Tips on Cutting Everyday Expenses

Groceries

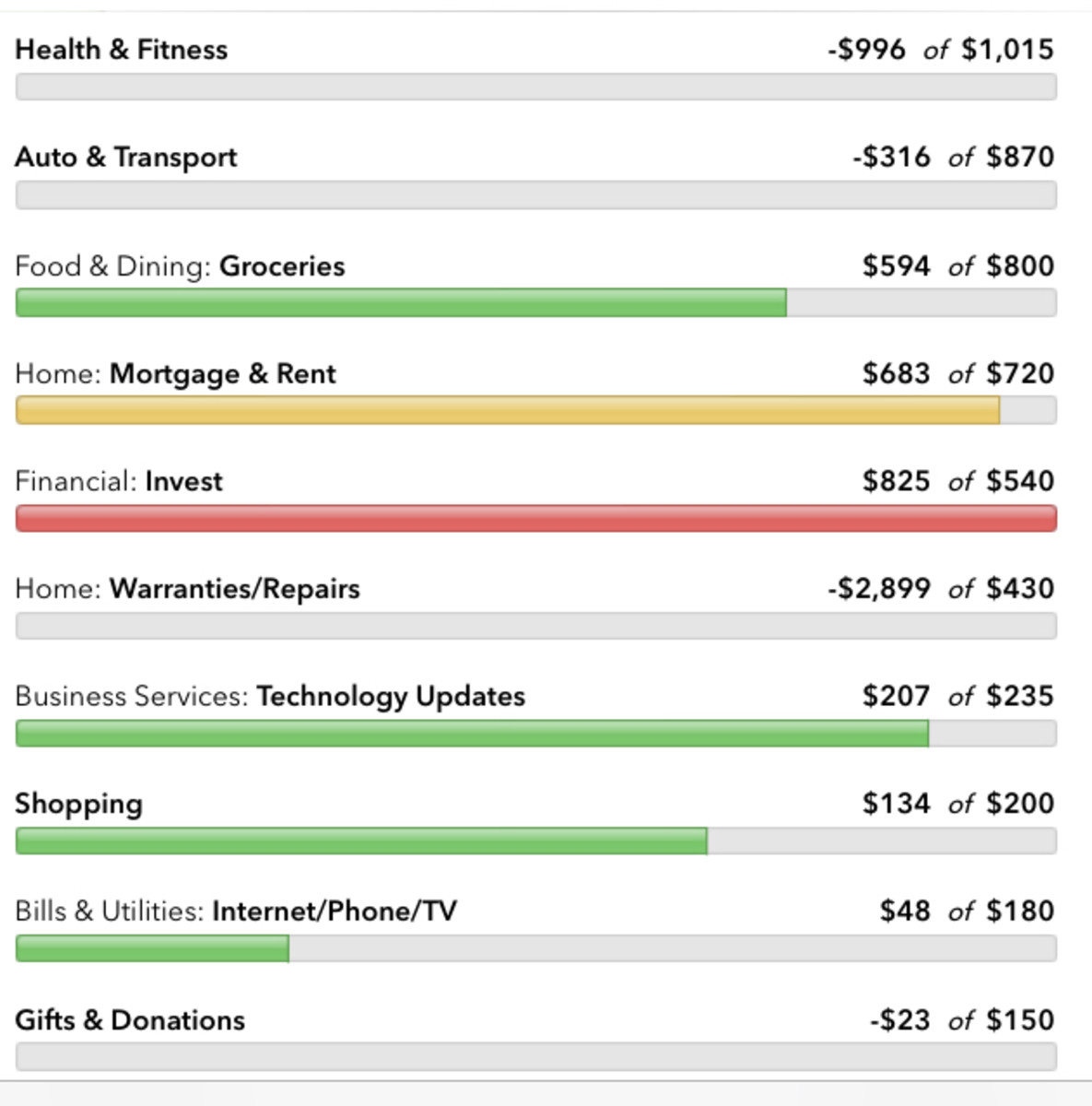

Cutting back on everyday expenses whether it is food, gas, car repairs, utility bills, clothing, toys, house repairs or other miscellaneous costs, we all can relate. Especially during these hard economic times. The following guidelines consists of everyday expenses that the average consumer can use as a tool to cut expenses:

- Purchase fruits and vegetables that are in season.

- Try to take a shopping list with you to the grocery store. Plan meals in advance when possible.

- Avoid buying toiletries and pet items such as dog food, bath soap, shampoo, toothpaste, detergent, toilet paper, and napkins at the grocery store. You can usually get these items for a lower price at a dollar or discount store.

- Buy less expensive cuts of meat and cook them in a crock pot until tender and savory. A slow cooker is also great for chili, stews and soups.

- Use leftovers to make soup. Take leftover meat, bones and vegetable scraps to make soup broth and freeze any excess.

- Go out to eat for lunch instead of dinner. The menus are often the same, except for lunch the prices are much lower.

- Avoid buying packaged, processed, and any unhealthy foods altogether.

- Make foods from scratch using preservative free ingredients.

- Prepare foods from home using only natural ingredients.

Look for coupons in the paper each week for restaurants and grocery stores and save them in a folder for future use.

Shopping

- Plan purchases in advance. Shopping with a list is a good idea not only for groceries, but for clothing and other household goods as well.

