INSURANCE FOR SINGLES | Financial Planning

Insurance for Singles

Insurance plans for young singles, including health insurance, auto, disability and life insurance – part of complete financial planning for future wealth.

-----------------------------------------------

Successful Singles Have Style

And it isn't something they bought in a store.

It's something they planned.

They chose an educational track that would give them status in a field with a future. They looked for a job with a career path instead of a dead end.

Right now, they are writing a plan for complete financial security. If they are doing this in their twenties, they will probably attain that goal by their fortieth birthdays. You can be one of them. This article will help you get there.

With insurance for financial protection and with the right financial planning advice, you can accumulate wealth and attain complete financial security. You don't have to be born into a wealthy household or marry a rich spouse. You can build it yourself.

Health Insurance for Singles

It Begins With Health Insurance

That's probably the last thing you would have guessed. Statistics show that the years from 20 to 35 will be the healthiest time of your life. Even so, one in 70 men in this age group develops cancer. If you are a woman, the statistics are one in 50. The chances of your developing heart disease are even greater. Add to that the probability of serious injuries incurred in an automobile accident, and you will begin to see that, even at your age, your health is at risk and so are your finances.

Major illness and serious injury strike people in your age group everyday. In addition to the acute suffering they cause, they can assault you with financial disaster that can literally affect the rest of your life. Full health insurance coverage not only protects the quality of health care you will receive, but it protects your financial future as well.

According to the Center for National Policy (CNP) in Washington, D.C., only 50% of people 20 to 35 years old have group health insurance through employers. Many singles, who do not have children and who do not have employer-sponsored plans, simply go without health insurance rather than pay the cost of private health insurance. It is a foolish mistake.

Lack of health insurance protection will adversely affect the quality of your medical treatment in an emergency, your physical recovery, and your ability to pay medical bills – all of which can devastate your financial future. Your paychecks can be garnished for years to come to pay medical expenses, your credit cards can be cancelled and your credit history can be ruined. Forget about your desire to build financial net worth if this happens to you. You may physically recover from an accident or illness, but your finances may never recover.

If you have group health insurance at work and change jobs, get private health insurance coverage immediately, even if you are offered temporary insurance through a COBRA plan. At the end of 18 months, the COBRA insurance expires and cannot be renewed. If you develop a serious illness or experience serious injuries during this time, you could find yourself unable to obtain insurance anywhere when the COBRA policy ends. Don't risk it. It can destroy your future.

Do you have disability insurance right now?

Insiders Disabililty Insurance Tip

Buy a non-cancelable disability insurance policy when you are young. The insurance will be less expensive each year in the future and the insurance company cannot cancel your policy or raise your premiums if you develop an illness or have an accident, as long as you pay your premiums on time.

Disability Insurance

Disability – The Hidden Threat

One of the most important insurance policies you need is disability insurance. Statistics show that you are more likely to be disabled than you are to die before the age of 35. Disability insurance will provide you with a monthly paycheck if you are ill or injured and unable to work. It can mean the difference between a financially stable future and living in pitiful circumstances. Disability coverage is not expensive and it's not worth the risk to go without it. Don't risk the rest of your life.

Insiders Auto Insurance Tips

You will realize substantial savings on your automobile insurance if you live near your workplace rather than commute. You will also reduce your risk of being seriously injured in an automobile accident.

If your car is older and you feel financially able to handle the risk of its value, you might want to consider dropping collision coverage altogether and just retain liability coverage. Put the money you save into a good financial investment and you might just be able to pay cash for your next car!

Save Money On Automobile Insurance

The ins and outs of saving on your automobile insurance premiums require a discussion with an insurance agent you can trust. One thing is for certain, if you are a 20-year-old man, your premiums can be three times that of a 30-year-old man.

Single men and women under the age of 25 will pay more for automobile insurance than any other age group except for the elderly. This is because statistics show that drivers under the age of 25 cause more accidents. Men in this age group pay higher insurance costs than women because they are involved in three times as many accidents that result in lost lives. While you may be a safe driver, many in this age group are not.

Young, single drivers will also pay more than their married counterparts. This disparity will even out as you age.

