Stop Living Paycheck-to-Paycheck Break the Cycle & Gain Financial Freedom!

In this article, you will learn to make and stick to a budget. Also, you will learn how to save for a disaster. More importantly, you will learn how to determine your needs versus your wants, how to manage risk, and how to stop living paycheck-to-paycheck.

A vast population of the world is searching for ways to stop living paycheck-to-paycheck and save money to improve their financial situation. The problem is. Most of us do not have an action plan to save money. We all know money comprises significant power in today’s world, and it plays a crucial role in everyone’s life. Most people know how to make money, but do not know how to save or spend it. Although most of us work hard on the job to earn a decent salary, we cannot manage our money right.

While a six-figure high-paying job can secure a person in the top 1% of earners, but it is the saving and spending habit that can get them on the road to better fortune. Because it is the minor things—your money habits—that often make the difference. We need to use our finances reliably so that there would be a portion of the money that goes into a savings account.

Tired of Being Broke? How to Break the Cycle of Living Paycheck-to-Paycheck

Breaking free from paycheck to paycheck cycle is not a simple task, but it can be one of the most mentally relieving things anyone has ever done. When you living paycheck to paycheck, getting out of debt and breaking the cycle to live a happier financial life may seem unlikely.

If you want to break the cycle of being broke so you can live a more comfortable economic life, here is my advice on how to break the cycle and start a sizable budget that will help you stop living from payday to payday.

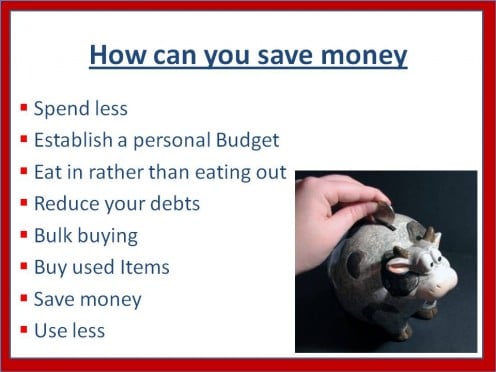

How to Save Money: Budget 101: If you want to save money, budgeting is the way to start. Most of us do not know what income is coming in or going out. Therefore, it is hard to achieve our financial goals. Putting a budget in place is a significant way to save money. The budget also assists to show how much income is coming in and what going out.

Three important things a budget will do:

- free up cash for savings goals

- help in paying off existing deb

- Assist to become financially independent

Downgrade

If you are living paycheck-to-paycheck and you tired of it, the most critical step you can take that will break the cycle is downgrading your lifestyle. Most of us try to do what we cannot afford and buy what we do not need. Get rid of the gas-guzzling car as an efficient one would do? Most people no longer need a sizeable house with five bedrooms. The children are off to college to get rid of that enormous house and consider moving to a more efficient version of it. The smaller, more efficient version of a home will lower the monthly bills and utterly put some cash in your pocket.

Downgrading is a way to start saving: With the cost-of-living going up, and wages down or at a standstill. Many are searching for ways to save money and improve their financial situation. Very few people substantially have a plan to save money to escape the stress and live a better and carefree life. As consumers, we have the option to live a stressful life or take action to better ourselves by putting a plan in action to save and living a happier life.

How to Save Money: It is significant everyone knows how to save money. It also a pattern that everyone should makes a habit of doing. However, saving money is hard for most people to see. Before you save it is essential to find out why you are saving. There are many reasons to save, but the most imperative reason is to stand on a firm financial foundation. To save money it necessary to have a savings account. Many savings accounts can help many meet the goals of saving money.

Ways to save money: the first way to save is to spend less than you earn. It is hard to spend less than you earn, but it is possible. For most people, the ability to save is often easier said than done. There are lots of ways to save money, but why is it so complicated? One significant factor that can help with saving money and give you the ability to spend less than you earn is to know what drives your spending habit.

Next set up a financial plan, a financial planner can assist you in taking charge of your future. What is a financial plan? It is wisely planning and managing your finances so you can achieve goals and dreams. While negotiating the fiscal difficulties, that may arise unexpectedly in every stage of life.

Money-saving tips: Putting money up from every paycheck is a habit everybody should make. Putting up money per paycheck will assist with bills in the event of a disaster or if you should become unemployed. According to the survey, More than three-fourths of Americans don’t have enough money saved to pay their bills for six months.

