What Is A Reverse Split Or Stock Consolidation?

What is a stock consolidation?

There are two terms used to describe a relatively common corporate action: the reverse split or stock consolidation. A stock consolidation reduces the number of shares outstanding by a factor known as a reverse-split, or consolidation, ratio. All other things being equal, the market price of a stock will increase by a directly proportionate amount, inverse to the consolidation ratio, following a stock consolidation.

An investor who owned 100 shares of a company that consolidated its stock on a 1/10 basis, would be left with 10 shares, presumably trading at a price about 10 times higher, though in reality, this is not always the case. Further, consolidations reduce the number of shares outstanding for a given company, giving a tighter share structure, something many investors find desirable. Despite this, as explained by Wall Street's Best Daily, many investors disparage companies who consolidate their shares.

Zacks notes the smoke and mirrors nature of stock consolidations, "A higher share price is usually good, but the increase that comes from a reverse split is mostly an accounting trick. The company isn't any more valuable than it was before the reverse split. Whatever value it has is just distributed over fewer shares of stock, thus increasing the price. So a reverse split can generally be taken as a bad sign for a company."

Profitless companies with penny stocks listed on exchanges like the TSX Venture Exchange, where $0.005 minimum tick increments are in place, that have traded close to zero, are faced with large bid-ask spreads. For example, an investor who buys a stock with a bid-ask spread of $0.045 to $0.050, and pays $0.050, is faced with a 10 percent loss if they wish to sell immediately, and a 20 percent loss if the bid moves down just one tick. The situation is even worse at $0.010 and $0.005, where investors face immediate 50 and 100 percent losses, simply by buying at the ask.

For investors who use stop losses to manage risk, as described by Investor's Business Daily, instant 10 percent and near instant 20 percent losses make it impossible to operate and illustrate why low-priced stocks might be best avoided.

Proper consolidation adjustments

Missing consolidation adjustment?

What is a consolidation adjustment?

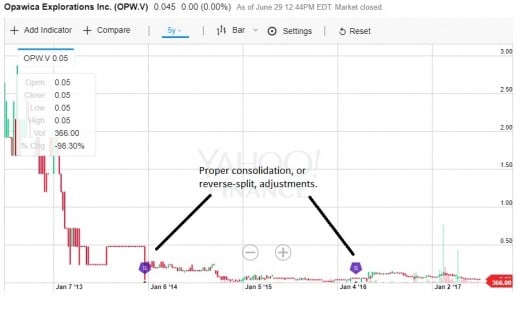

What is a reverse-split adjustment? Stock chart providers adjust prices prior to stock consolidations to give investors who held shares before a true picture of what their investment would be worth. However, the reality of what stock charts depict can vary widely.

For example. Yahoo Finance reports that on December 24, 2013, Opawica Explorations, Inc. (TSXV: OPW) consolidated its shares on a 1/12 basis. BigCharts reports that the prior day, December 23, Opawica stock closed at $0.005, the lowest possible price on the TSX Venture Exchange.

On December 24, after the consolidation, Opawica stock closed at $0.045, representing a loss for investors who held through it. For investors to have broken even with the consolidation, the Opawica stock would have needed to have closed at $0.06. Instead, Opawica investors were faced with a further 25 percent loss, from the lowest possible price on the TSX Venture Exchange.

Perhaps most interesting is the difference in five-year stock charts for Opawica offered by Yahoo Finance and Stockhouse.com. The chart offered by Yahoo Finance shows the stock losing money through the consolidation: prices have been properly adjusted. The chart offered by Stockhouse shows the stock jumping significantly, by at least 400 percent, through the consolidation. It appears that the Stockhouse chart for Opawica Explorations shares is missing the December 2013 consolidation adjustment.

Could this simply be an error? This was the question that was raised by the Janaury 2017 report to Canada's Minster of Public Safety Ralph Goodale, as hosted with HubPages, which found close to 100 charts of stocks issued by Canadian companies with similar errors with both Stockhoue and BigCharts. It has been noted that charts with such errors lead to investors being misled and have a potential use as a tool by those actively seeking to deceive others.

© 2017 Stephen Sinclair