How to Make Unlimited Profits with Limited Risk in Stock Market

Is it possible to get unlimited returns with limited risk in stock market?

It appears too good to be true.

What do you feel?

If there is anything like this, then everyone on the earth would have been making money through this.

Again coming to the question….Is it possible?

Yes,

It is possible. This can be achieved by “options trading” in stock market.

As you know Options trading is a segment of derivatives, that comes under Speculation. Derivatives consists of futures and options that are intended for aggressive traders.

Before looking into the technique, few words about options.

Options are of two kinds.

- Call options

- Put options

Any option, whether it is a call or put, is an agreement that is intended to buy or sell a particular stock or index for a fixed price on a future date.

You can find more information on options at "3 Ways to Make Money in a Stock Market Crash."

What is a Call option?

Cutting aside all the technical jargon, if put into simple words,

When you believe that the market is likely to go up, then you buy a Call option. If your prediction comes true, that is the market reaches new peaks, then you make profits.

What is a Put option?

You sense there is something cooking inside the market and markets are going to crash, you buy a Put option. When the market really collapses , you make money.

Is that so simple?

May not be yes, if this was that simple then every one would be doing that.

There are some limitations, obstacles in your way. But the conspicuous thing is by observing, learning, reading certainly you can achieve the mastery over trading Options, with time.

Pros and Cons of Options:

Pros:

Enormous profits compared to the investment you make.

Cons:

- Most of the times options become worthless and do not make any profits on the date of expiry.

The reason for this is , the value (price) of an option depends on

- Remaining days to expiration: As it reaches the expiration date, it loses its value.

- How far it is from its target. That is if the market is at 7200 and you buy a 7600 call option. It is an out of the money call and it has very little value.

- Market sentiment: Sentiment plays a crucial role in deciding the price of an option. When there is a strong sentiment, the prices of options are overvalued.

- Trading options is useless when there is no obvious trend. Indices often move sideways to stabilize themselves before showing a clear trend.

In these times of stabilizing process, normally markets show volatility and as a result, most of the times, any kind of option expires without making any profits.

What is the best time to buy an Option?

1. When there is a strong trend:

If you believe there is strong uptrend, then buy a call option. Here uptrend refers to either an individual stock or the index.

Vice versa for the Put options.

If you feel a stock market crash is imminent, then buy a Put option.

2. When there is a trend reversal is likely:

Occasionally you may suspect the whole market or an individual stock is likely to collapse in coming days.

A. A stock or the index that is normally in uptrend but suddenly crashes and goes downward.

Possible reasons:

- Unpleasant financial results

- FIIs started selling

- Government policies that could adversely affect margins

- Political uncertainty.

B. A stock or the index that is normally in down trend, makes a turn around and shoots up.

Possible reasons:

- Acquisitions, mergers, takeovers

- Extraordinary results

- Government policy or global scenario that unexpectedly turns favorable.

Out of these two opportunities, I prefer trend reversals very much, since the investment would be very little and profits would be huge.

To find the right opportunity to detect a trend reversal, you need to be very patient .

Trigger happy traders won’t make much profits with this technique.

- Trigger happy traders do not have patience.

- They can't sit idle.

- They tend to take a position quickly.

Sometimes not taking a position and waiting for an opportunity would be the best strategy.

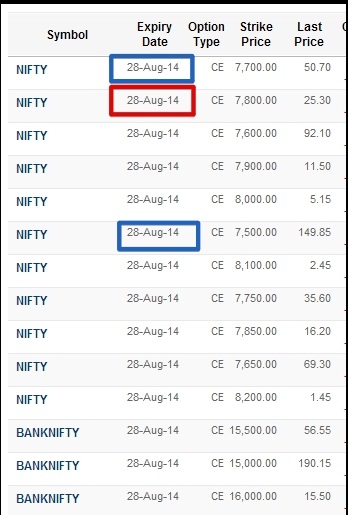

This data is taken on 8th August 2014 from Indian stock market index NIFTY. On this day NIFTY closed at 7568 points.

Usually options are available for three months. One current month and others two coming months, and here in this data, the 3 months are August ( current month), September, October).

Most of the times, volumes (transactions) are very low in future months ( in this example September and October), hence trading is hardly possible.

If you analyze the data, you find

- Though they belong to the same strike price 7800 (Red color), they differ in value ( 25.30, 76.80) . The reason is easy to understand, the first option (25.30) expires in August and the second Option (76.80) expires in September. It could be understood the price of the Put option varies, based on time remaining to expire.

- The Blue color marks reveal us that though the two options belong to same month (August), they differ in price ( 50.70, 149.85) since they belong to different strike prices i.e. 7700 , 7500 ( Index is at 7568) .

- Fortunately as per your expectation, if the indices reach your target and move beyond your target you make money.

Disclaimer:

Investing involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Nothing contained herein should be construed as a warranty of investment results. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. You should take a professional financial consultant's advice.