Earned Income Portfolios - Don't have one? Get one Fast!

How was work today? I am sure it was fantastic … or maybe not.

What if there was no work for tomorrow? Or the day after that? A week from now? Two years from now? How will you sustain yourself, pay the bills and feed the kids? Good luck with getting a job in time in this marketplace. And if you believe that you can keep a stable job these days, fuhgetaboudit!

Life after a layoff, termination, resignation or seasonal work can become unstable and overwhelming – quick. Most individuals diligently return to pounding the pavement daily, entertaining odd jobs here and there until it’s time to move on to the next odd job. In the meantime, your expenses are stacking up, your kids are starving and your family is about to be out on the streets. Soon you find yourself drowning in debt and health problems, so stressed out that you can’t think straight enough, long enough to get another job. Might I toss you a life vest? Catch!

It’s called an earned income portfolio. Simply put, an earned income portfolio is an organized list of multiple forms of income-earning opportunities available to you (and your family) for supplementing the loss of any other form of income, especially during emergencies and economic crisis. Earned income portfolios are not necessarily the same as financial portfolios, which consists of a combination of securities and investments - usually under the management of a financial advisor. Forms of income for an earned income portfolio can range from investment income to employment income to income generated from hobbies to income generated by family memebers. The portfolio describes the scheduling and allocation of various forms of income. The key is that the alternate forms of income in your portfolio should be “stable and consistent”, increasing in value over time if changing at all. For example, an earned income portfolio may include: 1) your regular day job; 2) annuity investments, and; 3) a long-time, a money-making hobby that is scheduled every weekend (i.e. playing the piano at a local café for tips). There are tons of income opportunities available to you with no skills required. Earned income portfolios may include activities you are currently learning, such as sewing, fishing or painting, of which you hope to capitalize on in the future.

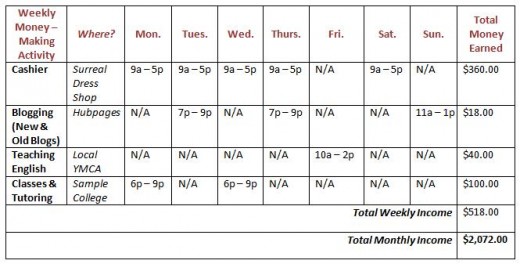

An example of an earned income portfolio is below for your review. This particular portfolio allocates regular and consistent time frames for each activity during the week. Note the format of the table which allows for simple changes or updates.

Example of a Simple Earned Income Portfolio

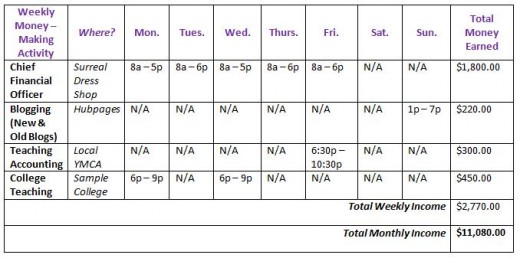

If you have more skills and experience (and you are able to afford a babysitter if necessary), your earned income portfolio may look a bit more like this example below.

