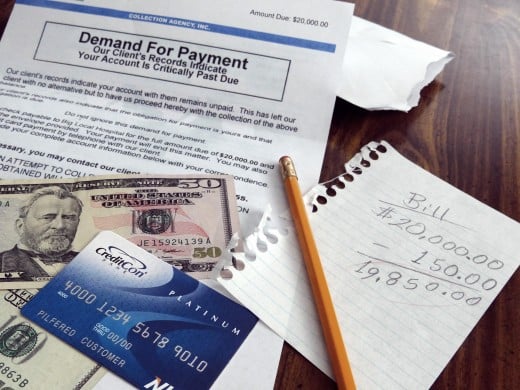

Step one: stop spending! I know it's easier said than done, but money can't build up if it's being constantly spent. Obviously things like bills and utilities must be paid (as well as paying minimum payments on credit cards and other debts - I'll get to that later), but the more additional spending you can cut, the better.

Analyze any non-vital spending habits to determine where things can be cut. It may help to write down a list of everything you buy each month; sometimes seeing it on paper puts things into perspective. Do you buy lots of clothing? Do an inventory of your closet; you'll probably find that you have more than enough clothes already. Your smartphone or tablet is almost certainly good enough to last for another year or so before an expensive upgrade. Think about daily luxuries such as coffee or snacks, alcoholic drinks, or fast food, and plan to cut

down or eliminate them for a while.

A money budget always has ins and outs, but try to minimize the money flowing out as much as possible!

Double Down on Loans

Most people in the modern age have at least one loan, sometimes many more than that. On top of a mortgage, many people have car loans, student loans, credit card balances, and other looming debt to deal with. Getting rid of these parasitic debts is one of the best ways to get your budget in gear and improve your finances.

Choose a debt, and go whole hog on it. Financial gurus have different opinions about which debt to tackle first, with some suggesting picking off the small ones first, and others who insist on working on the biggest, most expensive one. Either way is fine; the key is to hop on one of them and nail it hard! Once you've chosen a debt, put as much money as possible on it. The goal is to pay it off completely, so you never have to worry about it again. Of course, keep paying the minimums on every other debt, especially credit cards, so that they don't go into default and rack up fees.

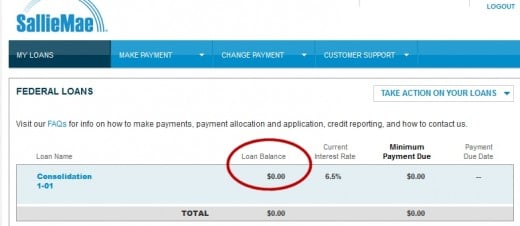

One of the best things I did on my debt-free journey was to pay off my student loans. The average college student finishes their education with tens of thousands or even hundreds of thousands of dollars in debt. This debt hangs over your head, charging extraordinary amounts of interest, for decades. A much better solution is to get rid of it ASAP! Try to pay double or even triple the loan amount each month, as much as you can afford. The more you pay, the lower the balance gets, and the less you pay out in interest. It's a fantastic feeling to see that zero balance on a big loan!

Other Ways to Save

Once you've stopped any extraneous spending, you can free up more money by looking for other ways to cut corners and save. Food spending is one big place to find ways to pinch pennies. Switching to store brands can save money without a big decrease in quality. Look for coupons to clip, or weekly specials that get you a deal. Consider buying in bulk at a discount outlet for items that you eat a lot of or that will last a long time. Bring your own lunch to work instead of eating out.

Other possible options are gasoline savings, such as accumulating points for price cuts at the pump, or limiting travel to save gas. Consider consolidating cable TV, internet, and other entertainment media into a money-saving package deal. Books, DVDs, video games, and other entertainment options can be found at libraries, borrowed from friends, or found on less expensive online services such as Netflix. Brown-bagging a lunch each day at work is usually much less expensive than buying at the cafeteria or a fast food restaurant (usually healthier, too!). Turn the thermostat down a few degrees and get cozy in a sweater or robe to save on utilities. Even pennies here and there can add up to big savings and free up money to slam onto your debts.

Make Additional Income

Eventually you will get to a point where there simply aren't any more corners to cut. The next step is to find new sources of income.

Traditional ways to do this are to get a second, part time job in addition to your regular 9-5. Other options may include babysitting, pet sitting, or even house sitting as a freelance job. For more modern internet options, there are income sources such as Fiverr, Ebay, article writing, and Swagbucks. If you have a talent at drawing or creating, starting an Etsy shop or Patreon can be a good way to get some extra cash flowing. Research the many ways available to get some extra dollars here and there! Everyone has some kind of talent, hobby, or ability that can bring in extra income.

And of course, when you get extra money, don't spend it - put it on the debt and watch it disappear!

Conclusion

I hope these tips have been helpful. I applied them in my own life, and I was able to pay off my student loans, a car, and two credit card balances in less than two years. The only debt I have now is my mortgage, and I'm working on that too!

It can be done! Good luck, and don't give up!