The $1500 Dollar Mistake and How to Never Repeat It!

"Free" Checking Account Feat: A Loss of $1500!

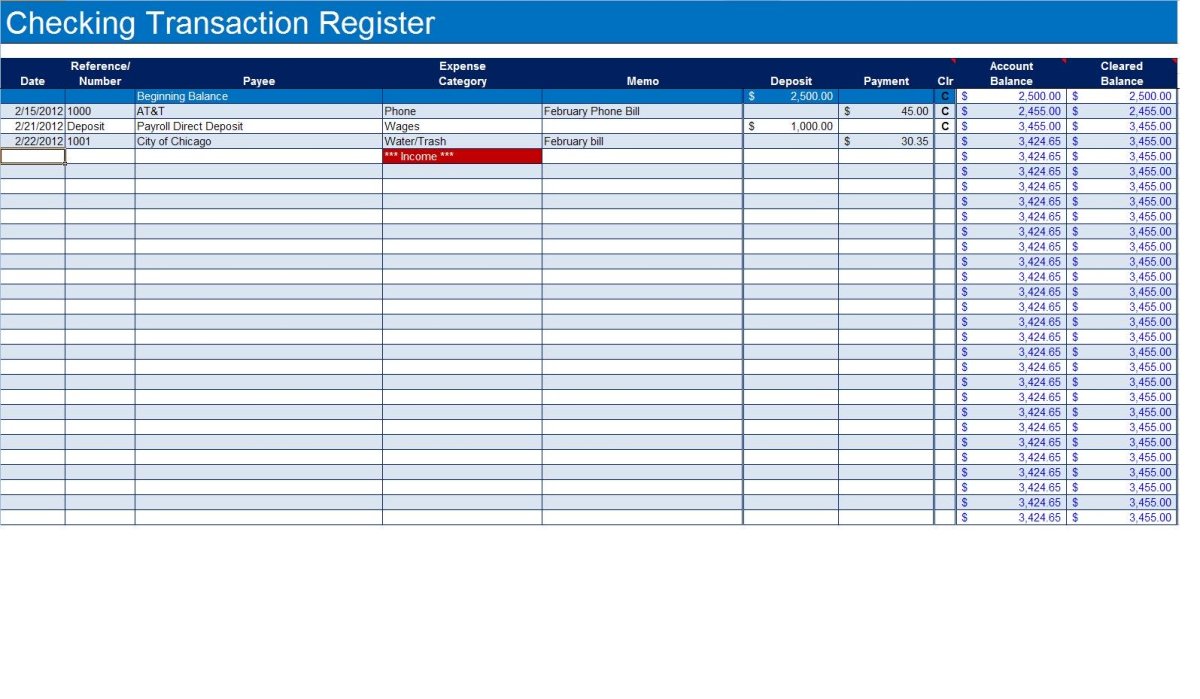

Checking accounts are a necessity in today's world. They allow you to move money around, pay bills, and have access to debt cards for those who do not use credit responsibly. The problem with any kind of bank is the fine print on all those miniature-not-even-letter-sized pieces of paper the bank mails you with the new account.

In large font the message says "Congratulations on joining our bank and opening a checking account!" Yet after the niceties it quickly turns into size 4 font with thousands of words on a few sheets of miniature paper. So what does all that bank terminology in the bottom amount to? Well most of it isn't even useful to the average user. It just lists how the bank will use your money blah blah blah how liable they are for your debt card - whatever. Now none of that is overly important. There is how ever two very important paragraphs in on this paper. One is the fee's for manually messing up - things like over-drafting etc. The other though...a sneaky paragraph hidden between two other paragraphs you would skip right over, is the paragraph that explains the MONTHLY SERVICE CHARGE.

What Exactly is a Monthly Service Fee?

This is where the bank terminology loves to stab you in the back. Many banks have "Free" checking accounts but some have strict guidelines to follow or you will be charged a fee. The fee can basically amount to two different descriptions:

- Inactivity Fee

- Poor Person Tax1

The ability to use this account is simple. Just maintain more then $1,000 dollars. Don't have $1,000 in the account at all times? #MonthlyServiceFee

1 Assumes you have less then 1000 United States of America Dollars in the account *daily* for the entire month.

Confirmation of Banks Increasing Fees

Just maintain more then $1,000 dollars.

— The Bank at Which this HappenedSo How Exactly Do the Folks with Less Then a Grand Daily Mange this Account?

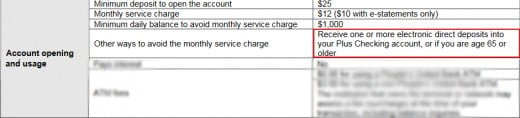

Well there is a clause that many will be able to take advantage of if they are employed in a standard job. There is a section that states "Other ways to avoid the monthly service charge." Its very simple yet for some could be complicated or difficult. The catch is you have to have at least 1 Electronic Direct Deposit in your account or be over the age of 65.

Create Passive or Active Income Streams

The catch is you have to have at least 1 Electronic Direct Deposit in your account.

— The Bank at which this HappenedPassive Income Streams

Passive Income Streams are often time more rewarding and and have the potential to generate more money over time for a large effort put out once and then with maintenance (no pun intended) as time goes on. Some of the most common ones are:

- Google Adsense

- Amazon Associates

- eBay Partnership Program

Compared to Active Income Streams, there is one major disadvantage that this route has. With Passive Income Streams you cannot control when the companies deposit amounts into your account. The only reason my bank didn't charge me more then $1500 in almost 10 years was because of the passive income I was getting to my account at random intervals based on performance and sales.

Active Income Streams

Active Income Streams are ways of generating money on demand. These mostly require work on your part for an instant reward that you can decide when it is deposited. These also are where the infamous "job" money makes its debut. There are now more options then ever to have funds deposited into your checking account from work sites. Some of these examples include:

- Amazon mTurk (Mechanical Turk)

- Amazon FBA (Fulfillment by Amazon)

- User Testing

- Gigwalk

- TaskRabbit

The benefits of these are they have an option that once you preform the task and the funds are cleared, you can deposit them into your checking account when you choose, and what amount! For example, you could make $12 on Amazon mTurk and deposit $1 a month into your checking account to avoid the $12 Monthly Service Fee. This would be enough to protect me from fees for an entire year!

Don't Make the Same Mistake I Did!

Regardless of the way you choose to go, passive or active, please please please make sure you never have to pay these fees. Stay over whatever Monthly Service Fee minimum balance is at your bank, or even better - challenge yourself to create income streams to make sure the pesky charges never eat away at your money ever!

There is also one last final option - upgrade your bank to one that doesn't have these charges. There are more banks then ever that are all FDIC insured so you don't need to spend your waking hours worried about you money.

Do you currently pay banking fees every month?

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.