The ‘Buck Smarts’ Here: About Understanding Finance and Making Money Work For You: Part One.

You Don't Have to Meltdown.

Developing Your 'Smarts.'

The ‘Buck Smarts’ Here: About Understanding Finance and Making Money Work for You; by Pearldiver, explains in simple terms what you will need to do when trying to develop good financial health. This Buck Smarts article also makes it easy to understand some of the important, complex issues to be considered, when you are attempting to develop workable goals within your general personal finances, debt management and investment regimes.

This is the first article in an informative series called Buck Smarts that will be published throughout this and next month; building into an interesting, original set of steps that will take you through the full spectrum of Financial Planning issues and strategies.

A Few Facts to Consider When Starting Out:

It really

doesn’t matter when in your life, you commit to establishing an improvement in

your personal finances. What does matter

however, is that (a) You Commit to the exercise and (b) You Commit to setting

an achievable goal and then to setting yet another achievable goal, once you

have achieved the previous goal and (c) that You Commit to changing your

attitude to a positive ‘I can do this’ approach, by making whatever attitudinal

and lifestyle changes you need to, to ensure that you achieve the goals that

you set and (d) that You Commit to being 100% Honest with yourself, both in your planning and in your performance.

You should have noticed that the common denominator with each of these points is the word ‘Commit.’ That means that you Must Believe in yourself and your ability to set and achieve all the stepping stone goals that will take you to where you wish to be. Remember here also, that if you can not be honest with the exercise, then you will only be fooling yourself, that you are 'financially mature' enough to succeed. You won't be able to convince a banker to believe in you, if you show that you are financially immature; so consider this exercise to also be practice for future dealings with, your banker, financial planner and/or mortgage broker.

Don't Blow Your Resources.

Build an Intact Solid Base.

Where are you going to?

If you are prepared to start gaining the smarts on making and saving a buck or ten, then you need to analyze exactly what you are trying to achieve etc. We do this by being real and not kidding ourselves that we can achieve the best results without planning! You can’t, so let’s make planning an easy, enjoyable exercise that is based on accurate and factual information.

Consider all your plans to always be based (position-wise) on: (e) Where you are today. (f) Where you wish to be at a forward point in time; say five years or so from today. (g) What you must do to get to that point.