Tips on how to save money

General: Save your pocket change. Collecting 50 cents per day in a year will permit you to save almost 40% of a $500 rainy day fund.

Keep count of your spending. At least once a month, use a bank card, check, and other evidence to review what you've bought. After this, question yourself if it has the sense to distribute some of this spending to an account with emergency savings.

Create a Savings Account: I would suggest you open a savings account at the regular branch you hold your checking account and transfer an insignificant amount into that account which is a significant way to build funds for emergencies. You may think about how money can be saved by transferring into a savings account? You can do that by not touching that savings account.

Make sure you explore interest rates and fees for the savings accounts and do not draw money from that account at any cost. It best to choose a bank with the highest interest rate but you can earn a higher interest rate on a CD account, over a regular savings account.

Every week on payday, transfer a slight amount to this savings account or CD account, whichever is your choice and make that as a hobby. You will be shocked by looking at the amount you have in your account.

A Bill-by-Bill Guide to Saving Money on Monthly Expenses

Established wisdom will tell those who use it that everything becomes more expensive over time and if you wish to live a more comfortable life, you need the income to cover the required bills by spending less than your take-home pay.

Living way above our means is a problem for those who are not natural savers. While some people know how to saving money, some go overboard and spend more than they earn.

Individuals who are virtuous spender know how to save and live within their means. They have a habit of keeping their living expenses level balanced on their earnings. People who are not good spender tend to overspend all of their income on wants and their human needs. Over slender waste more money than they bring home and piles up debt.

If you want to stop feeling like your paycheck has vanished after you have paid your required bill, here's a bill-by-bill guide to look over to lower your monthly expenses and make sure you keep a little extra cash in your pocket.

To stop living paycheck-to-paycheck for most of us, all we need is a few simple tips to follow, practicing a little know-how, and organize your monthly bills without giving up our lifestyle to do it.

How to Organize your Monthly Bills

- Mortgage/rent

- Cellphone

- Cable/ Internet

- Credit Cards Bills

- Water bill

- Electric/Gas bill

- Grocery bills

- Car note

- Car/life insurance

I cannot emphasize enough how important it is to take the time to look at how and where you spend your money. Once you have a handle on how much you spend if there are monthly bills that you wish you could lower or get rid of you can start eliminating additional debts. Now you know how to free additional debt, why not motivate yourself?

Motivate yourself: Keep track of everything you save. For example, save the money instead of purchasing items like clothes, Laptop, jewelry or a Television. Save your money for continuous six months and then pampering yourself. This will motivate you to save more and more money for a longer period.

Also, this would present you with a habit of saving money and it will be available when you need it in an emergency. However, if you decided not to pamper yourself at the end of the targeted time, then there is not any problem. Save that money itself and it will be available to add to the savings account

Paying the bills is not on a personal list of favorite things to do, but they are necessary for life and cannot be avoided. Therefore, in this face up to the real challenge, your goal is to organize your bills and get this done as efficiently as possible.

Four-step to organize the monthly bills.

Step one: Gather and sort all the monthly unpaid Bills.

Step Two: Set up a weekly schedule that will assist you to concentrate on your monthly household finances to successfully pay the bills.Step Three: Purchase an organized folder and file your bill into it after payment for swift access.

Step Four: Establish a monthly routine for handling the old bills to maintain your filing system.

Prioritizing Your Financial Goals: You'll most likely reach your objectives if you transform the savings process as a priority. First, you need a list of motives for what you need to spend your money on. Dream and write a list like, a house with a beautiful garden, the sports car, the trip around the world, etc. Next, you need to estimate the cost for each of these.

One of the primary issues is, you did not have a goal. You just have a plan that goes around saving money, but without a genuine reason for your money. It is tough staying influenced when you do understand what the money is for, so it is much simpler just to spend the money.

Instead of pointless savings, build obtainable savings goals that offer purpose to your money. Whether you want to save USD 6,000 in the next six to eight months for a vacation, or whether you want to cache up six months of expenses by the end of the year for your urgent situational fund deposit. It should have a rational aim, which can give you something to force your work toward.

The savings plan can be as simple as this:

-

Calculate the time necessary for saving the money you need.

- Build a schedule when you can put money aside. Be perseverant when making the respective savings. Put money aside with the same consciousness as when paying your taxes or your mortgage.

