Pain-Free Cost Cutting

Simple Method to Cut Cost

There are several ways you can cut you personal and household cost cost that are pain free. If you want to cut spending or need to cut spending then, take a look at what can be changed. For instance, your cable bill may be increased, but for the exact same service you can take your business to the competitor in your area and save.

We just did exactly that and are saving $72 a month, plus we are happier with our new service. Before you make any change, if you are happy with your current service, call the company and ask them to reduce the rate. If they think they are going to lose a customer they will often lower your rate.

Taxes

Cutting your tax costs is a good money saver. It usually means you need to pay more attention to your itemized deduction list. If someone has high medical bills for instance, don’t forget to count all the mileage to the doctors, hospitals, and pharmacies. If you are self-employed there are many more opportunities to find more deductions.

As for your investments that have lost money, you can save money by selling and then writing it off. They can then offset gains you have made on other investments. If your losses outweigh your gains you can deduct as much as $3000 of investment loss from you ordinary income.

Housing Cost

There are many painless ways to cut cost.

Since the interest rates are so low take a look at your current mortgage rate and see how much you would save by refinancing. If their interest rate is 1% or 2% lower, it is time to consider refinancing. However, it is much more meaningful if you have a $300,000 mortgage then a $40,000 one. If you plan to stay in your home for several years that is another consideration as there are closing costs when you refinance.

Lower home mortgage rates might also be a worthwhile consideration if you have a 30 years mortgage. Refinance and get a new 15 year mortgage at this lower interest rate. You will save a large amount of money on interest as long as the payment is affordable. This is something else my husband and I did, but it was a 10 year mortgage as we wanted our house to be paid off before my husband's retirement. This worked very well for us.

Streamline

Take advantage to streamline your life when opportunities present themselves. If you like one particular type of toilet paper and it is on sale, buy 3-6 months worth. If you have coupons, that makes it a better bargain. Many people like a particular type of soft drink and buy a carton a week.

Again, watch the sales, and buy 3 months worth at that time. Companies lower prices for a specific period of time, then they raise them back up hoping you are hooked on their product, so buying in bulk is the wise move.

Cut You House Taxes

If recent home sales in your neighborhood leads you to believe that your house is worth less than its assessment value, get an appraisal in support of your claim. You can file a grievance to the property assessor’s office to reduce your home taxes. An assessor will charge $200 to $300, so you might want to talk to a real estate agent that sells in your area first to get a generally idea of current selling values.

If someone if your family is disabled and living with you, get in touch with your tax assessor as in most states you will get some amount of reduction in your house taxes. Also, in the state of Florida if you have an elderly parent living with you, you may apply for a Granny Flat Exemption Tax, which saves some money on your property taxes also. Check your state laws to see what might qualify for a tax reduction..

There are several types of green energy upgrades that you may do on your house that will give you a tax credit also.

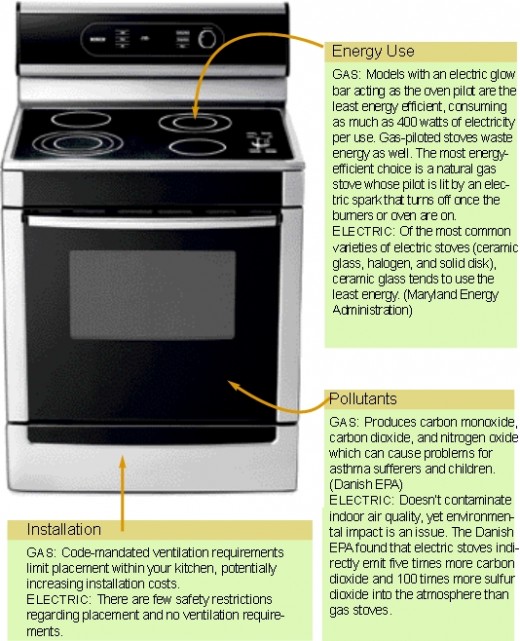

Energy Efficient Gas Stove

Telephone

If you have cell phones and a land line, you might consider getting rid of the land line. You really can live quite well with just one type of phone, and it might as well be the one you keep on your person. Raising the minutes is usually cheaper than paying for two types of phone service.

Energy Saving Appliances

If you are replacing large appliances first check a consumer report to find the best energy savings and a good quality appliance to fit your needs. Then, look for sales. Some stores typically have appliances on sale sometime during each month.

What to Cut From Your Budget | How to Save Money

More Cost Cutting Tips

T:hese are several cost cutting tips

- Turn lights off when no one is in the room and turn off all computers at night. Turn down your thermostat at night in the winter and in summer, turn it up in the day time. Dress according to the temperature in your home.

- Cut your water bill by not letting the water run constantly, when you are cooking or washing up some dishes. Turn the water off when you are brushing your teeth and back on to rinse. Have your hot water heater insulated and on a timer.

- Clip out grocery coupons and use them faithfully. Try to also find a sale when using the coupon for double savings.

- If you smoke, quit. You will be better off and healthier.

- Coordinate errands so you are using less gas and you will have move time to do other things.

Budget

If you want to cut cost or just track you money a good budget is a necessity. This is really only a 3 step process:

- Identify how you are spending your money now.

- After evaluating your current spending, set goals that consider your long term financial objectives.

- Track your spending to make sure it stays on budget. Software will really make the job a lot easier.

Summary

The most common over spending problems for people are houses that are too large and expensive, a car that is too luxurious or living a credit card lifestyle.

We all have a choice as to how we spend our money. It is good to put at least 10% of your income into savings, because if you want to meet your financial goals for retirement it takes planning. Most of the cost cutting in this hub really is pain free, and over the years the savings will mount into something that will make your retirement years much more comfortable.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

![These Companies Will Send You Free Stickers [#05] These Companies Will Send You Free Stickers [#05]](https://images.saymedia-content.com/.image/t_share/MTczODA2NTA0NDkzOTgzMzcx/stickers-free.png)