How To Lower Taxes

How to Lower Tax

How to lower taxes is something everyone thinks about at some point in life. Whether you are own an LLC, or operate as a sole proprietor;

According to the IRS, 63% of Americans take the standard deduction of their income taxes every year. For some, this makes sense; they don't have enough itemized deductions, like mortgage interest or contributions to charities or property and state taxes, to surpass the standard deduction that the government gives every taxpayer. But in many cases, the failure to itemize is due more to fear driven by ignorance, poor record keeping, or sheer laziness. When either of these reasons are the case, you are just giving away your money, and to the government, ugh!

Its a matter of looking at your records and understanding your filing status, and knowing what deductions you are entitled to.

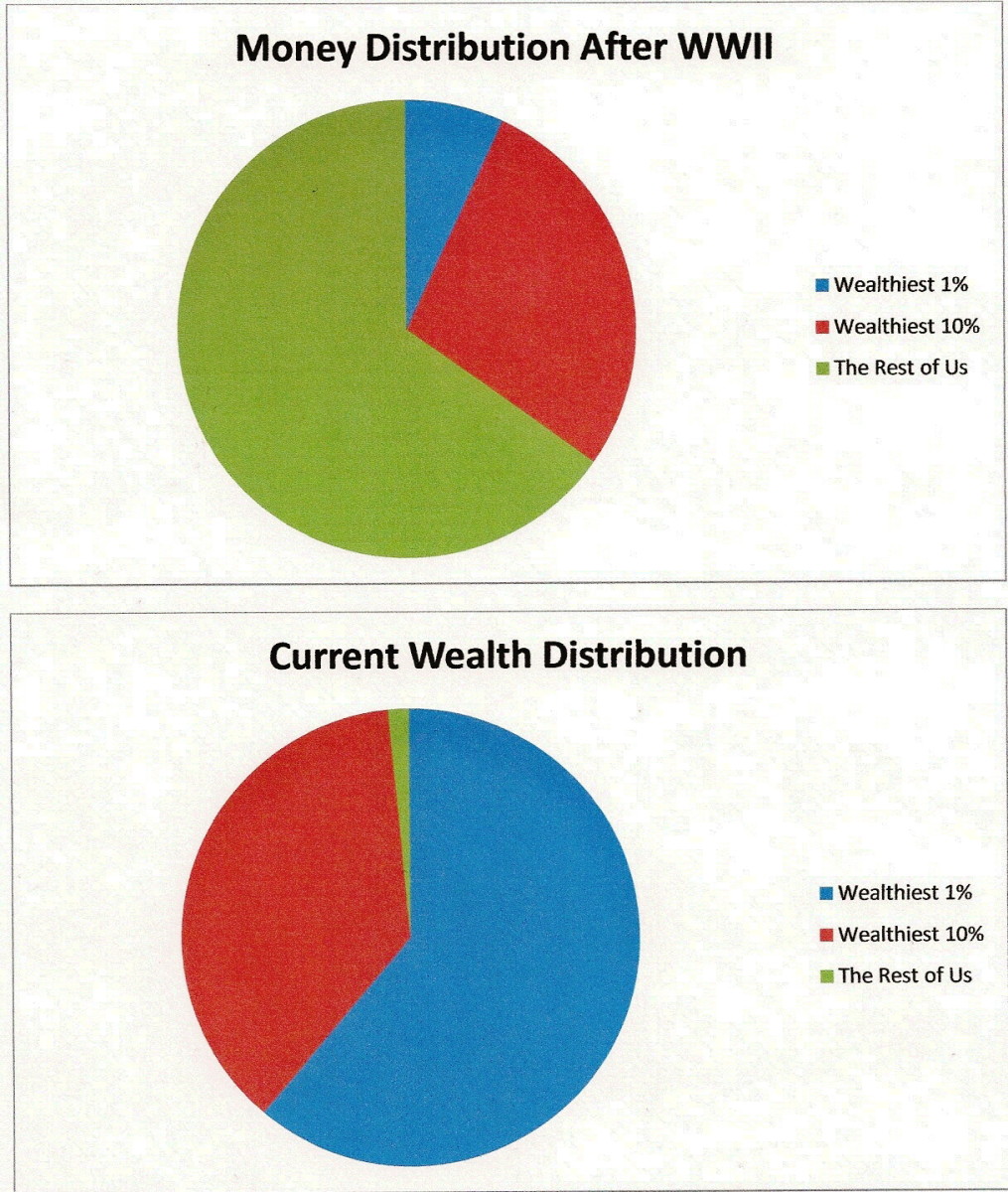

Remember that income alone does not equal wealth. You could have made a fortune investing in Real Estate, or the stock market but, you have to get the most out of your income so you can create and keep your wealth. One way to get more out of your income is to minimize your tax liability by taking all the deductions credits and allowances you are entitled to.

Filling out a W4 form

Generally people run into one of two things at tax time: They either expect a big refund, often hundreds or thousands of dollars, or they expect to owe money to the IRS, and they sweat it out, waiting until the last possible moment to file their returns. Having a better understanding of when we stand in the first place will give us more leverage in the second place.

Determining your filing status is just the first step.

- Single: you are not married, and you don't have any children or qualifying individuals to claim.

- Married filing jointly: You and your spouse are married and were still married and living together on December 31 of that tax year. If your spouse dies, you maystill do your tax return for that year under "married filing jointly." You or your tax preparer simply must note on the return that your spouse is deceased, along with the date of death.

- Married filing separately: Generally, this filing status means you and your spouse are separated and did not live in the same residence on December 31 of that tax year. Sometimes married couples choose to file separate returns instead of a joint one but that often opens them up to a higher total tax bill.

- Head of household: You are single, legally separated , divorced, or widowed, and you have a dependent child or other qualifying individual to claim.

Tax help from Amazon

Lower your Taxes

Many married people choose the married and or have dependents, choose the single/no allowances option when filling out their W4s. This ensures that your employer withholds the maximum amount from your paycheck, and, at the end of the year, chances are, you will be due a refund.

But claiming no allowances makes sense only if you are single and have no dependents or if you have substantial income from other sources like your own side business, stock dividends, or interest from hefty savings or money market accounts. In those cases, having the maximum withheld for taxes can protect you from having to write a big cheque to the IRS on April 15.

If none of those circumstances applies to you, and you claim single/zero on your W4, you are essentially taking money out of your own pocket to give to the government an interest-free loan for 12 months. This is something those in the lower income brackets often do out of fear and lack of knowledge. One of the things that separates the wealthy from the poor is that the wealthy know how to hold onto what they earn and the poor do not. Rule #1 in how to become a millionaire is , keep your money as long as possible. That means never give it now when you can give it later. The longer you have your money, the more interest it can accumulate and that is more money in your pocket.

Claiming Allowances

Even if you are single, you can claim an allowance, which reduces the amount of taxes taken out of your paycheck. You can actually claim 2 allowances, one for yourself, and the other if any of the following apply.

- You are single and do not have a second job

- You are married, but your spouse does not work

- The combines income from your spouse's job and your job is significantly low.

Knowing What is Deductible

Keeping accurate records is the only way of knowing if you are paying more taxes than you should. Save receipts, save receipts, and save receipts.

- Keep track of the miles you drive. You can not deduct the miles you drive to and from work but you may be able to deduct mileage for trips to the dentist, and errands.

- Make notes on receipts. This is the only way of remembering what they are for. You can not get a deduction if you do not even know what your receipts are for.

- Find out if there are special tax breaks for your profession. Check with your accountant or tax preparer to find out if there are any work-related deductions that you can claim.