Precious Metals Investing - Pros and Cons

Introduction

When there are economic worries or fear of an outright economic collapse, demand for precious metals soars. What are the pros and cons of investing in precious metals? What are the benefits and problems of investing in different precious metals? And what are your options other than buying precious metals and storing them in your safe?

Gold

One of the benefits of investing in gold is that it is nearly universally recognized as a store of value and regularly used in jewelry. The biggest downside of gold is the price per ounce or gram being very high. And investing in gold brings a problem investing in any metal asset does - it traps your money in an assets you can't use in some situations (you can't eat it or drink it) and may have to trade at a severe loss in other situations (trading gold jewelry for a basket of food because it is all you have to trade).

This is why investing in practical goods like canned foods, water filters, stabilized gasoline and other essentials is better than investing in gold bars you hope you can trade for what you need later. Hence the joke that the best convenience store to set up after a hurricane sells beer, ice, chainsaws and gasoline.

You can regain liquidity by investing in companies that mine gold, which may yield a dividend. Or own gold ETFs (exchange traded funds), which give you liquidity if you need to sell all the shares to pay unexpected bills and avoids the risk of running afoul the law if the government outlaws private ownership of gold as occurred in the United States during the Great Depression.

Silver

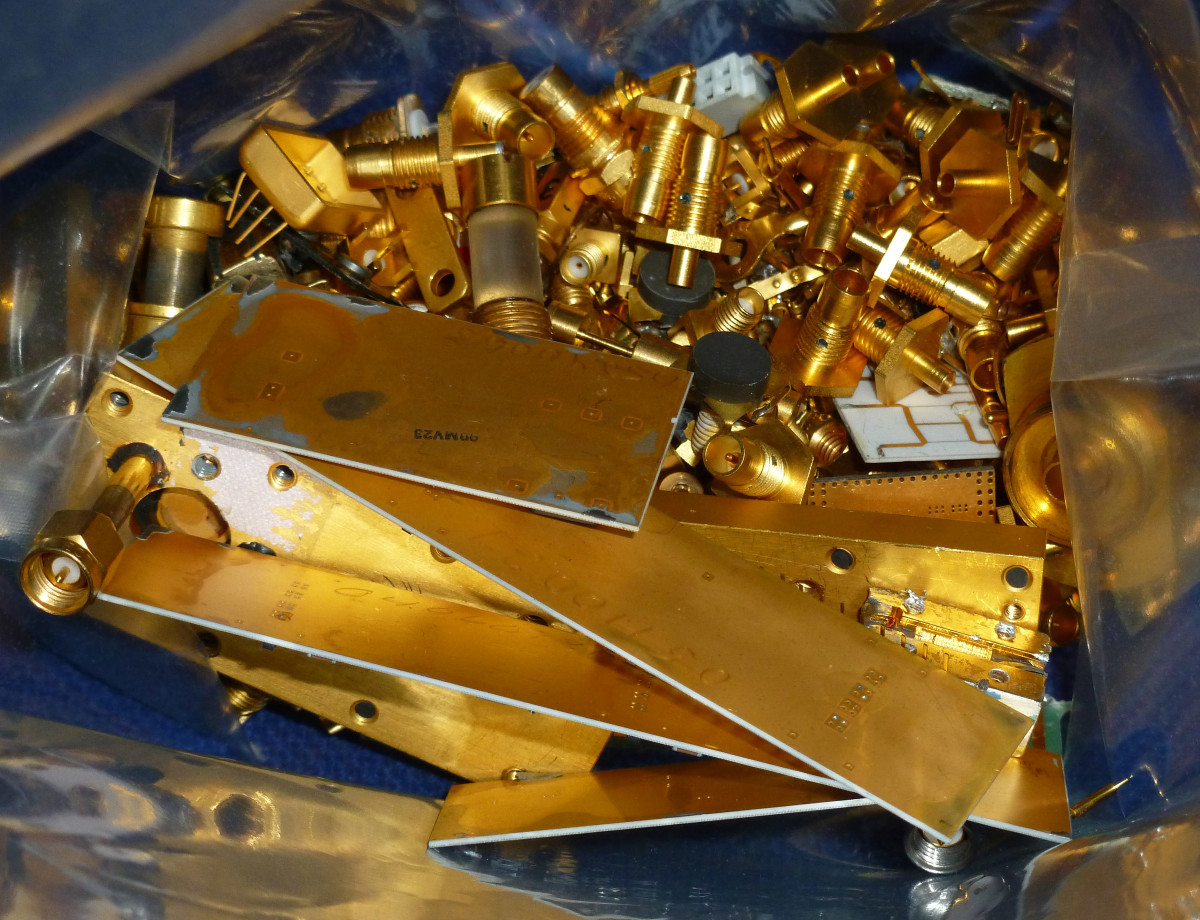

If you are investing in precious metals, the biggest attraction of silver is the fact that it is cheaper than gold. Silver prices have come down since their highs back when Polaroid used it significantly in fast developing pictures. Silver is still used in some industrial processes, but not enough to prop the price up at levels seen in the 1980s. Likewise, gold is less often used in industrial applications both due to its high price and the rise of other materials better suited to electronics.

Own silver jewelry if you like it and want some on hand to trade in an emergency. Old silver coins have at a minimum the value on the face of the coin. However, if you are investing out of fear, don't buy silver bars instead of survival items.

Lead

There is an old joke that if you truly think the economy is going to crash, you don't buy gold and silver, since you can't use them in day to day life. Instead, you invest in lead (bullets), beans and bandages.

Buying ammunition has several advantages over other "precious metals" as an investment. If you are a hunter or own a gun for self defense, you will probably use the ammo. Ammunition prices go up along with gun prices when there is an atmosphere of fear - but ammunition purchases aren't subject to the same purchase limits, waiting periods and background checks as guns in most states. You can stock up on ammo and trade it to those who have guns as a trade good, even if you don't want a gun in your own home. It requires no maintenance like a gun as long as it is kept dry, and it is more easily stored in a hidden location while being very difficult to use against you if someone finds it.

More Exotic Precious Metals

Any discussion of investing in precious metals isn't complete without talking about more exotic materials. Palladium has a high valuation because of its scarcity and use in catalytic converters, an industrial use that keeps its price high. Rhodium ranks as the most expensive precious metal, and it sometimes has the same use as palladium. The downside of these metals is their price and the difficulty selling them to anyone. You may trade a gold coin for a pallet of bottle water that is a relative devaluation, but no one is likely to take a shiny metal bar you say isn't even silver.

Alternatives to Precious Metal Investing

There are several classic investing options when you are afraid of currency devaluation or economic unrest.

The first is investment real estate, since everyone needs a place to live. Property values go up when currency values go down, and you can respond over time by raising the rent. One benefit of rental properties is that you can own rental units in your neighborhood and maintain them in almost any locale. All else fails, the tenets move out and you move your unemployed relatives in.

A second option, though more difficult to manage for most people, is to own agricultural land. In theory, we aren't making more agricultural land, while in many places, it is being built up with residential units or destroyed through poor agricultural practices. In reality, it is hard for someone who isn't living on the farm or familiar with the area and close enough to monitor the local environment real time to invest in agricultural land personally. The alternative to this is investing in real estate investment trusts that buy, sell and lease the agricultural land. Or invest instead in major agricultural companies like ADM or Monsanto. The benefit of buying these stocks is that you'll benefit from agricultural production without having to try to maintain or manage agricultural land far from home (and that's assuming it isn't nationalized or taken from you), as well as the possibility of dividends.