Selling Puts and Calls

Selling call and put options

If you are a novice investor or you want to try and increase the return on your portfolio then you might want to sell options. By selling an option you collect what is called a premium, this is cash you get by simple selling a call or a put. One option contract is the equivalent of 100 shares of stock.

Before getting into the strategy a bit deeper it should be explained what an option is. An option is a contract that gives the buyer the right to purchase or sell stock at a certain price. The option is only good for a certain time and has an expiration date. A call option gives the buyer the right to buy, while a put option is the right to sell. Of course you can also sell these options, by selling you collect a premium from the buyer in exchange for the right to buy or sell at a certain price. This article will concentrate on covered options because they are safer and a more conservative investment.

Selling covered calls

So what is a covered call anyways?

Lets say you buy 100 shares of a stock. You can then sell 1 contract and collect a premium, the buyer has the right to buy your shares at a specified price and call your stock away, hence the term covered call. Here is a real world example. (This is not considered a recommendation please do your own research and seek financial advice if need be)

If you buy 1000 shares of FB (Facebook) at $27 the cost will be $27,000

You can sell 10 contracts, if you sell 10 July 28 calls at 1.60 then you collect a premium of $1600. 10 contracts * 100 shares = 1000 *1.60 = 1600 (these prices are from the close of market June 11th 2012)

Note monthly options expire on 3rd Saturday of the month

The premium is yours no matter what happens with the stock. The biggest risk in this scenario is the stock decreasing in value because your shares are locked up by the calls assuming you only have covered options ability in your brokerage account. Your make loss would be $25400 if the stock went to 0.

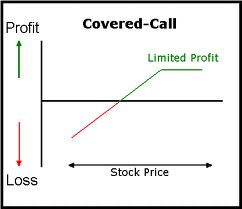

If the stock goes to $30 it will be called away from you at $28 because you sold that right to the call buyer for a premium of $1600. This strategy can of course limit your upside potential as well. As long as the stock stays below the $28 you keep the stock and when the option expires in July then you can always write another option and collecting another premium.

Selling covered calls is a great way to lower your cost basis and collect a premium. Using the above example by selling the July 28 call you can reduce your cost of the stock to $25.40 and keep lowering it until it gets called away.

A few important points to know. The buyer of the calls can exercise or call away your shares at any time if they are above $28. This typically happens at the time of expiration, however I have seen it happen a week or 2 before. When you sell the call you lose that right, also note that if your shares get called away before options expiration it is totally random. You can buy back the options that you have sold as well. If the stock is in the money you can expect to pay more to buy back the options, you will get them cheaper if they are out of the money and there is little time value left.

Selling covered calls is a conservative strategy, it would be considered to be a bullish to neutral in terms of your outlook on the stock.

Cash covered puts

Selling puts is a similar strategy to covered calls with one big difference. Instead of your stock being called away you may get stock put to you. You are covered on this strategy because you need the cash in case you have to buy the stock.

Lets us the Facebook example again with some different numbers.

You sell to open 10 of the FB July 26 puts. For this investment you will need to hold $26000 in cash. You still collect a premium of $1600 for selling the put. If the stock stays above $26 then nothing will happen, if Facebook trades at $25 at time of expiration then the stock will get put to you at $26, meaning that you have to buy the stock $26.

The biggest risk again is if the stock goes to 0 and you have to buy at $26.

Keep in mind selling puts are also a bullish to neutral strategy and it is a great way to get a bit of extra premium. If you are selling a put think of it as placing a limit order for a stock that you want to buy at a lower price. If the stock trades lower and gets put to you then no big deal you wanted to purchase the stock anyways. Of course the stock can really go down and cause you to lose money however that is the risk investors take when trading on the stock market.

High yield covered calls are they worth it.

Riskier stocks will have higher call premiums, these stocks would have higher volatility, or some sort of product like a drug coming out that needs FDA approval. Other stocks with upcoming earnings also have a high call premiums due to the increase in price volatility. Is it worth writing covered calls on these stocks? For a conservative investor this would not be a strategy you would want to use due to the risky nature of sell calls into earnings or speculating on a big price move for a stock due to pending material news.

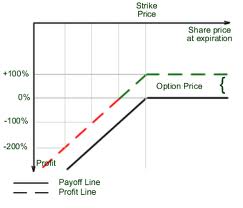

Biotech stocks are a good example of a high risk high reward covered call play. An example I will use is a small stock NVAX (Novavax) they are a development company of vaccines. Based on a value as of November 23 2018 the stock trades at $1.72, you can sell a $2 april 2019 call for .66 cents. Here are the numbers.

10000 shares cost $17,200

sell 100 April 2019 calls at .66 for proceeds of $6600.

If the stock goes up to $2 you would profit $9400 (call premium + difference between the strike price and current price.)

The percentage gain would be 55%, not a bad investment. However your total risk is a $10600 loss if the stock goes to zero. You also have to keep in mind what if the stock goes to $5 based on great news you would forfeit $23400 worth of profit because you sold the right for someone else to buy the stock at $2. Keep in mind this is not a recommendation and the example is for illustrative purposes. If you are going to participate in this risky strategy just do it with money you can afford to lose. Don't go all in because you can lose out big time.

Selling options

If you are interested in this strategy then do your research or ask an expert. When dealing with options trading there is always risk and it is never as easy as it seems. I want to emphasis that you do your homework and educate yourself especially if you are a beginner. You work hard for your money and there is nothing worse than taking losses in the stock market because your strategy goes bad. Make sure these types of investments suit your investment needs. Good luck and I hope you do well in your investing.