Simple Ideas to Save Money

Face up to your situation

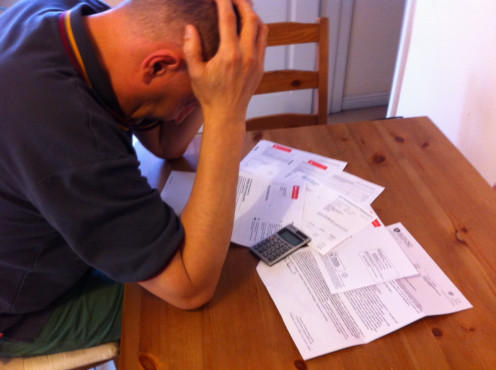

The temptation when money first becomes tight is to hide from it for a bit - or even spend more money by doing things that cheer you up - going out with mates or treating yourself. Well you simply need to STOP. Stop hiding from the issue and stop spending money so you can take stock of your finances. However bad your situation is it will definitely get worse if you ignore it.

The first step is to sit down and work out all you outgoings and your realistic income. Then you have two things to work with - cut down the amount going out and think about ways to increase income.

This hub looks at ways to cut down what you are spending and although some steps may only save a small amount it is really about a mind set, if you can start noticing the small amounts and make a few changes it WILL make a difference.

Face Up to Your Situation

Deal with Debt

There is a lot of advice available about dealing with debt and a whole range of options to consider form Individual Voluntary Arrangements to Debt Management Plans and Debt Relief orders. A good overview is available at https://www.gov.uk/options-for-paying-off-your-debts/overview

The first step is often looking at what you owe, who it is owed to and how, or if you can pay it back. In terms of credit card debt lots of people can be helped by simply switching to a credit card that has 0% interest - even if you are only paying £25 per month if there is no interest this will be £25 OFF your debt as opposed to paying some or most of the £25 in interest.

The important next step is to get some help. Citizens Advice, charities like Step Change and sites like Money Saving Expert offer a wealth of advice on assessing your situation and considering the best way out of it.

Tips from an Expert

Major Household Spending

Category

| Percentage of total income

|

|---|---|

Food & non alcoholic drinks

| 11%

|

Housing (net) Fuel & Power

| 13%

|

Transport

| 14%

|

Recreation & Culture

| 13%

|

Restaurants & Hotels

| 8%

|

Miscellaneous goods

| 8%

|

Househod Goods &Services

| 6%

|

Clothing & Footwear

| 5%

|

Communication

| 3%

|

Alcohol, Tobacco & Narcotics

| 2%

|

Education

| 1%

|

Health

| 1%

|

Other

| 15%

|

Table shows household expenditure as a percentage of total expenditure

Where can you make savings?

http://www.ons.gov.uk/ons/publications/re-reference-tables.html?edition=tcm%3A77-267317

It's evident form the table above, which shows data from the Office for National Statistics, that expenditure is spread over many areas. Some of these we have little choice over but others are much more within our control. The table doesn't show interest on mortgages and shows the average percentages across all households. For households on lower incomes the percentage of income spent on housing and fuel may be much higher and the spend on recreation lowe.r

There may still be savings to be made on things like housing, moving may incur further cost but can help change a situation, for example through downsizing, and switching mortgage provider can also help. There is also a lot of advice available to support switching energy companies in order to save money and again citizens advice and others can provide help and advice. But lets take a look at some of the areas where it is very easy to make savings.

Small Savings Can Add Up

New Habits

Improving your financial situation through saving money is all about a mind set - about new ways of thinking so try some of these tips to help get that new mind set

- Don't ignore bills, demands or fines they only get worse if you bury your head in the sand

- Make a budget - plan what you will spend then stick to it

- If you use cards try switching to cash it's much easier to keep tabs on how much you are spending

- Each time you are about to spend ask yourself if it is something you need or want and if it is a want would it be better to wait, do without it, or find a cheaper way of getting the same result

- Keep track of the small savings and you will be amazed how they add up

- Don't be afraid to say 'no' - to invites from friends when you know you shouldn't be spending the money on say a night out, to demands form children or to yourself if it's a reckless spend

- Change is tough but sometimes essential and everyone feels happier when their finances are under control

Save on Food Bills

Take a moment to look in your kitchen cupboards, fridge and freezer - the chances are that there will be a quite a lot of tins and jars and packets in the cupboard. People vary tremendously in the way they shop, cook and eat but whatever your preference try out a few of the tips below and see if they can help you to save a few pounds.