- Avoid buying on impulse.

- Many stores will hold merchandise for one day at no charge. If you aren't 100 percent sure something is a good buy, put it on hold overnight while you think about it. Then make sure it is something you really need and the price is right before you buy it.

- Trends usually reveal people tend to spend less when they pay cash for purchases instead of using a credit card. If you are a careful shopper, instead of paying cash you can save money by charging your purchases and using a rebate card for additional savings.

- If you have the storage space, stock up on staples when they are on sale.

- Buy in bulk when you make regularly scheduled trips to warehouse clubs.

- Keep a list of prices for items you regularly buy so you'll know when you see these items on sale whether or not the price is really a good deal.

- When shopping for gifts, consider inexpensive calendars, planners, and organizers for great low cost gifts.

Entertainment

- See movies in the afternoon at matinee prices.

- If you belong to automobile associations like the American Automobile Association (AAA), many museums, zoos and other attractions offer discounts to AAA members.

- For a night of family fun, pull out the board games and play classics like Monopoly, Life or Scrabble.

- Try stocking up on board games at after Christmas sales when many of the toys are marked down in price.

- Put together a complicated jig saw puzzle for the whole family to work on over several evenings.

- Plan a barbeque or picnic in a picturesque area like a park or the beach for a low cost outing.

- Visit the library and borrow books and videos for free. Many libraries have free special activities for children as well.

- Zoos and museums have free year long passes in exchange for annual memberships. As an added bonus, some of the membership fees are tax deductible and include free admission.

- Join clubs that are free or that have nominal memberships.

Gas

- Maintain your vehicle well and schedule regular servicing by certified auto technicians. This will ensure that your car runs great and is economically fuel efficient.

- A great tip on saving gas is to fill up your gas tank either early in the morning or evening when the sun is not out. Because temperatures are lower during these times of the day, the gas will be denser therefore, you will end up with more quantities of gas for the same price.

- Use gas cards and get a credit card that gives 5 percent or more cashback on gas, like that from Discover or Mastercard. If you buy gas at $4.00 and use a gas card, gas now costs only $3.85.

- Stop driving aggressively and breaking hard. This consumes a lot of gas. Anticipate when you need to brake and you can save up to 39 percent.

- Use your cruise control inside of your car to save additional money on gas everytime you maintain a constant speed.

- Reduce idle time by turning off the engine whenever you can. Newer cars don't require you to idle when starting up the car in the morning.

- Plan your trips ahead. Go to the post office, grocery store and to the cleaners in one trip.

- Walk or use bicycles.

- Change the car's air filter regularly.

- Inflate the tires properly.

- Park in the shade since heat evaporates gas in the car.

- Use a GPS to avoid unnessary traveling.

Electricity

There are so many ways for you to lower the consumption of electricity while saving money on your monthly bill.

- One thing you can do is to never keep electrical gadgets that are not in use on. If you are not charging your cell phone, then pull off its charger from the electrical switch or turn it off even if it's plugged in.

- Investing in an alternative form of energy such as solar and wind will definitely help you save money on electricity.

- There are lots of electricity providers that offer lower rates and discounts. If you think you are paying too much for electricity, one good way would be to change your electricity service provider.

- Another good tip is to turn off electrical appliances such as lights, water heaters, TVs, stereos, coffee makers, toasters, irons and blow dryers in the morning when you are leaving for the office and at night before you go to bed.

- You should also turn off all the lights in the home at night when you are going to bed.

- You should also try to turn off computers, printers, and other digital equipment before you fall asleep.

- You should also avoid over plugging laptop and cell phone chargers. Always monitor them and turn them off after your devices are fully charged.

- Reuse batteries by recharging them.

Health Care

- One of the best investments in time and money you can make is in your health.

- One way to consider improving your health is to develop inexpensive hobbies that allow you to get both exercise and fresh air.

- Invest in your own gym equipment. You can often pick up gently used sets of weights, exercise bikes, rowing machines and similar equipment at garage sales.

- Buy home exercise videos instead of joining an expensive gym.

- For exercise, stress relief, and relaxation try a yoga or meditation class.

- You can often find yoga classes through inexpensive community adult education classes and your local community organizations.

- Become familiar with breathing techniques and how to do yoga postures, so you can practice at home with just a book or video.

Vacation and Travel

- If possible, travel off season when the rates are lower.

- For vacations, go camping instead of staying at hotels.

- Buy airline tickets in advance. If you delay, the price usually increases the closer it gets to your trip time.

- On trips pack light and only necessary items in the luggage.

- Shop online for deals before you arrive at your destination city.

- Many attractions offer special passes in conjunction with other attractions.

- Check for special rates on hotel rooms.

- Book group tours and excursions as they tend to cost less than individual tours.

- Avoid traveling during peak times of the year like holidays, spring break and summer.

- Check out discount prices and promo codes.

Informational Hubs on Saving Money

- 70 Frugal Tips to Save Money On Groceries, Electricity, Banking and More

Find some tips on how to save money on groceries, clothing, eating out, utilities and more. - Practical Ways To Save Money For a Large Family

Having a large family necessitates wise spending decisions. Here are some tips and suggestions on how to save money without having to feel the stress of the budget slashes.

Grow your own Garden