Why You Need Long Term Care Insurance

The high cost of long term care

Consider the following statistics: According to the U.S. Census Bureau, 4 out of 10 individuals will stay in a nursing home at least once in their lives. Meanwhile, 1 out of 10 individuals will reside in a nursing home for 5 years or longer.

By 2060, it is estimated that 24 million Americans will be needing some type of long-term care.

1 out of 4 individuals 85 years or older lives in a nursing home.

Long-term care, whether received in assisted living facilities or nursing homes, is never cheap. Assisted living care, which includes such amenities as room, board and transportation, costs a minimum of $3,000/month in a state like Wisconsin. Nursing home care, which includes personal as well as medical care from on-site staff and registered nurses, can cost up to $77,000 per year in a state like Florida and over $100,000 per year in a state like New York or Illinois.

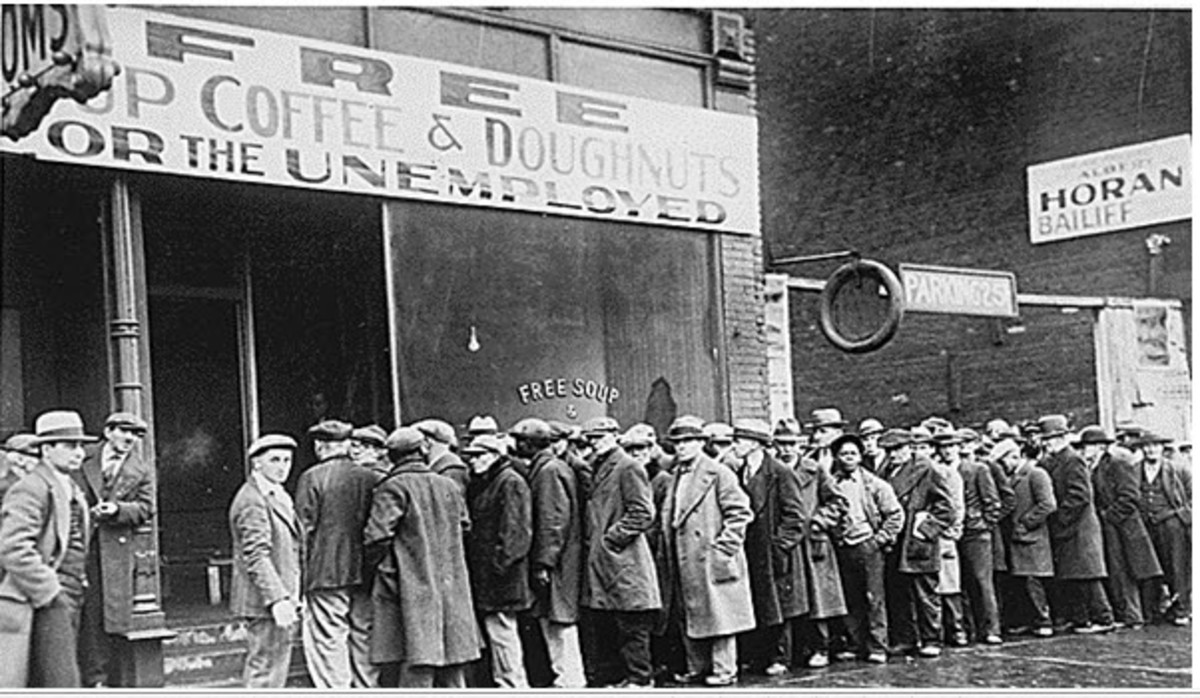

The "traditional" path that many Americans, including you, typically take is to pay for assisted living and/or nursing home care out of their personal savings and investments. When those personal savings and investments are exhausted, these individuals enroll in Medicaid-sponsored long term care. At this point in their lives, such individuals are completely destitute, having fewer than $2,000 in personal assets so that they qualify for Medicaid.