- Plan your shopping - if you shop weekly try planning meals for the week BEFORE you go shopping and buy what you need - this often minimises waste and really it is a luxury to have freezers and cupboards full of food without knowing when it will be eaten

- Put off the shop - simply by using up your stock, the unused tins and packets in the cupboard can sometimes delay your big shop by several days, which can definitely save money.,or try spending a small amount say £5.00 on a few ingredients to make sure that you can use up all the stock in your cupboards.

- It may cost a bit to buy things for packed lunches but they can nearly always be made at home more cheaply than they can bought - unless you have a subsidised workplace restaurant.

- Use vouchers - they may be a fiddle but they can cut the cost also there are a lot of websites that offer codes for money off vouchers

- Use loyalty cards where you can - I saved enough points on nectar to do the entire Christmas shop, but don't feel you have to be loyal if competitors offer better value.

- Some people find it helps to go shopping with a friend (this may be especially useful if you live alone) that way you can get the most from the buy one get one free or bulk offers without spending more than you need to at the time

- Take good look at your eating habits - do you waste food regularly? If yes that could be an area to save - many families I know simply cook too much as they hate the thought of their children being hungry but then end up throwing quite a lot away. If you do cook too much try and save leftovers for another meal. Think about portion sizes and what you have available as snacks - some are much more expensive that others.

- Try opting for supermarket own brands and you can often save money.

- Shop around if you can - toiletries for example can often be very expensive in supermarkets

- Think about your health as well, some, but by no means all, cost cutting changes can be beneficial for your health as well as your wallet. One pack of cigarettes, or bottle of wine less each week can save money and may be good for you. Pulses can be a good source of protein and may be much cheaper than meat or fish.

Use Loyalty Cards & Vouchers

Save & Have Fun

Recreation and culture accounts for 13% of household spend. It is important, especially when you are feeling the pinch financially that you still have some fun - but it is possible to have fun and save a bit too.

The way we choose to have fun and relax is very individual but check out some of the ideas below and see if any could work for you.

Now summer is approaching there should be lots of opportunities for outdoor fitness - walks, bike rides generally being busy outdoors so maybe now would be a good time to cancel a gym membership, take a holiday from the gym or check out that you have got the best deal possible.

Eating out is something lots of folk enjoy and rightly so but occasionally instead of going out try arranging something at home - if the weather is nice a simple meal al fresco can taste great and cost considerably less than going out.

The cinema is great too but again a few mates a DVD or streamed movie and some popcorn will be a lot cheaper than a cinema trip

Beware of coffees and 'quick drinks' - I love meeting a mate for a coffee or having a drink after work - or looking for work - but with a coffee costing just under £3.00 and other drinks often more it is something to be aware of - try meeting at each others homes at least some of the time or shop around for the cheaper coffee houses or pubs

Don't assume everywhere charges the same - a white wine spritzer in my town costs £2.75 at the cheapest place I know up to £6.70 and they are literally just a couple of hundred yards apart.

If you enjoy being pampered and having a manicure or massage see if the local college doesn't offer some cheap treatments performed by students or watch out for special offers.

Store Cupboard Meals

Cutting the Clothing Bill

Although this may only account for 4% of the spend I know that for some people this accounts for a lot more and buying clothes is a pleasure as well as a necessity for many fashion and style conscious individuals. The economic climate means that sales are an ever present feature of the high street and an offer great bargains but beware however cheap or reduced an item is shops rarely give things away it WILL involve you parting with cash.

Clearly some items are essential and that is when it is good to utilise the bargains of sales. If spending on clothes is a bit of an issue for you then try some of the tips below

Ask yourself f it is necessary - that doesn't mean you can't buy it if it isn't but it is a good moment to just stop and think.

Could you get a similar item cheaper elsewhere - again it doesn't mean you have to have the cheaper item but stopping to think is good

Do you really need to be at the shops - if not don't go - I once worked in offices near a huge shopping centre and would enjoy making unnecessary purchases on my lunch break just because I happened to be in the shops. I know we can buy online but the principle is if you don't browse unless you need something - you'll just end up spending

Check out your old clothes - can they be updated, or sold, as well as internet selling lots of places pay cash for bags of old clothes.

Try having a swop evening with mates - most people have clothes they don't wear often brans new so see if you can't get a few friends together and help each other out.

The same can apply to children's clothes that have been outgrown.

A bit of wardrobe de-cluttering can free up space and make a bit of money