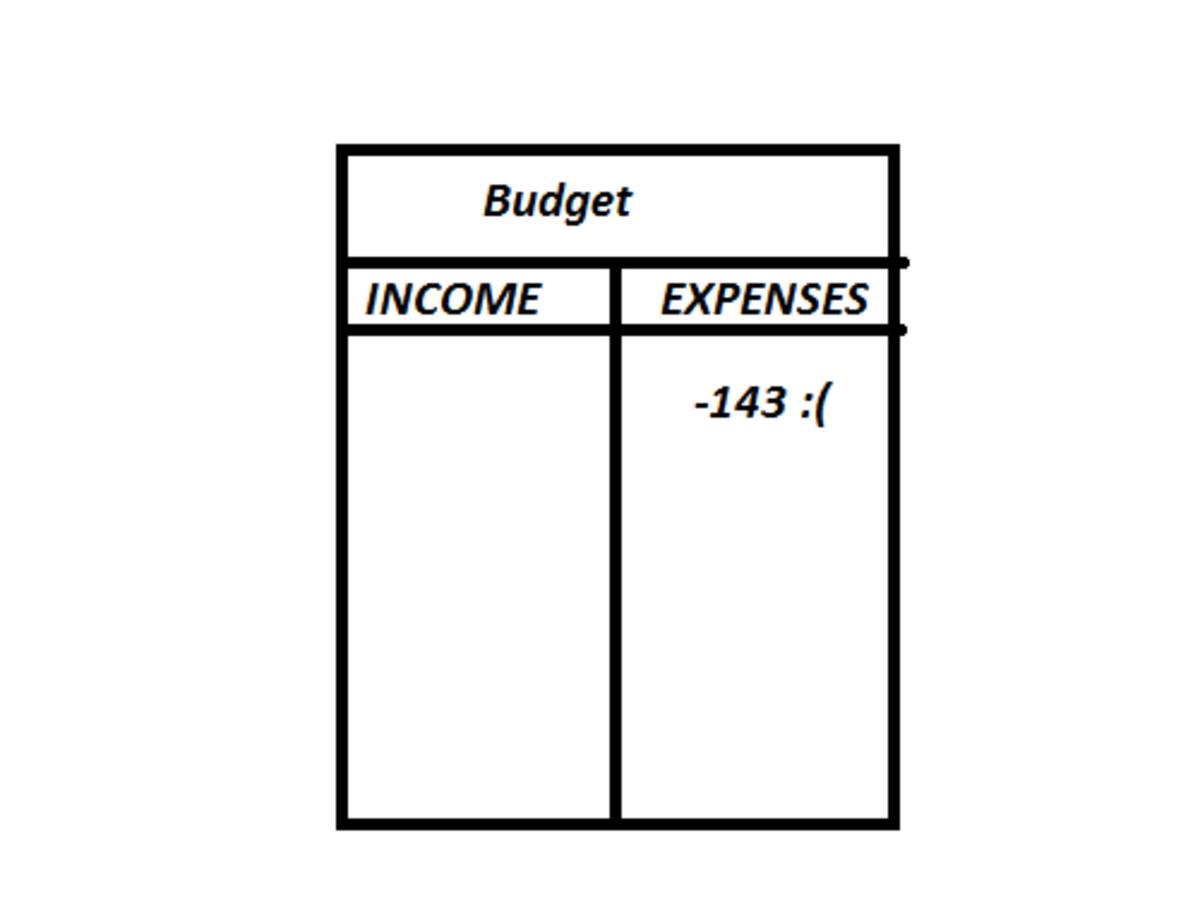

Analyze all your resources by listing all net (after tax) income from all (h) regular sources, plus secondary sources and then expanding the equation to a calendar monthly period, preferably from the beginning to the end of the month.

This now gives you an idea of what your gross

(pre expense) deposable income looks like.

From that amount you will need to deduct (i) your monthly regular outgoings. For this exercise only include your fixed and

regular amounts. Make a separate total

for (j) those amounts that are of variable value. Many of these variable amounts can be reduced with

the right budget and we will look at that later in this series. Right now we are just assessing the basics.

To gauge your current spending levels, once you have arrived at a subtotal by deducting (i) from (h), then deduct (j). This leftover amount is (k) and is effectively your net disposable income. It is a very important amount because, irrespective of what it is, we have to grow it in value, by pruning some of your spending and applying some of the tricks we will show you in Buck Smarts.

We need to establish what the percentages of your total net income (h) are in regard to the dollar amounts of (i) so divide (i) by (h) and write down that percentage for later. Do the same exercise for (j) and for (k). These should be the worst that they will be, once you have commenced your program.

Is it Best to Follow the Crowd or Stand Out From Them?

What Other Things Do I Need To Consider With Financial Planning?

We are going to suggest that you change the way you think about several things in this series. We want you to start thinking in percentages and in calendar months. The reason for this is that once you have trained yourself to do that, then you are always going to understand how money and interest really works, because it works in percentages of a basic amount called the principle. You will need to understand that relevance of this when you start looking for the right bank loan, mortgage, or investment.

We have to look at your Wants and your Needs. They are vastly different. On a separate sheet, list all the things you Want To Achieve in the next 60 Calendar Months. Now in regard to your Needs, these are the things that you Must Have To Achieve what you do today; your income for example. If you are completely honest with yourself and your budgeting commitment, then you know that many of your ‘Wants’ can realistically be left out, for merely being extravagant. Perhaps once every three months you can give yourself a bit of a reward for sticking to your plan… maybe?

You Need To Make A Total Commitment To Yourself.

What Else Do I Need To Know?

We need to look at your current exposure to debt and evaluate what effect that debt is in reality, having on your ability to get ahead. Does it need to be consolidated or have its structure changed in some regard, for example from Principle and Interest to solely Interest Only for a set period of time to help you through a tough patch financially? What specific debt can be fast tracked and given your current circumstances, is it actually viable. How much are your bankers taking from you each month that you aren’t aware of? How can we change your mindset in regard to lowering your debt ratios, during those periods that your equity levels dip, as a result financial factors that you have no control over? What different rates of interest are you paying and can we realign those rates to better terms?

Have a good

look at what we call ‘Lifestyle Expenses,’ these are the costs of living and

playing the way you currently do. You

will find that this is where a great deal of spent money is actually wasted. Also remember that saying; ‘There is no gain,

without some pain!’ Well this is the

area where you have the most ability to change positively as well as hurt a

little. But remember, you have Five

Years to achieve your goals right? That’s

a long time, isn’t it? Far longer than

60 months, don’t you think? How many

months have you been earning an income?

