Money Creation & The Impact of Debt & Deficits

Everyone one of us just about every day reaches in our pocket and removes some money to purchase something. We receive money for our labor, whether self-employed or paid by an employer. Yet, many of us have very little understanding of exactly where this money originates from and how it circulates into our pockets. If you ask the average citizen who creates money, most people will say the gov’t and some will even reference the Federal Reserve Bank. However, the reality is quite a bit more complex.

Money…whether US dollars or any other currency, is simply just a medium for the exchange of goods and services. Currency is a financial asset, but has no true intrinsic value on its own. We use currency because it is simply more efficient than attempting to barter our way thru life. If we had to stand in line at the bagel store for an egg sandwich while each person offered some other product or service in exchange for their bagel, we’d be there for some time while the store owner attempted to estimate the value of each product or service offered in exchange for the egg sandwich. Using currency is simply about efficiency in the exchange of goods and services.

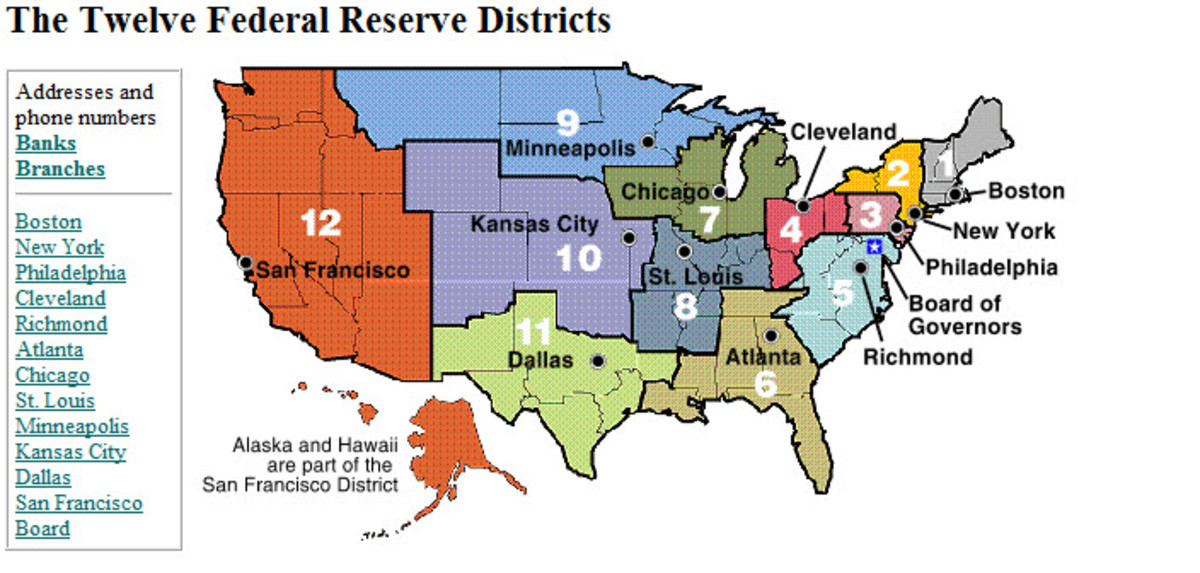

Legally speaking only the Federal gov’t can actively create net new currency as per the law. Yet, the lines between what we classify as money, and non-money is not always so clear. Money is broken down into many different groups. There is M0, MB, M1, M2, M3 & MZM. Rather than examining all of the details of each classification, let’s take a look at the basics for a general understanding.

Base Money

Base money is the net new money created by the gov’t. This is the amount of actual bank reserves that are held on deposit with the Federal Reserve, plus the physical currency in circulation (dollars and coins in our pockets). The bank reserves portion is what the banks must keep on deposit with the Federal Reserve or in vault cash. However, these reserves CAN’T and DON’T ever get lent out in circulation among the general public. The Fed loans these reserves to the bank, and the bank deposits them back with the Fed. At no point are these reserves ever placed into circulation as they cannot be lent out to the consumer. The Fed can also increase reserves via Open Market Operations. This is a process in which they can enter the fixed income markets and purchase or sell gov't securities as means to increase the supply of reserves, and influence changes in interest rates by manipulating demand for fixed income products.

So if the Fed is printing money...lending it to banks...while also buying and selling bonds to increase or decrease the amount of money in bank reserves, but they never place that currency into circulation with the general public…then how does it get into our pockets ??? And if so, why do these banks then need to hold these reserves ???

