When Is It Okay to Rent-To-Own?

The Rent-To-Own industry has flourished exponentially in the last twenty years or so. And depending on what state you are from, it can be a very profitable business venture for the RTO owner and a very dismal one for the consumer.

I worked for an RTO company in the Midwest for quite awhile in the late 80’s and early 90’s. It was a ground floor opportunity to get into upper management within a fairly new company, and my tenure there went very well. I began my career there as an accounts manager and worked my way up to District Manager for the Western and Central Missouri area. It was a good job, I worked for good people, but something wasn’t completely right about it, and it bothered my conscience. The people higher than me were making a killing by putting these stores in the smaller rural towns and communities where the median income was slightly above minimum wage.

On the surface, this was a boon for the community because now the low wage earners with poor credit could have “nice” things in their homes without spending a lot of money at one time. It was a major problem for the retail furniture and appliance stores because they were losing business to the RTO stores. And to make matters worse, the RTO owners would put two stores of different names in the same community, to make it look like there was competition moving in, when in reality, it was the same company. Their logic was “competition stimulates business, so we create our own competition.”

At the appearance of the first RTO store in these small towns, people flocked in to rent-to-own new televisions, washers and dryers, refrigerators and VCR’s. In fact VCR’s were our biggest seller. They were still relatively new on the market and the lower income people could not afford them at full price. But for $10 a week, they could. There was living room furniture and bedroom sets available as well. Ladies from all over the county were elated to find that they could have a new living room set or bedroom set for just a few dollars a week. Business was fantastic. There was no credit check, and no down payment, and to get the contract started, the renter would pay for one week and get two weeks free (which were back loaded at the end of the term).

The store did offer “90 days same as cash”, which was in a sense, a rip off. If the customer paid his $10 weekly rent for 5 weeks for a total of $50, of which half went toward paying it off, he was still paying nearly full price for the VCR, plus $25. It was pure profit. He would have been better off putting it on layaway at Wal-Mart.

