Property Taxes and Your Home

your home

Don't pay more than you should

Have you received your new property tax bill? Are you in shock over your latest assessment? The local governments are raising tax millage rates and dropping a lot of the deductions you had in the past, due to the poor economic conditions that counties and cities are facing throughout the United States.

With the housing industry in the tank and millions of home in foreclosure, is your home really worth what the tax man said it is? A lot of municipalities are trying to increase revenue by using unrealistic numbers when it comes to evaluations. But, you do have rights as a tax payer to fight these assessments to reduce your tax liabilities.

Don’t fool yourself into thinking that your home is worth what the tax man said it is. I know it’s hard to face the fact that your home may be worth way less right now than you want it to be, but, it can work to your advantage on your tax bill.

Ask yourself, is there any way that in today’s market that you could sell your home for its Tax appraised value? Probably not, what do you think you could sell it for? That would be the fair market value that the house should be taxed on, not what they say it’s worth.

Also, they separate out the land value from the structure itself. Make sure that you calculate the combined amount on your tax appeal. Pay close attention to the land evaluation as well, if there was no home sitting on your land what do you think it would be worth? Use this as your basis for the land tax on the line item.

County appeal forms and requirements vary greatly from municipality to municipality so check with your local tax assessor’s office to determine exactly what they require. The following sample form was provided by Lumpkin County, Georgia for their appeals process. I have provided sample numbers and explanations for you.

APPEAL OF ASSESSMENT FOR DIGEST YEAR 2010

PROPERTY OWNER NAME

Your name

DAYTIME PHONE #

404-555-2154

CELL PHONE # 404-555-0129

PROPERTY OWNER MAILING ADDRESS

190 Any road

Dahlonega, GA 30533

PARCEL OR MAP #(S)

Map code 004 057

NOTE: APPEALS MAY BE FILED ON ISSUES CONCERNING TAXABILITY, VALUE, UNIFORMITY OF ASSESSMENT, AND DENIALS OF HOMESTEAD EXEMPTION.

SPECIFY GROUNDS FOR APPEAL (ATTACH ADDITIONAL PAGE(S) IF NEEDED):

Land overvalued – land is undeveloped and land locked by property on all sides, we are in rural Lumpkin County surrounded by undeveloped land. We feel that our property would only sell for about 9500.00 per acre retail.

House overvalued-Due to the rural location of the dwelling and lack of maintained roads, no access to fire hydrants or other public services, such as county water or sewer. Retail value estimated at $145,000.00

Charged reservoir fee / we do not use county water or sewer

ASSESSORS 2010 VALUE

100% FAIR MARKET VALUE

LAND $38063______________

RESIDENTIAL IMP $169180____________

COMMERCIAL IMP $______________

ACCESSORY IMP $______________

TOTAL: $207243

TAXPAYER STATEMENT OF 100% FAIR MARKET VALUE

(What do you think the fair market value is for your property?)

LAND $14250________________

RESIDENTIAL IMP $145,000_____________

COMMERCIAL IMP $________________

ACCESSORY IMP $________________

TOTAL: $159,250

I CHOOSE MY APPEAL TO BE HEARD BY (MUST CHOOSE ONE) IF I DON’T AGREE WITH BOARD OF ASSESSORS:

BOARD OF EQUALIZATION (IF NO CHANGES ARE MADE YOUR APPEAL WILL GO AUTOMATICALLY TO BOE)

OFFICIAL CODE OF GEORGIA ANNOTATED, CODE SECTION 48-5-311

x NONBINDING ARBITRATION

BINDING ARBITRATION

SIGNATURE OF OWNER OR OWNER’S LEGAL AGENT (WRITTEN AUTHORIZATION FROM OWNER FOR AGENT TO SIGN MUST ACCOMPANY THIS APPEAL):

SIGNATURE: DATE:

FOR OFFICE USE BELOW THIS LINE

DATE RECEIVED:

ADDITIONAL

INFORMATION

ATTACHED?

