How to Prepare a Budget Plan

What is a budget plan?

A budget plan is simply a thoroughly written calculation of one’s expenses, savings and spending. Yet, this very simple concept can be tedious to write and difficult to follow through with consistently. If you are anything like me you have probably written several budgets but lost steam somewhere along the way. If you are ready to clear your mind of your bad experiences and start off fresh, you have come to the right place.

What are expenses?

Expenses are simply what it costs for you to live. Your life consists of several categories including health, bills, rent/mortgage, car, etc. Knowing how much each thing costs you a week, month and even year can help you prioritize spending and save money.

What are savings?

Savings refer to money that is set aside each week, month or year. Often there are goals attached to savings (short term or long term). Other times, savings are simply set aside for emergencies or future expenses.

Books on Budgeting

How to Prepare a Budget Plan

Step One: Keep Track of Spending

The very start to becoming financially responsible is to find out how much you spend. Writing down how much you spend and on what each day for 90 days ought to give you a clear picture of your spending habits.

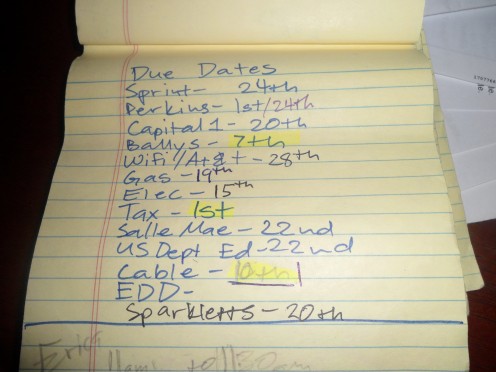

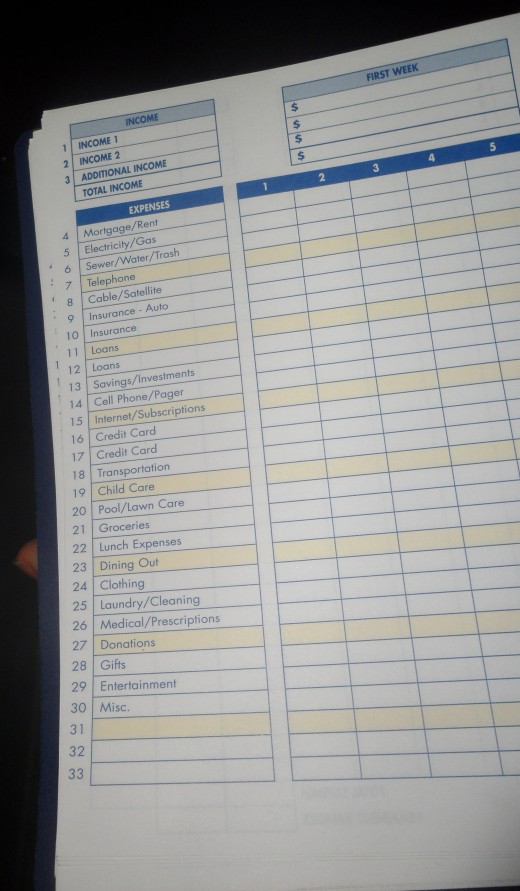

Step Two: List Expenses

Once you understand your spending habits, lump common expenses together. For example, over the counter medicine, toiletries, hair products, salon visits and nail shop visits could be included in a category you could name self-care. Your light, gas and water bills could all be included in a category entitled utilities. A common list of categories for expenses might look like this:

- Rent/Mortgage

- Car

- Utilities

- Food

- Clothes

- Debt

- Self-care

- Health

Step Three: Savings Plan

Do you have any short term or long term goals in need of funding? How about retirement? Emergency nest egg? Make a plan for your specific goals and decide how much you can afford to contribute to these goals each time you are paid. While some goals may be easy to fund each month, others, such as retirement funds may require more research. Your Human Resources contact as well as certified financial planners can help you determine a realistic plan based on your specific needs.

Step Four: Monthly Budget

Use the information you gathered in your expense monitoring along with your saving plan to determine how much you want to reasonably spend each month/bi-monthly in each category. Your budget needs to balance. This means that it should equal no more than what your income will be for that month or two week period.

Not one to write it down? Try using Excel to create your budget!

Do you have a budget?

Step Five: Manage Spending

Once you have your budget, in order to keep track of your spending, write down every time you spend in each category. This can be tiresome but trust me, this makes all the difference. I have found a budget journal to be extremely helpful for this. At the end of each day, I check in to my journal and add my spending for the day. Some people find keeping receipts helpful. This does not work for me. It make take a few months to find a routine that works best for you but keep with it and you will see progress in the area of controlling your spending and saving.

Step Six: Monitor and Adjust

If you notice that something has changed in your expenses or it is simply not enough money allotted for a certain category, adjust your budget. As long as you keep you budget balanced, you should be able to adjust as needed.