Your diving record is the critical factor in determining your insurance rates. Only you can control this. You will be financially rewarded for your good judgment on the road. You should also be aware that your credit history can be used to determine your automobile insurance rates. Statistics show a correlation. People who are responsible with their use of credit are also more likely to be responsible drivers. Paying your bills on time and using credit wisely will save you money on your insurance payments.

Did you know that the car you drive can impact your financial future? Buying a car model that is known to be expensive to repair, more prone to theft, or one that is statistically involved in more accidents can double the cost of your comprehensive and collision insurance coverage. The money needlessly spent for insurance by purchasing the wrong car could be invested and, over time, accumulate to tens of thousands of dollars. Think about the insurance costs before you choose a car. Saving just a few hundred dollars on your insurance coverage and investing that money in sound financial instruments is a step on the way to building financial security.

If you are a good driver, you can save a bundle by assuming some of the automobile insurance risk yourself. Increasing your deductible to $1,000, for instance, can save you more than 40% on your insurance premiums. It's like betting on yourself. If you lose the bet, the $1,000 expenses will not cause your financial ruin. If you win, that 40% savings can be invested each month in your plan to build wealth.

Do you have a dog?

Do you own a dog?

Insiders Liability Insurance Tip

Having a dog increases your homeowners or renters insurance payments. Dog bites result in about 25% of all liability claims. The Centers for Disease Control and Prevention reports that "more than 4.5 million Americans are bitten by dogs every year." If you still want to keep a dog, don't even think about dropping the dog from your liability coverage. "The average insurance claim for injury from a dog is $16,600."

Save Money on Homeowners or Renters Insurance

This insurance protects your real estate, your personal property and your liability for injury to others. If you own your own home or condo, make sure your homeowners insurance policy covers the true worth of your property. If your home has increased in value since purchasing, make sure your home is covered for its present worth. The equity you are building in your real estate is probably your greatest financial asset at this time in your life. Protect it!

Like automobile insurance, you can reduce your premium payments on homeowners and renters insurance by increasing your deductible amount and assuming more of the risk yourself. Increasing the deductible to $5,000 can save you as much as 40% in premium payments. Put the money you save into a savings plan with the assistance of a good financial planner and you will have the cash reserves you need to cover a $5,000 expense. If you have no expense, the money is yours to keep on deposit in your fund to build wealth and financial freedom.

Do You Need Life Insurance if You're Single?

Yes, You Need Life Insurance

Singles are now 48% of the adult American population. Singles with children know that they need life insurance; often, singles without children don't have a clue.

Why do you need life insurance if you don't have dependents? Think about the college loan you got. Did your parents cosign? If they did and something happens to you, can they afford to pay off that loan? Will your parents be able to care for themselves as they age if you aren't there to help them?

There are other long-term goals that can be achieved by having life insurance. You may be marriage minded and looking forward to having children in the future. Setting up your life insurance now, while you are young and healthy, will give you low insurance premiums and guarantee your protection should you become ill and unable to obtain insurance in the future.

Whole life insurance is an option to consider because it provides a savings plan. Ask your insurance adviser which type of life insurance other singles in your age group are getting.

Insiders Insurance Tip

Having two or more of your insurance policies with the same company usually results in a discount on your insurance premiums.

Life Insurance for Financial Planning

Insiders Financial Planning Tip

Never keep the majority of your investments in your employer's stock. Learn the lesson from what happened to Enron's employees. Tell your financial planner that you want to diversify your investments.

