How to Lower Your Financial Risk in Personal Investing

How much risk do you take every time you buy or sell a stock?

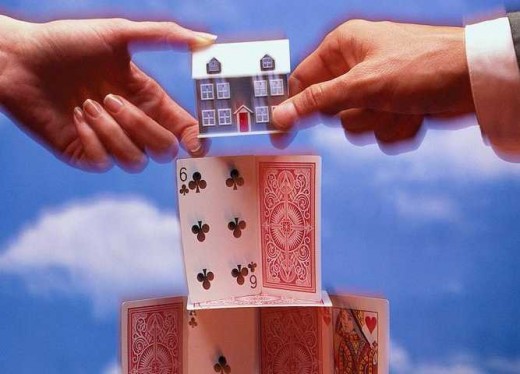

We are in the Great Recession, with job losses and billion dollar bailouts competing for headlines every week. It "started" with the housing sub-prime crisis, but really it started with our willingness to borrow beyond our means in the hope that the future value of our assets would keep increasing. The risk of default was leveraged by large financial firms who underestimated their exposure because their bonuses were tied to ever-expanding profits. This spiral exploded in 2008, leaving the financial system on the brink of collapse. Now we have the grim reality of massive unemployment, enormous government deficits and yet we still seek news of a quick rebound and a return to "normal".

As we individuals attempt to deal with our current situation, it is impossible to remain passive, logical and calm. We are emotional beasts, slaves to our subconscious instincts of flight or fight, handed down since our cave-dwelling days (i.e., before stock markets were created). Wall Street is an insider's game, regardless of what the many talking heads proclaim on TV, the Web, the blogs and in your local advisor's office.

There is only one rule to personal investing, one rule to govern your personal finances, whether it is saving, spending or investing your hard-earned money. What is this rule? Here you go: No one cares about your money as much as you do! The financial risk is all yours!

It is your money. You have to take care of it. Everyone else, from financial advisors to brokers to investment gurus to your local bank care about getting a piece of your action. Fees and commissions are the lifeblood of the financial industry. Every financial transaction you make costs you money. A slice of your personal wealth. If you add in the bad advice you receive for the priviledge of paying fees, then you compound your debt and reduce your equity even more.

If you need some inspiration to get started, watch Raiders of the Lost Ark again. Think of yourself and your money like Indiana Jones and his treasures: Know the risk and be prepared. Remember, despite all his adventures and close calls, Indiana kept his day job as a professor. He may risk a lot, but he treasured the steady paycheck as well.

Think about Risk like Indiana Jones

Grab the Gain & Avoid the Pain

Four Simple Rules to Reduce your Risk

So, what can you do to lower your risk? How do you grab the gain and avoid the pain? There are four simple steps to manage your financial risk, now that you have decided to take control of your personal investing strategies. Follow these four steps every time you make a financial transaction, whether it is buying a house, a stock, a bond, a car, an insurance policy or any other significant event which opens your wallet to others.

1. Educate yourself. Your personal investing is PERSONAL. It is about you! You are the only one who can make the best investment decisions for yourself. If you are not interested in learning enough to protect yourself, stop right now. Give up your chances of financial freedom. You will experience the death of a thousand fees.

2. Comparison shop. Do not take the first offer you receive, from the first person you meet. Do not impulse buy, or hurry because of a time-limited offer or some other nonsense. You always have a choice, and if you succumb to sales pressure you are playing their game. Gather information and walk away. Get other information to compare. Select the BEST deal, not the FIRST deal.

3. Know your risk. Always, always discover what could go wrong. Remember, you are dealing with a salesman of one form or another in every transaction. They will present the best case in order to convince you to buy. You must know what financial risks you are exposed to; the worst downside you can expect. Sure, you can dream of the best case scenario, but what if things do not work out? Will you lose your house, your job, your savings? What is your exposure? What happens if you miss a payment? What happens if you are ill, unable to work, unable to manage your affairs? What if the person across from you is a crook, a Bernie Madoff in another suit?

4. Diverisfy your exposure. Do not put all your eggs in one basket. EVER. Do not own stock in only one company, even if it your own. Do not have just one credit card, or bank account or one asset class. If you get a hot tip to buy gold, or Microsoft or foreclosed houses or whatever, do not put your entire savings into it. If you think you just have to hit it big once, you will wipe yourself out. Life is a lottery ticket and even if you buy a hundred or a thousand tickets, you haven't increased your chances of winning. You just think you have.

Investment books on Risk

Take Charge of your Money

These four simple rules will save you every time. Investing is the best way to increase your wealth, but a personal investing strategy that manages your financial risk, preserves your equity, minimizes your fees and builds wealth over time is the way to go. You have to take charge because no one else will.

It's probably not what you wanted to hear. Perhaps you wanted a hot stock tip or a sure-fire strategy to buy houses with no money down. Act now, don't think. Use your emotions. Yeah, that'll work. How much was that swamp land in Florida again?

Indiana Jones isn't the only movie hero who manages risk

- Use charts to assess risk and reward - MSN Money

How to use charts to assess risk in stocks - Understanding Risk and How Risk and Reward work together

Risk and reward go hand-in-hand with investing in the stock market. Learn about this relationship and how you can make it work for you.

Financial sites to help you

- Kiplinger - Personal Finance, Business, Investing, Retirement, and Financial Advice

Trusted personal finance advice, business forecasting, investing advice, and financial management tools. Kiplinger.com hosts all of the best personal finance advice and business forecasts Kiplinger has to offer. - Personal finance advice, news - CNNMoney.com

News & advice on retirement planning, college saving, taxes, mortgages, autos, real estate, investing and more from CNNMoney.com. - Yahoo! Finance - Business Finance, Stock Market, Quotes, News

At Yahoo! Finance, you get free stock quotes, up to date news, portfolio management resources, international market data, message boards, and mortgage rates that help you manage your financial life.