The reserves that banks hold are used as a base which determine a multiple of lending permitted…or bank credit. Because the amount of credit a bank can extend is a multiple of these reserves, the Fed can theoretically affect the supply of money by simply increasing or decreasing the reserve requirements that banks must hold. But this is really affecting the supply of credit. This credit is part of what is called M2, typically referred to as "broad money". In fact the vast majority of money that we see on deposit in our bank accounts or that we receive in our paychecks is a result of this bank credit. This credit is known as Fractional Reserve Lending. In this process, contrary to popular belief, banks DO NOT take in your deposit and then subsequently lend it to someone else. In fact the process is precisely the opposite. The bank creates a dollar of credit out of thin air, and simultaneously produces a loan note. To the bank, the loan is the asset and the dollar created is a liability. The new dollar lent will get spent on whatever it was purposefully borrowed for, and likely re-deposited somewhere in the banking system. At the time the loan is initiated the supply of M2 money has just expanded. And when the loan is re-paid the same dollar created is then extinguished and completely vanishes from circulation. Or more simply stated, the deposit does not create the loan...but rather the loan created the deposit. And every time we pay our mortgage, car payment or any other loan payment...we are shrinking the money supply. Each time we choose to borrow money from a bank...we expand the supply of money.

If any of these bank credit dollars are withdrawn as physical cash, the bank must increase its reserves to offset the withdrawal. So the bank can borrow from another bank with excess reserves, or go back to the Federal Reserve and borrow more from the Fed to increase its reserves. So in general, while the vast majority of the digital dollars in our accounts are created by banks, this is not net money as the financial asset is being created with a corresponding liability. Only the gov’t can purposefully create net new money. So that brings us back to how it is that the gov’t can create money and then put the actual dollars into circulation.

Gov’t Deficits

The Federal gov’t each year spends money on various things from national defense, infrastructure improvements to social entitlements. The gov’t then collects back some of this money via tax revenue, fees, fines etc. The difference between what the gov’t spends, and what the gov’t collects is the increase in the supply of net new money, and is financed via US treasury bonds. This money then gets spent by the recipients and deposited into the banking system as another source of bank reserves. In reality, every dollar of national deficit is a new dollar circulating in the system…hence permanently expanding the money supply. Each year in which the gov’t runs a budget surplus is a year in which the supply of net money has contracted. So isn’t more money good ??? And if so...then deficits must also be good. The answer to that question is Yes…and No.

The topic of deficits is not only politically charged, but also actively debated among economists in terms of when they become a concern. Some economists even believe in using a fixed money supply, although they are in the minority. The concern about deficits is really a concern about inflation. The creation of money is not necessarily inflationary. However, creating new money can become inflationary if the rate of turnover in spending increases, also known as an increase in monetary velocity. Rapid increases in inflation most typically occur when spending is not met by production and an item becomes more scarce. So when we have larger deficits, but not a corresponding increase in productivity of new products and services…the value of our currency declines, and we can buy less with each dollar. Yet at times, the price of goods and services will rise even without an item having become scarce. A seller will increase their price whenever they feel it is feasible to do so. Essentially, you may at times be charged more...just because you can afford it. Which is why at times the same product may cost more in a more expensive neighborhood. This concept also applies when we think about the aggregate money supply. So, an increase in the supply of money without a rapid increase in velocity can and has created additional inflation.

This is expressly why the gov’t cannot simply print and hand out millions of dollars to each citizen. If we all had a million dollars in extra discretionary savings, then a million dollars would not buy us very much anymore. We would all be millionaires...except many of us would be very poor millionaires. Since money is simply just a medium of exchange which holds no intrinsic value on it's own, it's supply needs to be managed carefully in order to retain its value.

So the size and scope of a deficit is not the only relevant factor, but also the composition of how the deficit occurs. If the gov’t collects less in revenue because it created a tax incentive for a business owner to invest in a new manufacturing plant, the temporary decline in revenue to the US treasury produced more dollars in the system, and assuming the business is successful…productivity also increased. When the gov’t spends money on necessary infrastructure needs that promote things like increased commerce, it can certainly be argued that this also creates an indirect benefit to increasing productive capacity. The less direct impact that there is in producing a capital investment, the less productive the new dollars created by a deficit will be, and the more inflationary they eventually will be. As an example…if the Federal gov’t began to simply pay more and more people money to dig holes all day and then fill them back up, we would be increasing the money supply and producing nothing that anyone needs or wants. That will inevitably become inflationary and hurt the purchasing power of those who hold dollars.

There are theoretically times when there is too much money circulating in the system and a period of surplus is a positive, and times when money is not turning over fast enough and an increase in the supply of money may be warranted. Unfortunately, controlling how and when we simply expand the supply of base money is not so simple because of politics. Since the Fed controls the monetary side of policy and most directly impacts lending and the monetary base, the remaining responsibility of the supply of net base money falls on the shoulders of our elected officials who control fiscal policy.

If we think back to 2009, in the midst of a global financial crisis, the President and congress proposed a stimulus spending bill designed to jump start the US economy. While there is clearly some strong need for various infrastructure spending across the US, only about 3% of nearly a 1 trillion dollar stimulus bill ended up having been directed towards infrastructure improvements, that in many cases were badly needed. The reason is simply politics. Politicians when given reign over where and how to spend money will invariably repay favors to their friends and allocate resources poorly. This is not unique to the current administration or congress. It is simply a function of the fact that political altruism is either scarce or non-existent.

