Late Payments...What Are They and How They Affect Your FICOs?

For the millions of consumers struggling with his or her finances, perhaps striving to get back on track after a credit or financial crisis (i.e., a medical emergency, bankruptcy, etc.), the road to credit nirvana can become a rough one. This especially holds true for the few who experience what’s called credit road blocks. Late payments, as bad as they appear, are just that: road blocks. Road blocks are meant to be driven over, right? Having good credit is a benchmark of financial responsibility and for millions of Americans anything less than perfect isn’t acceptable. Certainly, it comes as no surprise why late payments are so damaging to your scores, but how they affect your FICOs is another matter.

FICO Scores are All About Risk…

The important thing to remember when dealing within the dynamics of credit reports, credit scores, etc. is that, all things being equal, your FICOs are mainly derived from how risky you are as a potential customer. To put it more bluntly, late payments (as bad as they appear on the surface) are really nothing more than risk indicators, in that, it signals to FICO that something just went wrong, thus the scoring model penalizes you in the short-term. In the long-term, however, late payments tend to become a nonissue. Unlike major blemishes on your credit such as collections, charge-offs and repossessions, a late payment—from the perspective of FICO’s scoring model—doesn’t’ necessarily brand you financially irresponsible. Thus, FICO is forgiving.

90 Days Late and the Ballgames Over…

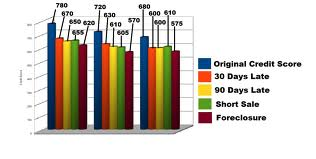

FICO’s scoring model isn’t that complicated to comprehend: the entire model is based on the premise that you’ll go at least 90 days late. In fact, 30 and 60 day late payments that didn’t occur recently aren’t that damaging to your FICOs. Nevertheless, the ballgames over once you have a 90 day late payment. Again, this is mainly true because FICO’s scoring model will brand you a greater risk to do it again. Thus, it can be left to very little speculation that one 90 day late payment will damage your credit for up to seven years. In fact, a single 90 day late payment is as damaging to your credit score as any other major blemish, including a collection, a charge-off, a bankruptcy-filing, a tax lien, etc.

How Do Late Payments Affect Your FICOs???

30 days late – Although damaging for the first 6 to 12 months, a 30 day late payment isn't something that you should worry about that much. The only exception to this rule is when you have what's called multiple 30-day late payments. This can ding your FICOs for a longer period of time, but certainly not long-term.

60 days late – Quite similar to a 30 day late payment, a 60 day late payment shouldn't cause too much damage. Why is this so? It's so because, again, FICO's scoring formula is based on financial responsibility--and to be quite frank, a 60 day late payment, albeit a bit careless, doesn't necessarily brand a person financially irresponsible. Again, the exception is if you're 60 days late on multiple accounts.

90 days late – Unlike a 30-day or 60-day late payment, a 90-day late payment is a hold other ballgame. In fact, a 90-day late payment is just as damaging as any other major delinquency including, a collection, a charge-off; or even worse, a deficiency judgment. Why so much emphasis on 90 days? Not sure, but what isn't left to speculation, (especially in regards to your FICOs being hurt over time) is this: if a consumer hasn't paid his or her credit bill in at least 90 days, you can rest to sure that something major is going on with their personal finances. So remember: what ever you do, don't go 90-days late!

120+ days late – At the 120-day mark, the debt is completely out your hands now, and will most certainly be either sold to a third party debt collection agency--or even worse, written to profit and loss (better known as, a charge-off).

Staying on Top of Your Game...

Alas, if you’re going to be in the market for a new car or perhaps even a mortgage loan, late payments of any kind can mean an utter disaster. This is why it behooves conventional wisdom to stay on top of your credit reports, checking all three (once every three months) for as many errors as you can find. The key thing to remember when dealing with late payments is this: as long as the payments aren’t 90 days late, then there’s still hope for your FICOs.