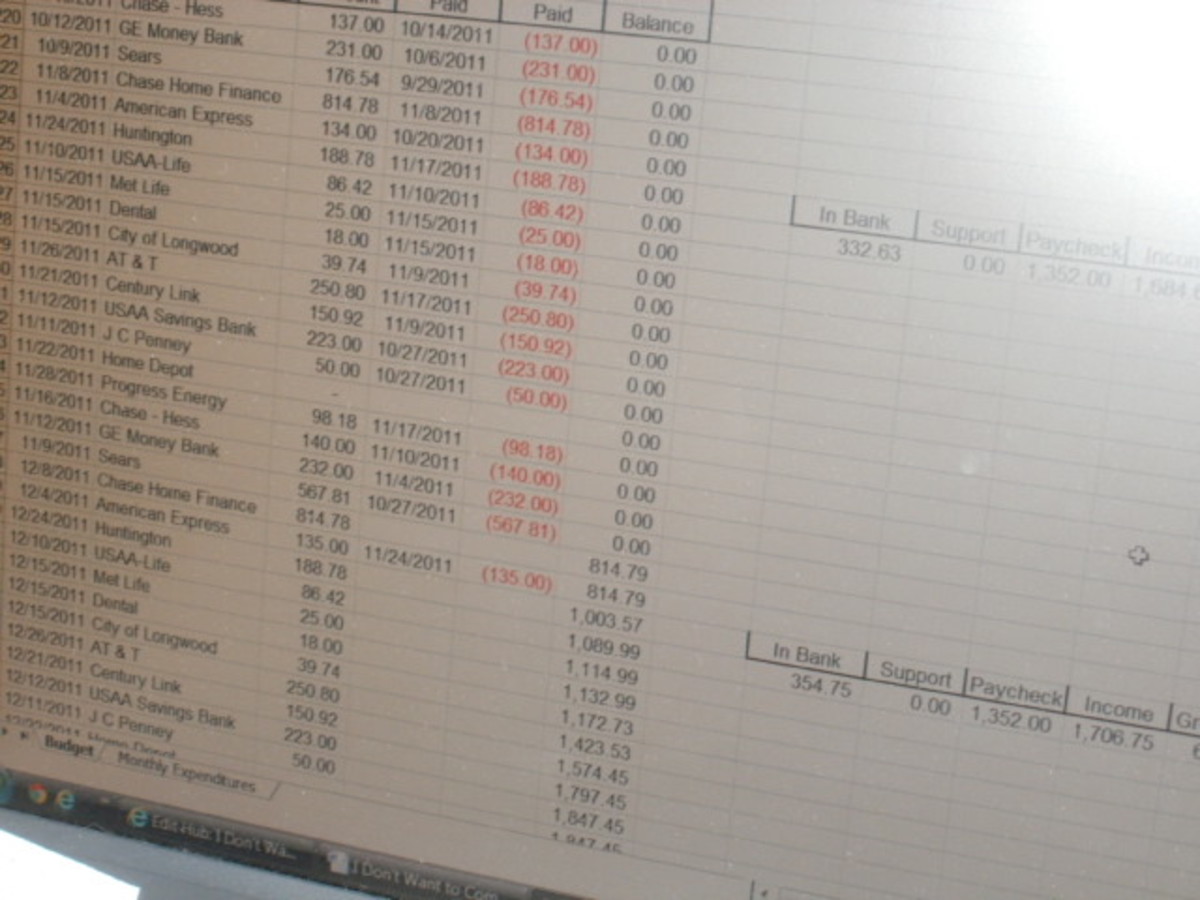

Now let’s do some math. Let’s say a new VCR costs the company $100.00. The retail markup on that would be 150% or $225. The RTO formula calls for the cost ($100) to be multiplied 5 times ($500) and divided by the term of the contract (52 weeks or $10 after rounding up). So a $100 VCR after a year would cost the consumer $520, just in time for the warranty to expire.

But that’s not the worst of it. More often than not, the consumer would default on the rent or just return it because they realized that they were being ripped off. So the VCR comes back, and the process starts over again. The profit margin for that piece of merchandise gets better and better for the company until it is finally paid through by the renter. It is really nothing more than an extremely high interest finance rate on a purchase.

Some states have now made RTO businesses illegal, or have changed the rules tremendously. In many states now if a customer actually pays off a rental item, from start to finish, then the RTO company is required to refund the excessive rent charges to make the purchase more realistically in line with retail sales. If the consumer defaults on the contract 1 week before making his last payment, he loses all rights to the deal and it is money lost. That is what the companies hope for.

So when is it okay to Rent-To-Own? Almost never. Some stores offer different rates for “rent to rent” which are usually a bit higher. If you are having your refrigerator repaired and need a temporary fridge, then rent one. If you suddenly need one because yours died and you have no credit, then by all means, you do what you gotta do until you can find used one somewhere. But of you just want to rent-to-own a new TV or a nice living room set to impress the neighbors, it is an expensive way to go.

I always told my customers that the only reason that a rent-to-own purchase was justifiable was if they had a large family with a lot of laundry. The RTO price of a new washer and dryer set was far less than the expense of going to the Laundromat twice or three times a week.

The worst cases of RTO irresponsibility that I have seen came during the holidays. People would actually rent-to-own gifts for their loved ones. Parents would RTO video games and TV’s for their kids, or living room sets for each other. The sad part was having your gifts repossessed because the payments couldn’t be made later in the year. We even RTO’d jewelry! Diamond rings and necklaces! It was such a sad thing to have to go and repossess an engagement ring or a wedding band from a lady in tears. I had one store manager that actually tracked a wedding ring into a hospital delivery room and repossessed it while a woman was in labor with her baby. Incredible!

But the thing that finally broke me of the job was having to repossess a refrigerator from a recently widowed young mother with three kids. The refrigerator was full of food, and they had no other means of support. I paid her rent up for three months and then resigned. I couldn’t take it anymore.

If you can’t finance something or buy it outright, at least put it on layaway somewhere. Never Rent-to-Own unless you absolutely have to.

The entire contents of this writing is protected by the copyright laws of the United States of America. © 2010 By Delbert Banks.