Example of an Advanced Earned Income Portfolio

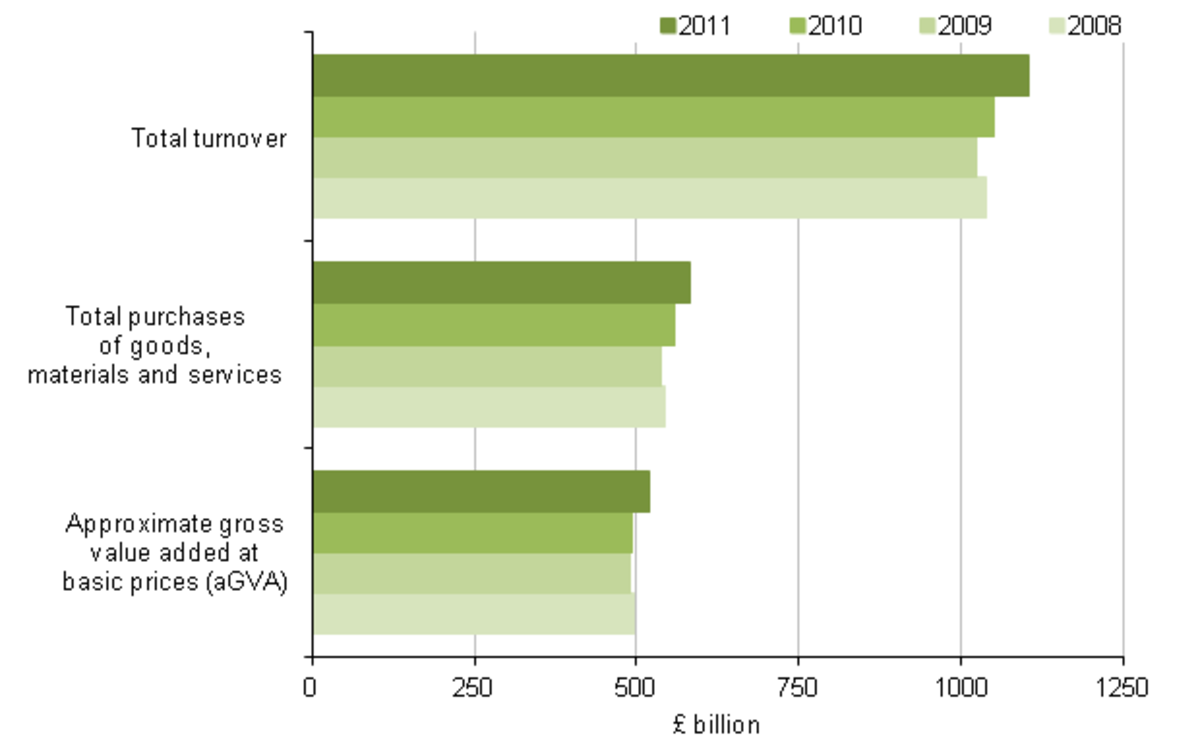

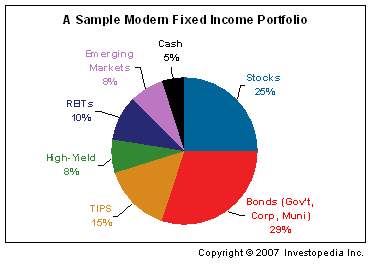

Some income portfolios are specialized. For example, below you will see a fixed income portfolio that focuses on income derived from various types of fixed-income investments, as opposed to income derived from employment or work projects. These types of portfolio use pie charts as opposed to tables and specify income allocation merely by percentages of the "Total Income" generated or earned.

Earned income portfolios do require regular management. I recommend a time management chart, such as a Gantt chart,

MS Project tables or MS Excel spreadsheet. As life changes, so will opportunities to make money – opportunities will increase, decrease or be replaced. An important aspect of earned income portfolios is that you must manage your time or schedule accordingly. If your regular job hours increase, then you may consider decreasing the time you spend teaching English during weeknights or baking cakes on the weekend. Changes in family, health, residence, etc. may also impact your ability to manage your current schedule of income activities. You, as the creator and manager of your own schedule, must be diligent in attending to your portfolio requirements, since no one else will do manage it for you.

It is indeed true that any of these activities can still become unstable, but that’s okay. Why? Because you have other forms of income in your income portfolio (or plan) to substitute. Yay! It is very unlikely that every one of the many forms of incomes listed in your plan will become inapplicable at the same time. (Hence the term earned income portfolio, where components of the portfolio offset or balance each other.) The plan permits for an emergency course of action should other forms of income fail or terminate for any reason.

Overall, earned income portfolios work! They are functional and practical. They will help you increase your total income, save money, minimize possible stress, meet financial goals, plan for changes in life, build a safety net, etc. Income portfolios are easy to create and manage. Earned income portfolios are our friends – our own personal financial consultants.

So, if you don’t have an earned income portfolio yet, you should get one fast - like yesterday. Perhaps the next time you feel as if you are drowning, you would have fallen off the yacht you bought with all that extra cash you earned and saved.

Read more of my financial blogs at http://missinfo.hubpages.com/