The Basics of Qualified Employee Stock Purchase Plans

ESPP's 101

Employee stock purchase plans (ESPP) are a common benefit that many publicly traded companies offer to their employee’s as an additional savings option to supplement their other defined contribution plans. There can be a number of benefits associated with these plans, as well as some potential disadvantages.

Under a qualified ESPP plan, the employer permits the employee via payroll deductions to defer some of their income to purchasing the company stock commonly at a discount to current market value. This discount is often as much as 15%. Most companies will permit you to utilize between 1-15% of your wages to be set aside for the purchase of the company stock. The price paid per share is usually based on an offering period. So as the funds are set aside during each period, the price is fluctuating each day. The actual purchase price will be a discount based on the price at the beginning or end of the offering period. Some employers offer an option known as a “look back” which permits you to use the better of the two prices during the offering period.

While the income received from wages that were deferred towards the purchase of the stock is still subject to income tax, the bargain element…the discounted portion of the stock purchase is exempt from income taxes until liquidated, and not included as an AMT liability. Generally speaking, the tax is realized at the sale of the stock.

As an example, if you acquired $100 worth of company stock for $85 (15% discount), the $85 dollars you earned before the investment was taxed as ordinary income. The 15% discount or $15 dollars is not taxed until the shares are sold. If the shares appreciated to $150 and the shares were subsequently sold, the $15 would be taxed as compensation income and taxed at ordinary income tax rates. The gain from $100 to $150 would be treated as a long term capital gain at the time of the sale.

However, in the cases of a qualified ESPP plan, in order to qualify for long term capital gain treatment it must be sold in what is classified as a qualifying disposition. This means that the shares must be held at least 2 years from the offering period and one year from the purchase period. If you liquidate the shares too soon the sale is considered a disqualifying disposition and looses the favorable tax treatment. Additionally, the transfer of shares as gift within the qualifying period is also classified as a disqualifying disposition…with the exception of shares transferred as a Qualified Domestic Relations Order (QDRO) as the result of a divorce.

In the case of a disqualified disposition, the tax is treated as compensation income (ordinary income tax rates) on the bargain element as well as any capital gains from market appreciation. For example, the difference between the fair market value at the time of the purchase and the actual purchase price is ordinary income, even if the stock declined and was sold for less than the purchase price. So if you purchased the stock for $85 while it was valued at $100, then subsequently sold it at $80 in a disqualified disposition, you would still be subject to the $15 (difference between the $85 discount and $100 market value) taxed as ordinary income.

Some of the obvious benefits of an ESPP in addition to potential tax benefits would the discounted purchase price, as well as the ability to automate an additional savings plan from your payroll. Yet, there are some potential detractors. Because there is ordinary income tax treatment on at least the bargain element, that portion is subject to payroll taxes. But employers do not withhold payroll taxes on the bargain element for a qualified ESPP. So the employee will be subject to paying that tax at the time of disposition.

Another major consideration is the risk of stock concentration. It is never a good idea to concentrate too much of your wealth in any one individual security from a diversity perspective. Furthermore, while we would all like to assume our jobs are secure, that is not always the case. Considering that a good degree of your financial stability is based on your earning power, it is not always wise to concentrate too large a portion of your wealth in the same entity which you also depend on for your wages. In the event of the organization experiencing a turbulent period, you may be at risk of losing both your job and a substantial savings simultaneously…as the company stock price may be highly correlated to their ability to compensate you. Even if you don’t see a substantial decline, it is not uncommon for these concentrations to present a tax problem later in life when you are trying to implement a more conservative strategy.

While utilizing and ESPP plan that an employer offers may make sense to a certain degree, it should not be done at the expense of sacrificing contributions to more traditional retirement savings plans such as a 401k. These more traditional retirement plans offer more of an immediate tax benefit in reducing your adjusted gross income, and a much greater degree of investment flexibility.

- How to Understand Floating Rate Notes

In recent years we have seen unprecedented actions by global central banks to influence economic events and create monetary stimulus. Here in the Unites States, the Federal Reserve has held interest rates well below historical norms through... - 2013 in Review...A Case for Asset Allocation