Additionally, the expansion of credit which is supposed to be managed by the Federal Reserve is not always managed very well. If credit increases at too rapid a pace, this to can be inflationary and hurt the purchasing power of the currency. In theory the Fed can raise reserve requirements to contract excessive credit. However, practically speaking...when a bank simply asks to borrow more money to meet those increased reserve requirements...the Fed rarely denies them. So in reality credit is only limited by the demand for borrowing, as the Fed has rarely denied a solvent bank new reserve lending.

The Dangers of Political Influence

One of the arguments for the role of gov’t to be limited to just essential services is not just the notion that they don’t deliver services efficiently or timely. But also the role of currency creation is a dangerous thing when not handled carefully. When politicians can essentially buy additional votes with promises of new entitlements to the masses, the decline in the value of a currency can and usually will occur. This impairs economic prosperity and destroys the purchasing power of the very people most in need who are receiving what amounts to empty political promises.

John Maynard Keynes proposed the need for countercyclical deficits, in which the gov’t should spend more money at a time of economic contraction, while decreasing deficits during periods of prosperity and economic expansion. While this seemingly makes sense, there is little to no evidence that politicians can be entrusted with this role. And in fact if fiscal policy is limited to spending money on only essential items, countercyclical deficits will invariably be the result as a function of organic changes in the marketplace, as was largely the case prior to the 1930s.

During periods of expansion, people spend more money because they are making more money. Their spending equals income…which equals increased tax revenue…which equals deficit reduction…which translates into contractionary forces on the monetary base.

During periods of contracting growth or recession, private spending will decline and cash may be hoarded out of fear, or the patience of a consumer/investor looking for prices to achieve absolute value and eventually reach an equilibrium. This cash hoarding means less spending…which equals less income…which means less tax revenue…which equals an increase to the deficit and the expansion of the monetary base.

It should also be noted that the supply of money available in circulation domestically can also be increased via foreign dollars entering the nation. However, this requires that exports exceed imports and the counter party nation is then forced to run a deficit creating net new money. This is yet another reason for the importance of productivity.

While I don’t disagree with the premise of a need for countercyclical deficits proposed by Keynes. I do disagree with the notion that the govt’s fiscal authorities should take an activist role in the control of when these deficits and surpluses will occur. Many would argue that the marketplace would not deliver the changes to the money supply in a timely enough manner to reduce volatility in the economic environment. However, gov't does not respond timely and efficiently to very many things, if anything at all. So why would we expect that policy makers whom are forced to digest vast amounts of information, and then deliberate in a politically influenced forum of ideas and suggestions for endless periods of time would be any more effective at instituting timely changes to policy. They are not likely to be more effective than the organic changes to supply and demand that is dictated by the consumer as they determine how and when they deploy their resources. It seems that when the gov't pursues a more activist role in fiscal policy, it always results in long anemic drawn out economic recoveries not unlike the one we are currently experiencing which began in 2009

Suggested Reading

- Living Benefit Annuities…Buyer Beware

As a result of two major market panics in the last two decades, the use of variable annuities as a solution to the financial needs of the consumer has increased. These products have been marketed and re-marketed in various different formats with... - The Benefits of Master Limited Partnerships

A Master Limited Partnership (MLP) is a partnership which has the ability to trade on a public securities exchange. There are two core components which are the Limited Partner and the General Partner. The Limited partner is the investor who puts up.. - The US Housing Crisis...How it Happened

One of the most impactful recessions in US history began with the linchpin of the inflated US housing collapse which culminated in 2008. This has been one of the most discussed topics in recent years, as it has had a profound economic impact on both. - How to Understand Floating Rate Notes

In recent years we have seen unprecedented actions by global central banks to influence economic events and create monetary stimulus. Here in the Unites States, the Federal Reserve has held interest rates well below historical norms through... - Term Insurance vs Permanent Insurance

Life insurance planning is a topic that is often very confusing for the average individual. There are various different types of insurance products available, and it is not always clear which solution is the most suitable for an individual to... - National Income Disparity...A Look Behind the Number...

Over the years there has been an ongoing discussion about the growing income disparity in the United States. This discussion has been particularly emphasized when compared to the income distribution of other parts of the world. While it’s true... - Managed Futures: An Alternative Investment Strategy

The core principles of applying investing to a sound financial plan have for more than a half of a century revolved around the work of Harry Markowitz, and the foundation he outlined for Modern Portfolio Theory (MPT). Yet, in recent decades we have.. - 2013 in Review...A Case for Asset Allocation

As we look back at 2013 and how individual asset classes as well as sub asset classes performed, we see a strong case for maintaining a longer term asset allocation strategy. The timing of the short term direction within financial markets has not... - Retirement Savings & Reducing the Tax Burden

Saving for retirement is something most Americans understand is of vital importance. Yet often investors are confused about the best places to save for retirement. The answer in most cases is not one or the other, but rather multiple places. The... - Understanding The Long/Short Strategy

The single most important factor in a successful long term asset allocation investment strategy is the ability to maintain a low correlation between asset classes. In order for the notion of an asset allocation to work, a portfolio must be actively..