As if being bereft of all your assets wasn't bad enough, Medicaid-approved assisted living and nursing home facilities are usually of a lower quality than private pay facilities. These facilities also often require a considerable waiting period before a vacancy appears. Finally, such facilities may be located far away from your family and friends.

My personal struggles with long term care costs

In late 2010, my mother was diagnosed with frontotemporal dementia (FTD) of the primary progressive aphasia form, a rapidly progressing neurological disease which leaves its victims unable to speak, follow basic directions, and complete activities of daily living such as meal preparation, driving, paying bills, taking medication, bathing and housekeeping. She is currently 58 years old.

Once my mother's diagnosis was in place, I looked for caregivers who could prepare her meals and supervise her throughout the day. Caregiver cost was rather high; the average rate for in-home care in Illinois is about $22 per hour. I also looked into possible assisted living facilities and nursing homes. Although I already knew something about the high cost of long term care, sticker shock hit me nonetheless when I found out how much an assisted living facility cost per year. In essence, I was looking at annual costs of $60,000 - $90,000 for some of these places- more money than I earned at my full-time job for the entire year!

My parents had managed to save some money over their lifetimes. However, at the rate that I would spend this money for my mother's care, she would be destitute in 3-4 years. My parents had not purchased any long term care insurance to cover such an eventuality, leaving me scrambling to find at-home care that wouldn't cost me an arm and a leg. Inevitably, between the good graces of concerned friends, relatives and neighbors, I cobbled a rudimentary in-home care plan together. At this point in time, my mother has two part-time caregivers, a neighbor who cuts her lawn in the summer, and friends who shovel her snow in the winter. I am in charge of paying the bills and caregivers, buying drug prescriptions, home repair and maintenance, medical/dental appointments, grocery shopping and at-home holiday care. Incidentally, I live 140 miles away from my mother.

I embarked upon getting in-home care for my mother because the alternatives were too cost-prohibitive. However, as her condition worsens, I am left with the nagging feeling that at-home care will become insufficient for her needs. Had she purchased a long term care insurance policy, my worries would only have included getting her the best care possible. Because there is no long term care insurance plan in place, my worries now include how to take care of her for the next 30 years without going into substantial debt myself (If you'd like to read further about this very personal issue, click on the following link entitled "My Money Issues with Long Term Care and Nursing Homes").

Medicare does NOT cover long-term care!

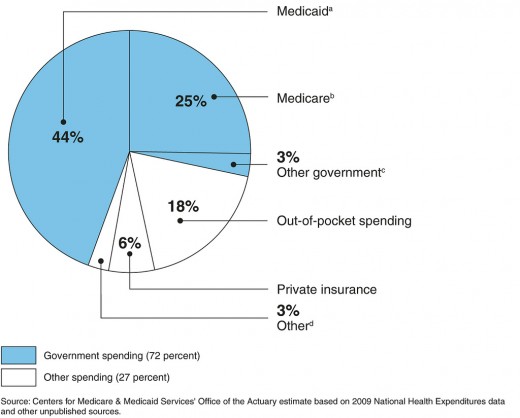

You may be assuming that Medicare will cover the costs of your long term care. However, Medicare does NOT cover the costs of long term care, which it terms "custodial care". The only exception to this rule occurs if you are hospitalized for three or more days and now require skilled nursing and rehabilitation to fully recover. At that point in time, if physical rehabilitation or additional care is recommended by a physician, Medicare will cover your nursing home stay for up to 100 days. For more information about what medical services are and are not covered by Medicare, click on these Medicare FAQ.

At best, Medicare pays only 25% of long term care costs

The advent of the Long-Term Care Partnership Program

Over 30 years ago, the Long Term Care Partnership Program was created so that individuals like you would have the information and means to finance their long term care requirements ahead of time. The Long Term Care Partnership Program is a partnership between private health insurers and state and national governments which encourages individuals to purchase long term care insurance premiums on a pre-need basis. Depending on the premium amount paid, these plans all offer some measure of asset protection once Medicaid coverage is activated. In essence, if you own a long term care insurance premium, you do not have to spend down your assets to $2,000 before qualifying for Medicaid. Instead, your long term care insurance policy provides the assets that would normally be given up to the assisted living facility or nursing home. After those initial assets have been used up, Medicaid coverage automatically kicks in.

