Best High Interest Savings Accounts in 2019

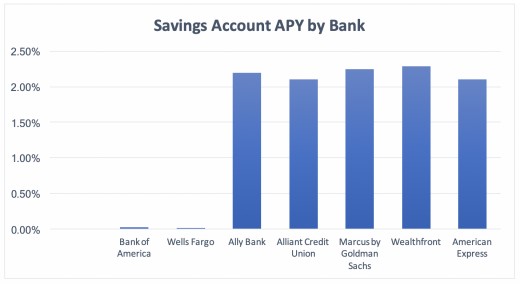

With interest rates rising, it’s becoming more important to keep money in a savings account with a high interest rate. Most large national banks have extremely low interest rates - for example, Wells Fargo’s Way2Save savings account offers an Annual Percentage Yield (APY) of just 0.01%.

Many smaller banks offer higher interest rates to attract more customers. In some cases, banks have opted to stay out of the retail banking business, removing all physical branches and passing the cost savings along to customers in the form of higher interest rates.

Below are some examples of banks offering exceptional interest rates on savings accounts in 2019.

(Note: interest rates are accurate at the time of writing, and are subject to change)

Ally Bank

• Annual Percentage Yield: 2.20%

• Online-only, part of the Allpoint ATM network. Rebates up to $10/month on ATM fees for out-of-network ATMs

• FDIC Insured

• Also offers high interest checking accounts

• Offers other financial services such as auto loans, CDs, stock trading, mortgages, and retirement accounts

• Supports Zelle Pay

Ally Financial was created in 1919 and was originally the financing arm of General Motors. It is largest provider of car financing in the U.S. and the 19th largest bank in the country. It has no physical banking locations, providing all of its services online through its website and mobile app.

In addition to its checking and savings accounts, Ally provides auto-loans, mortgages, investment accounts, retirement accounts, and a rewards credit card. Ally has the most diverse services offerings of all of the options mentioned here.

Alliant Credit Union

https://www.alliantcreditunion.org

• Annual Percentage Yield: 2.10%

• Online-only, with the exception of a small few locations

• Offers a wide range of financial services including credit cards, CDs, personal loans, mortgages, and student loans

• Part of a network of 80,000 ATMs nationwide. Rebates up to $20/month on ATM fees for out-of-network ATMs

• Non-profit credit union, insured by NCUA

Alliant Credit Union was created in 1935, originally as United Airlines Employees’ Credit Union. Alliant is a non-profit financial collective. It offers a wide range of financial services including multiple credit cards, student loans, insurance, and mortgages.

Alliant Credit Union is similar to Ally Bank in it’s offerings, with the benefit of $20/month of ATM fee rebates compared to Ally Bank’s $10/month offering. Alliant Credit Union would be a good fit for those looking to replace their current bank entirely.

Marcus by Goldman Sachs

• Annual Percentage Yield: 2.25%

• Online-only

• FDIC Insured

• Also offers CDs and personal loans

Marcus is offered by Goldman Sachs, an investment bank started in 1869. Marcus is Goldman Sachs first entry into the consumer banking space. While the services does not provide checking accounts, it does offer savings accounts and Certificates of Deposit with competitive interest rates. Marcus is a good option for those looking to supplement their primary bank with a separate high-interest savings account.

Wealthfront

https://www.wealthfront.com/cash

• Annual Percentage Yield: 2.29%

• FDIC Insured (up to $1 million compared to the standard $250,000)

• Also offers an automated investment services

Wealthfront started in 2008 as kaChing. Its primary service is an automated investment service which invests deposited funds into a balanced portfolio based on the user’s desired amount of risk. Wealthfront introduced its savings account product in 2019.

Wealthfront’s investment services make it an attractive choice for those looking to invest in the stock market in addition to holding cash in a high-interest account.

American Express Personal Savings

https://www.americanexpress.com

• Annual Percentage Yield: 2.10%

• Online-only

• FDIC Insured

• Also offers CDs in addition to their primary Credit Card offerings

American Express started in 1850 as an express mail service. It is well known for its large credit card network which is the 3rd largest credit card network in the U.S. by volume. It also offers Certificates of Deposit, but does not offer a checking account or any other consumer banking services.

American Express Personal Savings is a good choice for those who already have a credit card with American Express and would like to supplement their financial portfolio with a high-interest savings account.

Review

Below is a comparison of all the mentioned options, with two major national banks (Bank of America and Wells Fargo) included for reference. As you can see, the large U.S. banks cannot compare to the smaller banks when it comes to savings account interest rates.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.