How to live on one cheque a month

Introduction

If you're like me, you need to plan out your expenses for at least 3 weeks at a time, because you only get paid once a month. To many, the thought of being paid once a month is unbelievable, undesirable, and impossible.

The truth of the matter is, that it is quite easy to get along being paid once a month. In fact, I've found this to be more beneficial to me, as I don't spend nearly as much as I used to when I was being paid every two weeks. You really learn to budget, and only purchase what you need, instead of what you want.

Now I'll admit, the first cheque I received at my job was pretty awesome (because you only get paid once a month, it's a bigger amount), and I may have gone a little overboard with it when I shouldn't have. I continued to live as I was before, only now I had more money to spend than usual. It wasn't until the start of the 3rd week when I checked my bank account and realized that there was a lot less money than usual, that I learned that I needed to make a serious change now that I'm only being paid once a month.

Step One: Make a budget

When I was paid every two weeks, it was much easier to count on money being in the bank when I needed it. If I overspent one week, I just had to wait another week and there would be more money. Now that I'm only getting paid once a month, if I overspend, chances are I'm going to cause a lot more problems for myself than in the past. This is where a good budget comes in.

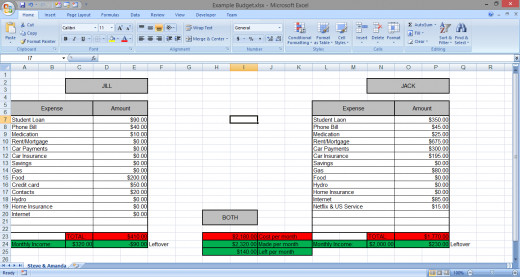

Making a budget is fairly simple and straightforward. I like to use Microsoft Excel spreadsheets because it does quick calculations and you can set it up to allow you to make changes as needed (I think we all know that nothing stays the same forever). The included screenshot is the exact same format I use to manage the budget for my fiancee and I.

What you want to do, is enter your net monthly income (The amount you have left AFTER tax) rounded down to the next multiple of 5 (I like to use rounded numbers as this makes estimating a bit easier.). If you are wondering why we round down instead of up, it's simple. Rounding down ensures the amount you have entered is an amount you actually receive and worst-case-scenario planning, which I find works better for financial planning.

Now make a list of all of your monthly expenses such as a student loan, car loan, rent or mortgage payment, phone or cable bill, and enter the amount rounded up to the next multiple of 5. We round this up, to give us a better idea of how much money we have left after all of these expenses are paid.

Next add any expenses you have on a semi regular basis, but average out the cost and round up. For example, say you have a particular medication that you take. You need to purchase a refill every 3 months. That purchase costs you $85. To average this to a monthly cost, simply divide 85 by 3. To ensure it fits with the scheme we have been using for everything else, round it up to the next multiple of 5. This means that we need to save $30 every month for this medication. Doing this prevents the need to take one large chunk out of the money we get paid when we need it.

It's a good idea to include expenses that vary each month such as gas for your car, food, or entertainment. Make an estimate on how much you spend for each and add it to your list. If you are unsure, I recommend online banking, as it can help you keep track of your expenses.

We're almost done, we just need to total our expenses and then subtract it from our income to see how much we'll have left each month. It's optimal for your monthly expenses to use 40% or less of your monthly income, but it is possible to live with a higher percentage. To figure out what percentage of your monthly income is used up by expenses, simply divide your total monthly expenses by your monthly income, and then multiply that by 100. If your percentage is 90 or over, you may need to sacrifice some luxuries such as cable, Internet, or going out to eat, or you'll be up to eyeballs in debt in a year's time!

It's ALWAYS possible to prevent debt, you just need to be willing to find money elsewhere by giving up some things, or getting another job to help pay for things.

What do you find is using your money the most?

Step Two: Prioritize

Now that you've put together a budget (Good Job!), it's time to sort out what is more important to you. Chances are, if you've just started a job where you only get paid once a month (or you've been there a while and just can't seem to get the hang of being paid once a month), your expenses to income percentage may be much higher than you like. Not to worry, there's a proven strategy to bringing it down, you just have to be willing to work on it.

Prioritization is making a conscious decision to value something more than another. For example, my fiancee and I want to travel the world but we are getting married next year. The world is going to be here after we get married (as far as we know anyway), so saving for our wedding is more important.

It is up to you to look at your own life and what you want to achieve, and prioritize your goals. You don't have to plan out exactly how you want your life to go (because if I've learned anything in life, it's that nothing, and I mean nothing, ever goes exactly to plan). You just need to make a sort of outline as to what you want to do, and the order you think you'd like to do it in.

Say you want to get your degree, get married, get a job in your field, travel the world and have kids. These are all admirable goals. If I were to prioritize how I like it would be like this:

- Get my degree

- Get a job in my field

- Get married

- Have kids

- Travel the world after the kids have grown up and moved out

Now that you've got a plan (or outline), this next step is the most important part.

Right now, what is your first goal in life?

Step Three: Stick with it

Now that you've got a budget and a plan (or outline), comes the most important, and often hardest part, sticking to it. Trust me on this one. I have no doubts that you will encounter some situations where the temptation to spend is almost impossible to resist, it's what we get for living in our consumer culture. Everywhere you look there's a reason to spend your hard-earned money. This is why this part is the hardest.

You need to increase self-control and remind yourself of your goals. Seriously think each potential purchase through and ask yourself:

Do I really need this?

I've found that asking myself this question before purchasing something helps a lot. You really begin to differentiate between things you need, such as food and a place to stay, and things you want, such as the newest video game or movie. I've also found that online banking helps tremendously.

If you are comfortable with the idea of online banking, sign up for it if you haven't already. If you have a smart phone, download the mobile app for your bank and check it regularly. Consistently seeing how much you have in the bank will really help you to monitor your habits.

Once you make a few small changes, the rest is cake and you're on your way to making a comfortable living only being paid once a month.

Final Thoughts

When I started getting paid once a month, I thought I'd never be able to do it, there were definitely days (weeks even!) where I just wanted to spend a little more, or buy something spontaneously because I "just HAD to have it", but I've been doing it for well over two years now, and I think I've done pretty well. I'm saving money for my wedding, and I've been able to put money aside for a vacation here and there, as well as spontaneous gifts for me and my fiancee once in a very long while.

It may be hard to do, but it's incredibly worth it. I've become very good with managing our money and I even have some friends asking me for advice.

As always, stay excellent.

- Financial advice, basics, a financial plan

A short and sweet ABC of financial truths which can give direction to those trying to budget and make their dollars go further.