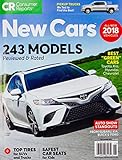

Save for a New Car

Buying A New Car...

Everybody wants a brand new car, right? Who doesn't! However, if you are saving for a brand new car, depending on how much money you make monthly, it could take a while. If your credit is good, then you should have no problem getting a car on credit. To increase your chances

When saving for a car, you will need to have at least 10% down to satisfy the dealer's basic requirements, if you plan to go to a dealer. So if the new car of your dreams is 30 Grand, you will need $3,000 down for the dealer. Another option to buying a car is to lease a car and you may want to look into this as an option so you can "trade it out" every year for a brand new car.

If you own your own business, please make certain you call your favorite accountant and ask if you should buy your car for the business. (Hint: If you put a magnetic sign on the sides Monday-Friday, it becomes an advertising, tax write-off vehicle). There is a man I know who does this, he buys a brand new Mercedes every year and sells it at the end of the year for a brand new one for his business and after his initial investment, it becomes a free car pretty much. His business pays for it and it is a lovely write off for him.

You may also want to look into buying a used, or what I call a "new-to-you" car. If you decide to go this route (sorry, I could not resist the bad pun!), it will be easier to save your money faster towards this goal. Your local dealer may let you make payments on a used car, depending on price and the dealership. When buying from a private owner or at the local car auction, obviously, you will need to have all money up front. Auctions typically charge an extra 10% on top of the cost of the car you buy.

So bid and budget wisely if you want a good deal.

Sexy New Car!

Let the Savings Begin!

The best advice I can give is to start a "Long Term Savings for Spending Account" at your bank. This could be attached to your main checking account, but please do NOT at all cipher any money from yourself. This account becomes sacred ground, until you are driving your new car around. Put 10% of your monthly or weekly paycheck into this account and make sure you designate it in your mind as the "New Car Fund". Once you have enough money to make the down payment or buy the car,

you can designate it as something else. (I recommend the "New HD TV with 3D Fund" --LOL!)

In addition to saving a portion of your paycheck, I also would advise you to cut down on gas usage, save the money you normally would have in your budget for fuel costs and start adding this money to your New Car Fund. So if you tend to drive somewhere everyday, try to combine your trips. Stay home on weekends for awhile. If you can cut down your gasoline by a minimum of two tanks, that can be as much as $70-$100 dollars extra monthly towards your new car.

In my family growing up, we had what I call now the "pancakes, beans and rice" days. When the family was saving up for something good, such as a new tent for camping or new fishing poles, we would all sacrifice our grocery budget to this cause. We would eat simple meals that cost little money, eat less meat and sacrifice desserts altogether until this goal was reached. It was a surefire way to get our desires met quicker and there was nothing like eating ice cream from within the confines of a new tent!

You may want to sacrifice the "extras" for a little bit to meet your needs. This way you get to the goal faster and you also appreciate it more when you do get it. Then, treat yourself to a sweet ride in the country or go out to the beach in your new ride to celebrate your sacrifices and your victory!

I know that you can save money for your new car and I have faith in you, so I want to be the first to congratulate you:

Congratulations on your new car!

Love,

Mermaid Girl

Cool View from Your New Car...