How much have you managed to save over that period? What percentage of your total income was

that? Have you invested that money away

from your ability to draw on it? Do you

currently save in a Spending Account? What is your Credit Score like and can it be improved?

We will also need to consider what your Risk Profile is later. This is based on how you really feel about risking your money in regard to gaining a higher return on your investments. The general rule of thumb is: The higher the promised return on investment (ROI) is, the higher degree of risk you will likely to be exposed to. Further to this, your preferred risk profile will dictate the style and terms associated with what you consider to be prudent investing. It varies for each individual.

Gradually Add to the Base You Have and In Time it will Take Care of You.

You Mean There's More?

We need to have a look at the taxation structure that you currently are exposed to and explore the options available to you to improve upon that situation. Would it for example be a good idea to put a corporate (company) structure around you, so that your income related expenses can be claimed back, as a result of changing your tax rate? Do we need to consider establishing a family trust structure to maximize investment and taxation opportunities, while ensuring that your children gain ease of asset transfers from your estate, along with other long term benefits, including not having your estate dispersed in an enforced marriage settlement?

We need to look at your Contingency Planning needs later also. This covers the ‘What Ifs’ something like death, disability, chronic illness or loss of income, occurs within the period of your life that we are planning for. Each of these factors has their own set of elements that must be aligned to your overall objectives.

The Long Road to Financial Independance Is Easily Missed, Because it is Easier to Just Swim Through Your Life, Like Others.

The overall objective for us should be to achieve Financial Independence in our lifetime. We are generally able to do that if we have an uninterrupted income stream and can invest approximately 20% of our disposable income throughout our greatest earning periods. In simple terms, the best way to consider this has to be thinking along the lines of considering that we need to save and invest until such time as our invested money earns enough income in its own right, as we do as a productive earning individual. In reality, it is possible for the average person to achieve that goal; but unfortunately, the average person fails, because they fail to plan effectively. Remember what I mentioned at the beginning about not fooling yourself and being real?

As you can see, Personal Finance is not solely about getting out of debt, rather it is about having the Buck Smarts to actually make debt work for you, when it is prudent to do so (dependant on the prevailing financial climate) and debt service furiously when prudence dictates that is the investment option. Debt is one part of the many aspects that need to be taken into consideration in an overall Financial Plan that caters for your current circumstances, your future circumstances and ensures that irrespective of any of the current dynamics changing, at any stage within your income earning lifespan, your planned objectives are achieved.

Remember: Don't Take a Fragmented Approach.

How Serious Are You Now?

I hope that you will join me for this in depth series The Buck Smarts Here and that you have been given a lot to think about as a result of reading this article. If so, then have a practice run at those things that I have touched on here and you will be ready to make a commitment to yourself and your family to improve your financial circumstances, your knowledge and the way you think. Until next time, take care and thank you for taking the time to consider the benefits of Financial Planning.

© Copyright Pearldiver nzpol 2011 with all rights reserved.

And Getting Out of Debt:

This article was sponsored by:

The 12 Steps Of Pain.

- The 12 Steps of Pain: Amazing Poems of Love and Hope: A Life Circle: About Falling In Love.

The 12 Steps of Pain: Amazing Poems of Love and Hope: A Life Circle: About Falling In Love; by Pearldiver, explains the amazing degrees of pain that some suffer, as a result of refusing to accept love...

Other Works By Pearldiver.

- Our Different Dreams': Amazing Poems of Hope: Life Circles: About Letting Go After a Relationship En

Our Different Dreams: Amazing Poems of Hope: Life Circles: About Letting Go After a Relationship Ends; by Pearldiver, is about breaking up and letting go, when a relationship ends, the end of a life...

The Reality of War.

- Where Once There Was Hope: Profound Words and Images of War: Volume One: World War One: The Western

Where Once There Was Hope: Profound Words and Images of War: Volume One: World War One: The Western Front; by Pearldiver features amazing, profound images of the unbearable conditions that an entire generation...

The Art of Body Language.

- This Sensuous Language of Love: A Life Circle and Seductive Poem of Hope: About Love and the Attract

This Sensuous Language of Love: A Life Circle and Seductive Poem of Hope: About Love and the Attraction of No Words; by Pearldiver. It is amazing how non verbal communication can and often does create...