How to Set Short Term Financial Goals: Lifehack

It is very important to have goals in life.

Goals help us to reach our destination fast and in a systematic way.

Goals can be categorized into three types namely short term goals medium-term goals, and long term goals.

Short term goals can be classified as goals for a time period of about six months.

Long term goals can be classified as for a time period of 3 to 5 years. Medium-term goals can be classified as for a time period of 7 months 3 years.

In this article, we will discuss 10 short term goals. Specifically, I will discuss 10 financial goals.

1. Learn about stocks and investments

Decide to learn about stocks and investments.

When it comes to personal finances, one should have some knowledge about stocks in investments.

Some portion of your money should be invested in equity and investments.

This will ensure that you want money on your money.

It is important to make your money work for you.

2. Earmark funds for contingencies

Your second financial goal should be to set aside money in case of unforeseen circumstances.

Life is pretty unpredictable and it can throw you off balance at any time. That's why you need to be ready financially for any contingencies that come up.

Regularly set aside funds for such unforeseen financial crises.

By doing this, you will not be caught unawares during times of crisis.

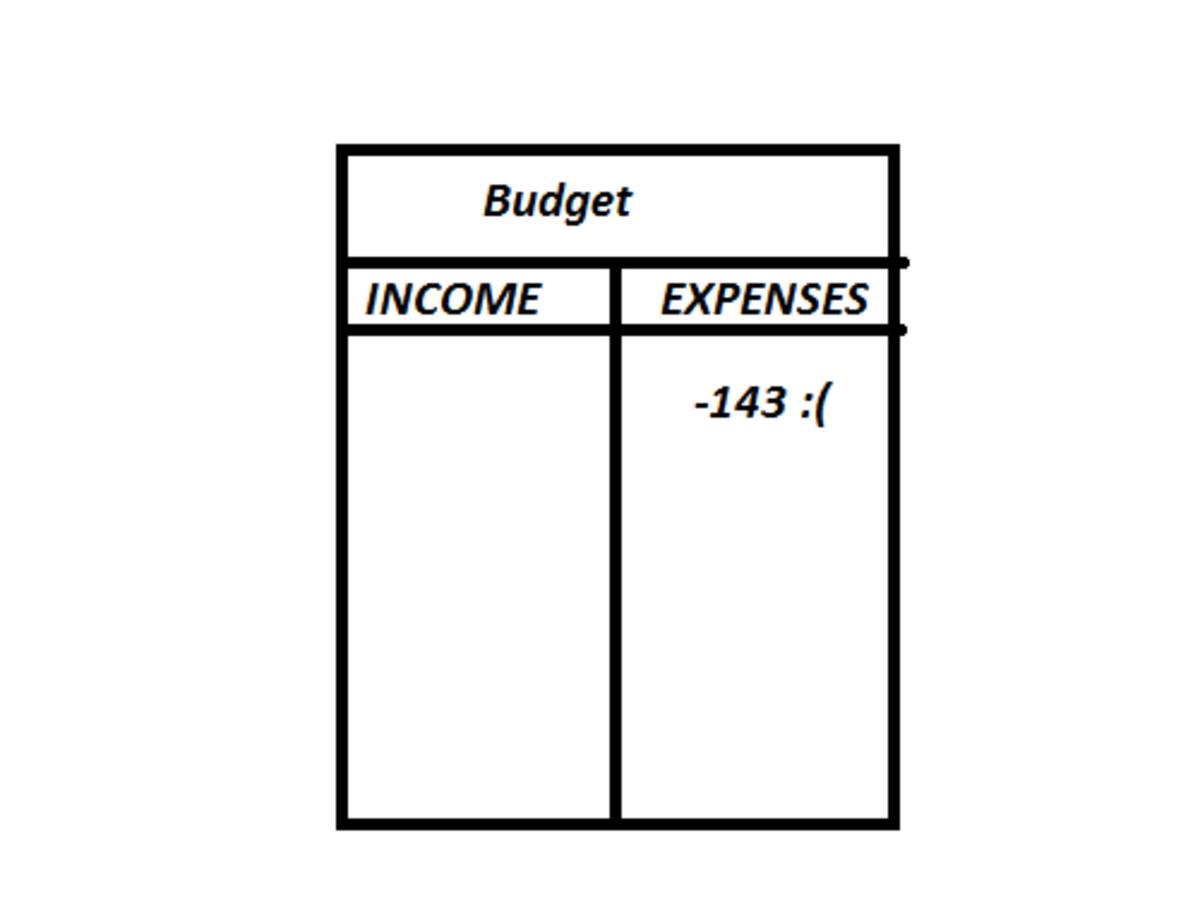

3. Prepare a monthly budget for your finances

Financial management includes earning money, spending money, and budgeting.

Budgeting is nothing but planning how you spend the money that you earn.

Budgeting helps you to understand where your finances come from and where they go.

Budgeting will help you to spend your money wisely and in a planned way.

It is very important to keep a budget every month.

Budget money for the foreseen expenses like rent, power bills, phone bills, groceries, and all the other routine expenses.

A certain percentage should also be kept aside for contingencies.

4. Get rid of credit card debts

All kinds of debt are like curses. Credit card debts are no exceptions.

Once you get caught up in the vicious cycle of credit card debts, it's almost next to impossible to come out of it.

Therefore avoid credit card debts like a plague.

Make it your top priority to get rid of these debts within 6 months.

If you can do it before 6 months, that's wonderful.

Also, make it a goal never to fall for credit card debts again.

5. Start savings account this month

Another short term goal is to start a savings account this month. Savings accounts will help you to save your hard-earned money.

There are facilities where you can automatically transfer a predetermined amount from your salary account to a savings account.