YES

NO

APPRAISER/MAPPING COMMENTS:

DISPOSITION OF APPEAL

21 DAY NOTICE SENT FORWARD TO BOE

APPEAL RESOLVED

This sample shows a big discrepancy between what the county said the property was worth and what the true market value of the property would be. The nearly $48,000.00 difference could be a big savings on the amount of taxes due.

There other reasons to appeal taxes, other than over paying taxes. If your mortgage is escrowed for taxes and insurance, a significant increase in your taxes could mean higher house payments to cover the extra escrow needed to cover the cost by the mortgage company. Think about this, if your taxes only went up six hundred dollars for the year that would equate to an increase in your payments of fifty dollars a month. Multiply this by five years, that’s three thousand, by ten years, you get the picture. Even if you never had another tax increase, which is unlikely, that’s money never recovered, and as rates go even further up, the more your house note will increase. Your insurance is also tied directly to the value of the home, and will cost more as well.

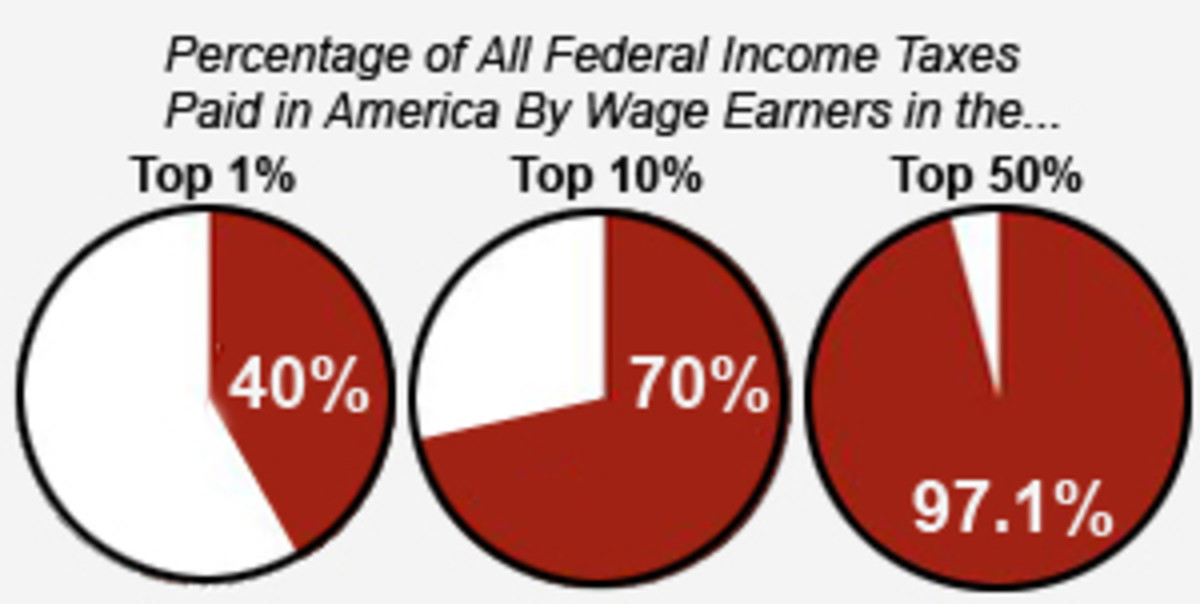

Don’t be afraid of your government. You have the right to fight and you owe it to yourself to do everything possible to keep more of your hard earned money. Remember the government doesn’t create income, for governments to operate they must take it from someone and give it to someone else.

Now don’t get me wrong, I believe that you should have to pay your share, but only what you owe and nothing more. We all use government services, roads, parks, fire and police to name a few, and the people who serve us deserve a pay check, just as anyone else.

So, when you get your tax assessment, look at it carefully and don’t assume that just because they say it’s what you owe, it’s what you owe.

slaves to the government

- American Slavery Today

Slavery in American is growing. The slave owners are the Democrat congress and President Obama. They are on course to enslave million more Americans every day. America is in the process of heading to a...

website for state of georgia, every state has one

- Georgia Department of Revenue

every state and most counties have similar sites