As an example, consider a woman who purchases a long term care insurance policy at age 55 for the coverage amount of $400,000. For the next 20 years, she pays an average of $100/month for her insurance policy, or $24,000 in total. At age 75, this woman now needs home care and adult day care. Her policy pays out $400,000 for her initial care, leaving $400,000 of her own money intact. Once that initial $400,000 is used up, and assuming the woman has no other assets in addition to her $400,000, Medicaid starts paying the additional long term care bills.

Incentives of long term care insurance

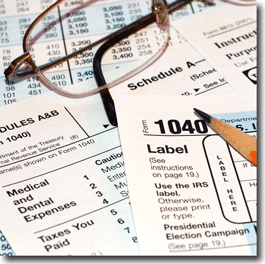

Thanks to the Long Term Care Partnership Program, there are several incentives in place if you purchase a long term care insurance policy. In most cases, the policy premium may be deducted from your income taxes as a medical expense. Once paid out, long term care policy benefits are also not generally considered taxable income. To find out if your own insurance policy is tax-exempt, look for a statement on your policy form that reads as follows: “This policy is intended to be a qualified long-term care insurance contract as defined by the Internal Revenue Code of 1986, Section 7702B(b).”

When claiming a tax deduction for payment of long term care insurance premiums, your total medical out-of-pocket expenses must be greater than 7.5% of your AGI (adjusted gross income). Likewise, there is a cap on the amount of insurance premium money that you can deduct from your AGI, depending on your age at the end of each tax year.

Most long term care insurance policies also provide a measure of inflation protection, meaning that your policy will continue paying for your long term care costs even as these costs increase over time. Initially, however, the inflation protection is covered by you; for example, if you are under 61 years of age when you purchase a long term care insurance policy, you will pay an extra 5% of your premium to account for inflation. Between the age of 61 and 76, that extra 5% will be reduced to a smaller and discrete sum. Upon reaching the age of 76, you will no longer be required to pay for inflation protection.

What your Long Term Care Insurance policy should state in writing

The National Association of Insurance Commissioners suggests that a long term care insurance policy include the following coverage:

- At least one year of nursing home/assisted living/home health care, including custodial care.

- Alzheimer’s disease coverage.

- The guarantee that the policy will not be canceled or terminated because the policy holder becomes older or deteriorates physically and/or mentally.

- The right to look over a purchased policy for up to 30 days and return it.

- No Medicare-like requirement that the insured party must first be hospitalized before becoming eligible for nursing home, assisted living, or home health care.

- No requirement that nursing home care must first be received before the insured party becomes eligible for assisted living or home health care.

Other benefits of long term care insurance

Even if you never require long term care in your lifetime, consider what might happen if you are seriously injured, such as through a car accident. The 100 days of nursing home care that your Medicare plan pays for may not be enough to cover your length of stay. This is especially true once you are retired and living on a fixed income. Long term care insurance kicks in to cover such acute care costs, including such treatments as physical rehabilitation, occupational therapy, medical devices, etc. This coverage is in addition to any eventual long term care that you might one day need.

Many individuals bet on the odds that they will never need assisted living or nursing home care. My father, for example, would've wasted his money paying for a long term care insurance policy that he never used; he died at age 63 of ischemic bilateral cardiomyopathy (i.e., fatal heart attack). However, are these the odds that you are willing to play? Furthermore, if you have children, consider the hardships and stress they will undergo trying to find adequate (and affordable) long term care for you. Is it worth the risk?

You purchase many forms of insurance over the course of your lifetime: life insurance, health insurance, personal liability insurance, dental insurance, and even pet insurance. When long term care can cost hundreds of thousands of dollars, isn't it worthwhile to purchase some kind of long term care insurance plan?