Take advantage of this automatic transfer facility and transfer of fixed amounts to a savings account.

6. Reduce your monthly expenses

You could also have a plan for reducing your monthly expenses wherever possible.

Check your list of expenses and watch for those expenses where you could cut down.

What you manage to spend less would automatically become your savings.

There are many things which we don't really need but we end up buying.

7. Find out a new source of income

One short term goal which you could have is to find out new sources of income- possibly passive income.

Adding a new source of income would naturally reduce the stress on your finances.

Some more money would always be welcome in the family.

With the Internet explosion, there is the possibility of earning money online in hundreds of ways, literally.

People are making money by the thousands on the internet through blogging, YouTube, and affiliate marketing.

Digital marketing, virtual assistant, social media manager, digital coaching and hundreds of other different ways are available to make money online.

8. Learn a new course on handling finances

There are many courses on handling personal finances available online and free too.

Enroll yourself in one of these courses and learn how to handle your finances systematically.

Since these courses are online, you can learn them at your own time and pace.

Take advantage of all the learning that the internet offers and better your financial position in life.

9. Read one book on finances this month

Apart from learning through online courses, make it your goal to read at least one book on finances in one month.

There are many books and finances like “Rich Dad Poor Dad'' by Robert Kiyosaki, “Think and Grow Rich” by Napoleon Hill, and many other good books.

These books will change your mindset about finances and attract abundance in your life.

In order to grow rich, you need to change your mindset first.

These books will teach you exactly how to do that.

Once you change your mindset, things will start happening fast, and blessings will start flowing into your life in abundance.

10. Check whether you manage your finances properly

Finally, make it a habit to check your finances at the end of each month.

Check whether you have followed the budget as planned.

Check whether you have deviated in some way from your budget.

Take note of the expenses that were not budgeted.

See whether you have spent more than what was budgeted on some financial heads.

Analyze your budget and make the necessary adjustments to your finances.

Once you incorporate these goals into your life, you will manage your money systematically, save more money and have more money at your disposal.

Monetary discipline will bring peace, happiness, and joy in your family life too.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2020 Nitin Khaire