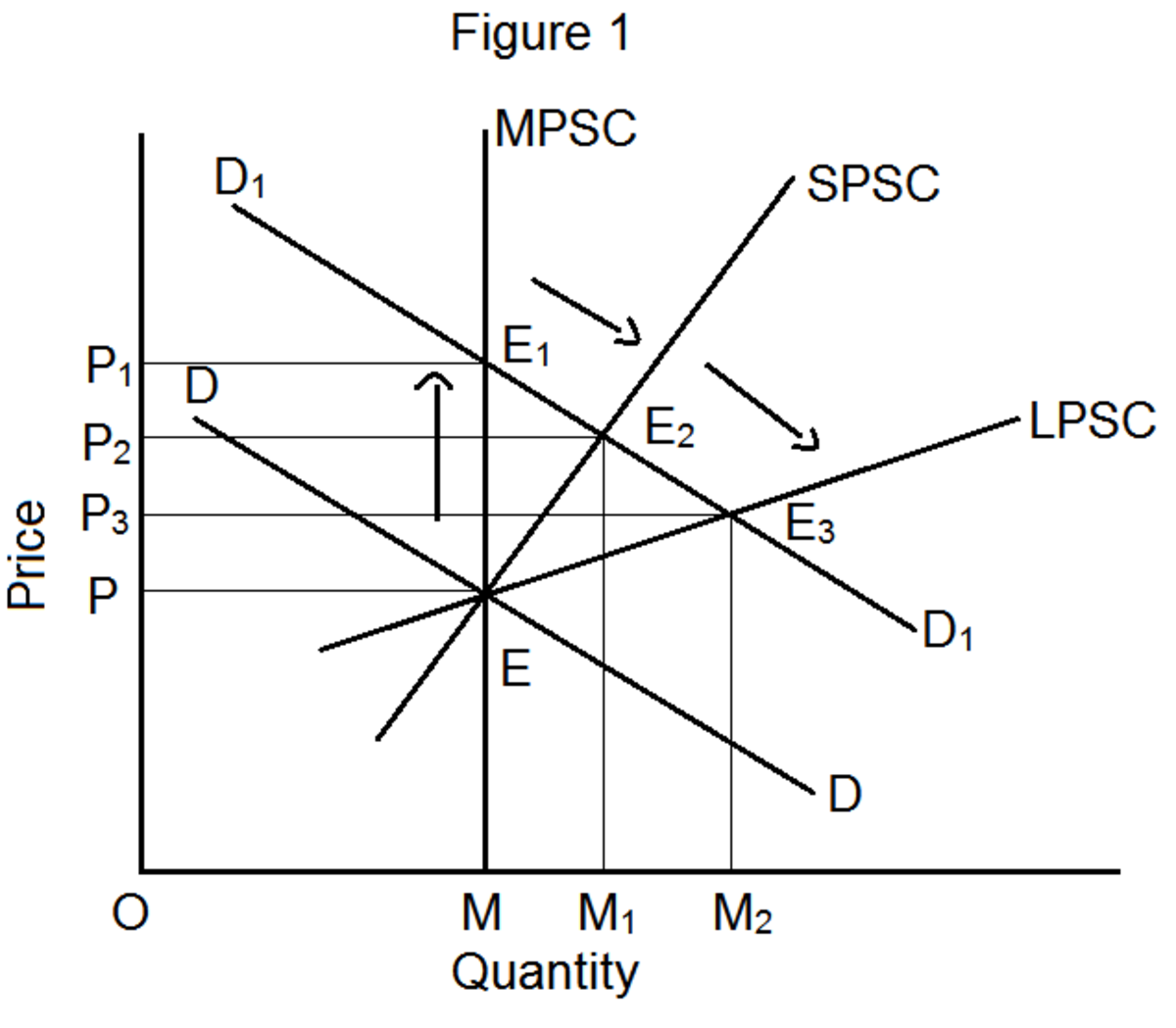

As we look back at 2013 and how individual asset classes as well as sub asset classes performed, we see a strong case for maintaining a longer term asset allocation strategy. The timing of the short term direction within financial markets has not... - The US Housing Crisis...How it Happened

One of the most impactful recessions in US history began with the linchpin of the inflated US housing collapse which culminated in 2008. This has been one of the most discussed topics in recent years, as it has had a profound economic impact on both. - Term Insurance vs Permanent Insurance

Life insurance planning is a topic that is often very confusing for the average individual. There are various different types of insurance products available, and it is not always clear which solution is the most suitable for an individual to... - National Income Disparity...A Look Behind the Number...

Over the years there has been an ongoing discussion about the growing income disparity in the United States. This discussion has been particularly emphasized when compared to the income distribution of other parts of the world. While it’s true... - Understanding The Long/Short Strategy

The single most important factor in a successful long term asset allocation investment strategy is the ability to maintain a low correlation between asset classes. In order for the notion of an asset allocation to work, a portfolio must be actively.. - Retirement Savings & Reducing the Tax Burden

Saving for retirement is something most Americans understand is of vital importance. Yet often investors are confused about the best places to save for retirement. The answer in most cases is not one or the other, but rather multiple places. The... - Money Creation & The Impact of Debt & Deficits

Everyone one of us just about every day reaches in our pocket and removes some money to purchase something. We receive money for our labor, whether self-employed or paid by an employer. Yet, many of us have very little understanding of exactly where. - Living Benefit Annuities…Buyer Beware

As a result of two major market panics in the last two decades, the use of variable annuities as a solution to the financial needs of the consumer has increased. These products have been marketed and re-marketed in various different formats with... - The Benefits of Master Limited Partnerships

A Master Limited Partnership (MLP) is a partnership which has the ability to trade on a public securities exchange. There are two core components which are the Limited Partner and the General Partner. The Limited partner is the investor who puts up..