Debit Card Fraud-How To Protect Yourself

Prevent iphone ATM PIN Code hacking. Watch here!

More on money matter by CrisSp~

- How to save money on gas with effective driving habi...

Are you an aggressive or moderate driver? EFFECTIVE DRIVING HABITS - SAVE MONEY, SAVE GAS, SAVE LIFE. Quick tips on saving gas money and staying on the budget.

Back from a red-eye flight, I sat on my computer to check my email, social networking sites and my HubPages. It's 3:30 AM. I’m sipping my favorite blueberry-pomegranate mixed organic tea when my instinct snapped and told me to check my bank account. Just like that, so I did.

I almost fainted and it felt like a mini heart attack when I saw 3 strange transactions on my chequing account: 2 purchases under UNIQUE (merchant) and an ATM withdrawal from a non-ATM machine for a total of almost a thousand dollars. This prompted me to call the Bank’s 24/7 line to inquire and report the unknown transactions. I have no idea what are all these and the fact that I was away-airborne at the time of these transactions, it was indeed alarming.

I did not manage to speak to anyone on the phone but I left a message twice to alert the bank of the matter. Then I couldn’t sleep anymore. I tossed and turned, waited for 8AM and then drove to my nearest banking institution.

At the bank, I requested to speak directly to the manager who happens to be very accommodating and truly helpful. After explaining what I thought was very suspicious transactions, we called the 1-866 number for Theft and Loss Prevention. Upon verification of pertinent information, the transactions were then verified to be fraud. The agent on the Theft and Loss Prevention explained that this is now rampant and sadly epidemic. Although, I was given a re-assurance that my money will be reimbursed to my account within 2-3 business days, it scares me now to use my debit card just like that and I was restless the rest of the day.

Quick poll

Have you ever been a victim of this debit/credit card hacking?

5 Notorious places to avoid swiping your credit/debit card:

Apparently so, there are 5 notorious places that we should avoid swiping our credit/debit cards:

1. Outdoor ATM locations

2. Convenience Stores

3. Gasoline Stations

4. Movie Theater/houses

5. Restaurants

Electronic hacking is scary!

Skimming off the top~

In my case, I suspect it is from McDonalds, where I last used my debit card. I have heard of a friend who was victimized from a movie house and another one from a gasoline station and then I’ve read a similar experience where it actually happened at McDonalds. I never thought it would happen to me.

I was petrified. The last place I used my debit card prior to the incident was at Highland Farm for an $8 sundry purchase and for $6.99 at McDonalds for a happy-meal chicken nuggets and a regular French fries, not upsize. But, I have been victimized by Canada’s super-sized debit card fraud and I’m so upset. This prompted me to write this Hub to share my experience and promote awareness on Debit card fraud.

Although victims of debit card fraud are protected by the Canadian Code of Practice for Consumer Debit Card Services, it can traumatize you, considering the anxiety and the hassle that you have to go through.

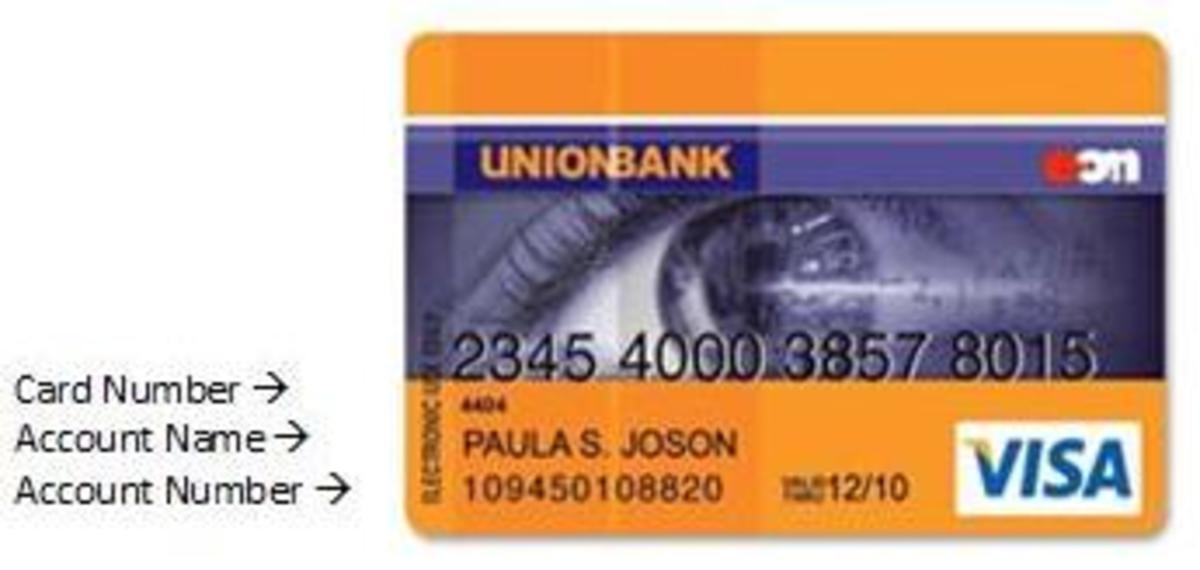

What is Debit Card Fraud?

Debit card fraud is when your card has been compromised. It happens when the information on your debit card has been duplicated and used to obtain money from your account without authorization. Thieves have a way to skim or swipe this information from the magnetic strip on the back of your card and in order to steal money from your account; they also have to capture your PIN. They have a high-tech way to do so, which could be ostensibly hard to recognize.

Debit Card Skimming

Did you know?

42% of Americans had experienced some form of payment-card fraud in the preceding five years. Source: economist

What to do when your Debit Card is compromised?

1. Report it immediately by calling the bank or better yet drop by in person as soon as possible.

2. You may also want to contact your credit bureau and asked them to place fraud alert on your credit reports.

3. Always report debit card fraud to the Canadian Anti-Fraud Centre.

Invest on this card holder. It's worth it!

7 ways to protect yourself against Debit Card Fraud and misuse?

1. Keep your card in a safe place. Don’t lend it to anyone, not even your best friend.

2. Do not disclose your PIN (Personal Identification Number). Your PIN is your electronic signature. Know it by the heart and try to change it from time to time.

3. Select a PIN that is unique and hard to guess. Avoid anything that is closely associated to your personal information like telephone number or date of birth.

4. Use only legitimate ATM locations; avoid non-ATM terminals like convenience store or small disreputable places.

5. It is imperative to protect your PIN. Use your hand or your body as a shield from onlookers when typing on your PIN.

6. Remember to take your card and the transaction record with you before you leave.

7. Make it a habit to regularly check your transaction history or your bank statements. Immediately report any unusual transactions to your bank.

Cash Against Slash

No, it’s not a matter of life and death, but for most people specially those who are living pay-cheque to pay-cheque, that thousand dollar is quite substantial (no exaggeration) to be without until it is returned to the account. So, I strongly recommend, do not delay. Report it in time!

And lastly, be very cautious with your debit transactions. Contrary to the old sayings: “It is only the poor who pay cash, and that not from virtue, but because they are refused credit” by Anatole France, I will now be paying cash as much as possible instead of swiping and slashing my debit/credit card. That way, I stick to my budget too. I'm not saying I'm poor. I'm also not rich. I consider myself blessed and unfortunately victimized. Now charging it to experience.

Copyright@CrisSp~TM/03/11/12. Fearless but not Heartless!

© 2012 CrisSp