Where Fictitious Value is in Negation of Real Value

There are many things we value as human beings, but in order to use them as a commodity, some of the real value is converted to fictitious value

There is real value and then there is fictitious value that is behind every economic bubble

Not everything that is proclaimed as a value has actual or real value. Quite the antithesis; instead if increasing value, it only increases costs and actually removes value. Therefore, something that is added to real value that subtracts from it is fictitious value. It does not exist, but the capitalist requires it in order to advertise, protect or profit from real value. Among these false values are items such as advertising, speculation and security. Everything that we hold as valuable has as its foundation, use value and onto this is added value by what labour does to transform use value of raw resources into something useful for human need. The real value of something thus has use value combined with labour value. There is real value for what is necessary for life and sometimes there is as a result of labour, a surplus which becomes a commodity that can be used as trade for other commodities. False value comes when labour is used not in producing a value from use value, but is used to either speculatively flip an existing value or commodity, to advertise it or to protect it from acquisition by someone who wishes to gain it by theft; without contributing anything in exchange for it. The last item is an issue of further commentary as the concept of property is involved and the question of property itself arises from original theft of surplus value.

For every exchange there must be a balance; or so the equations of economics tells us, but this is not always followed in real economic practice. There is the question of the definition of property, which has deep historical roots based on the development of civilization and specialization therefrom.

In the beginning, human beings were not far separated from other animal species, gathering and hunting for anything of value to allow life for another day. There was no surplus and all too often, want haunted humanity as can be proven from the archeological record of incidents surrounding the fall of the 4th Dynasty of Egypt and the catastrophe of 535 C.E. There were other periods of want such as prior to the French Revolution and the Russian Revolution. However, with the advent of civilization, despite the temporary setbacks, there came the advancement of specialization and of surplus production of value from use value.

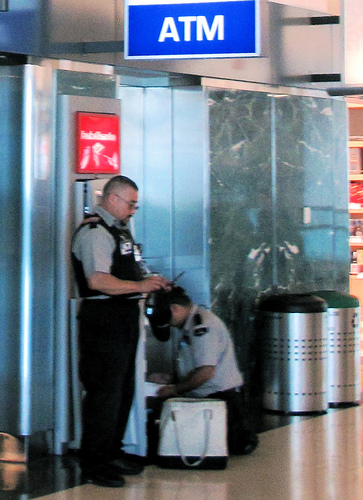

In the beginning, surplus value was used for trade and it worked for a long time while peace existed between different peoples. Periodically, an act of nature would create want and this often occurred in a combined and unequal manner where different people were affected differently, some suffering completely, some partly and others not at all. When this occurred, this inspired some to take everything of value by force from those who had it. Out of this grew the sense and idea of property and ownership. Property in a climate of combined and unequal development meant that property had to be defended and so arose the whole idea of armed forces, police and security. These professions added nothing to the value of property or use values. In fact, taken as part of the equation of value, these additions actually subtract from value. It costs a lot to protect property that is hoarded for one reason or another where no further value is added by the act of labour. Armies, police and security exist to keep use value from being taken without proper trade. Much of the law centers on property relations. Thus, in order to cover the costs of protecting surplus production, the value has to added to cover costs of protecting it. Nothing else is added but protection. Thus we can see that things of real value are inflated to cover the false or fictitious value added that add no real value. Even governments get involved with a "value added tax" that does nothing to add real value, but inflates the cost to the consumer.

But this is not the only scenario where real value is negated by fictitious value. The speculator adds apparent value by flipping something of value in the idea of buy cheap and sell dear. We see this in the stock market and real estate. When these values are inflated beyond what the market can bear, then there is the risk of a collapse. This is the scenario for the economic bubble, the latest of which was in the housing and mortgage bubble. Continually flipping a value for round after round of profiting increases the false or fictitious value while real value remains fixed. This is especially true fro a use value like raw land. The result is that the total value becomes mostly devoid of real value. When the big marketeers decide to sell off, the rest follow, only to lose the accumulated false value and the real value along with it due to legal trickery and financial manipulation. More real value ends up in fewer hands and most people wind up with nothing.

We live in a world of advertising. It surrounds us everywhere, encouraging us to consume beyond what the average worker can reasonably support. The cost of advertising must be dealt with as it adds no real value to an existing value. Here again, the labour of the advertiser removes value from something that exists. This is compensated by adding value to the original to cover the cost of the advertising and the working consumer must pay more to obtain the value and cover the cost of advertising that persuaded the purchase in the first place. Many people are frustrated by the constant harping of advertisers to buy this and that. Most of it the average worker does not even need, but has to be convinced to acquire. This is one way how capitalism keeps an economy going, especially if it is saturated.

There are other ways where false or fictitious value is added to real value like in the form of interest payments on credit and loans, but these are issues that are dealt with in Part 2; “Interest on loans, the real driver of inflation and devaluation”.