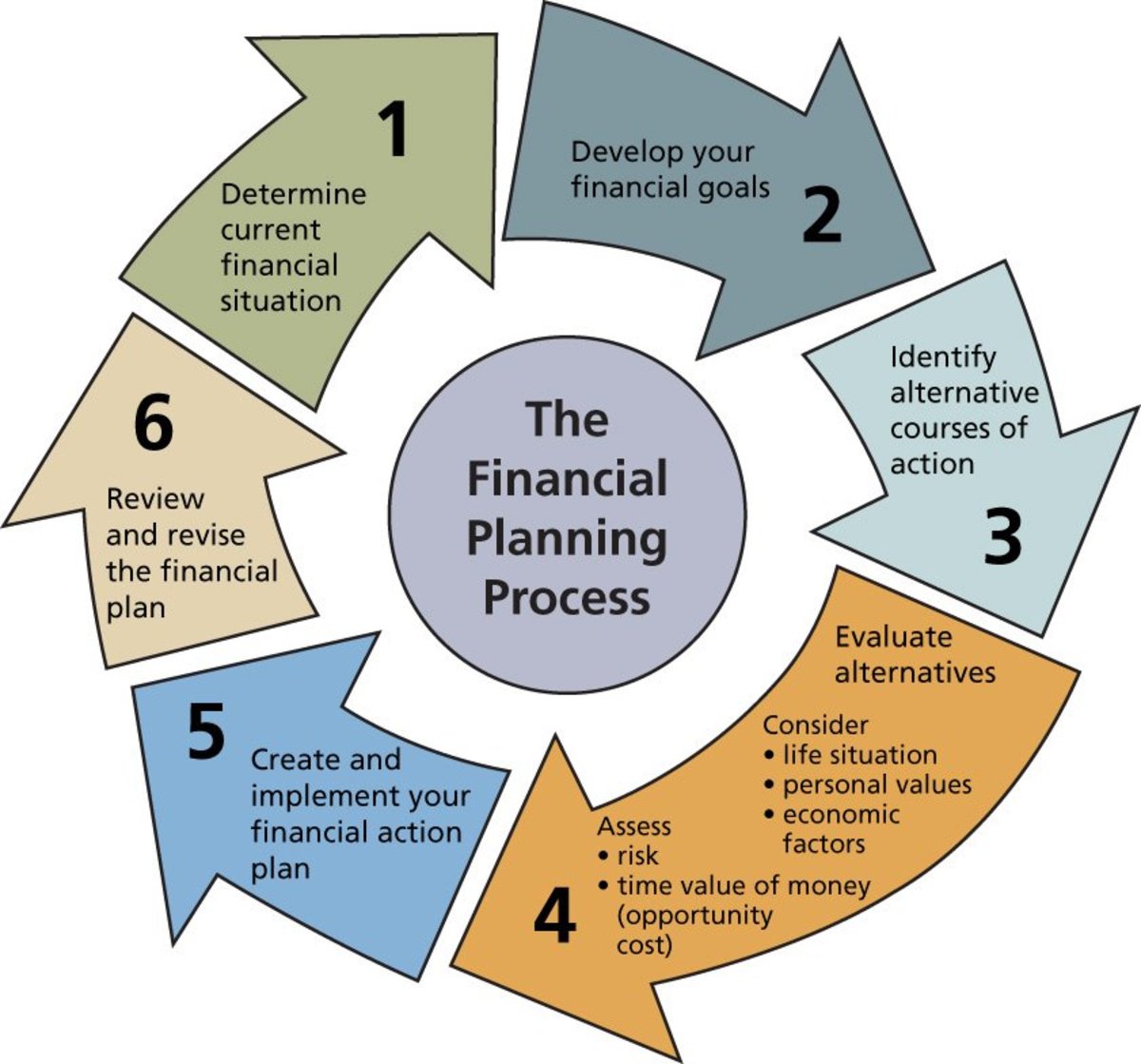

Financial Planning For Singles

Singles must be smarter with their money because they must live on one income and build a financial future with just one income. But, you don't have to do everything alone. An expert financial planner will help structure a plan for your financial life that will amaze you.

If you can only save $123 a month, a financial adviser who can find an investment for your money that pays a 10% return can present you with a check for $280,357 in 30 years. Saving $250 a month could be worth $569,831. That's the beauty of compounded interest in a savings plan!

Financial Planners can show you the tricks the wealthy use to get the most from an IRA account. For instance, they can show you how you can buy a rental house using the money in your IRA as a down payment and have the monthly rental payments sent to your IRA account as completely tax-deferred income. You don't have to know everything about investing and you don't have to know everything all at once. What you do have to know is that complete financial security requires a plan and that you must begin to plan now.

Developing your financial plan can be one of the most enjoyable hobbies you've ever had and probably the most profitable. You'll find out what many other singles already know: a financial portfolio has more sex appeal than a singles bar. And, financial planners are some of the most interesting people you will ever meet.

Additional Resources

Find out about the new U.S. Government Affordable Care Act, with special provisions for young adults aged 18 - 25.

Protected By Copyscape

Share - Don't Copy.