The right way to reward yourself: Most people will agree that there is no better method to increase motivation than rewards. Every time you achieve something great, reach a goal, or go forward with a task, a simple award will go a long way. Depending on the duration of your goal, you can reward yourself as determined milestones.

This can help you to track your progress and also assists in maintaining you motivated to continue saving money. These self-rewards should be joyful things that you may not normally do. Even if they are small, they play a good role and are a powerful reason for you to continue saving money.

It may be a day off, a walk in the park, dinner at a pleasanter restaurant than normal, or other fun activities. Just do not spend all your savings enjoying your reward. When you accomplish that milestone, the best way to commemorate and strengthen the positive performance remains to reward yourself, this indulges you a friendly reminder to not quit you're saving money task and keep moving on.

Motivation doesn’t always need to be in material things, just think of rewards that will calm you, inspire you, and settle your inner spirit.

Remove nasty habits and break bad spending savings: Some dreadful habits can put a significant damper on your efforts to save money. Besides, these habits can transform into serious dependencies, which are nearly impossible to overcome without aid. Most of these dependencies can be exceedingly hazardous to your health in the long term. Save your money and your body the trouble of passing across these addictions by keeping away from them.

Do not smoke! Smoking is well-known for its damaging effects like lung cancer, heart disease, strokes, and many diversities of other grave diseases familiar to be produced by smoking. On top of this, cigarettes are expensive.

Do not drink excessively! While one or two drinks will not hurt you, frequent heavy drinking can produce profound issues in the long run, liver disease, mild cognitive impairment, weight gain, even death.

Spending Money Intelligently: If you don’t already have a “rainy day” fund with sufficient money in it so you can get through if you unexpectedly lose your income, start donating to one right awaY. Having a rational quantity of money stored in a secure savings account offers you the liberty to easily sort out your cases if you lose your job.

After you protect your necessities, you will want to allocate a portion of your income to create this savings account until you have sufficient savings covering about 4-7 months of expenses.

Living expenses can fluctuate based on the local financial climate. While it is realizable to survive on $1,600 for two months in most cities, this could not even pay one month’s rent for a low-priced apartment in some cities. If you stay in a costly area, your “rainy day” fund will naturally need to be higher.

Apart from providing you the relaxing peace of mind of knowing that you’ll be just fine in the event of career problems, having a “rainy day” fund can also get you money in the long run.

If you suffer the loss of your job and you don’t have a “rainy day” fund, they might need you to take the very initial job it gives you, even if it doesn’t pay as you would Want. If you can get through without being used in working, you can choose from a vary of jobs and probably get a better-paid job.

Money Management: It the procedure of budgeting, saving, investing, spending, or organizing the money used by a person or group. The overriding use of the phrase in a financial market is when investment professionals make investment choices for a massive stock of funds, like mutual supply or pension goal.

Effective money management can be many things, like living inside the bounds set by your means of saving money for a short or a long-term goal, having a rational plan to pay off your financial obligations.

Build your subbase: Evaluating your net worth is the best way to see what your starting point is more exactly, in any financial help you want to develop. A balance sheet report estimates your net worth by matching your financial assets, everything you own, with your financial liabilities, all of your debt.

The distinction between these two is your private net worth. Don’t be demoralized if your net worth is negative, just keep in mind that this will be an accurate study of your fiscal situation. Placing goals is much easier once you know what your present net worth is.

Retirement savings: It is frequently discussed if Social Security will be around in twenty to thirty years. But you won’t need to be able to survive only on Social Security benefits. Structuring your prime concerns so you offer the same awareness of your future retirement savings that you offer to your present household and actual expenses are fundamental to strengthening that well-known nest egg.

The rule of thumb for retirement is named the four percent rule, and in the opinion of this rule, what you require withdrawing in your first year of retirement should be approximately 4 percent of your total retirement money saved.

Some are more restful with three percent or even two percent rules. When putting in an application to the rule, remember that specialists recommend that you plan on spending about eighty to ninety percent of what you pay out before you retire.

For example, if you lived on USD 100,000 before retirement, planning to spend USD 80,000 after retirement, then following the four percent rule, it would need to economize USD 2,000,000. Another rule is to economize eight times your pre-retirement income; this would be an outcome in just $800,000 of the nest egg.

You can stop living paycheck-to-paycheck, You can do It! It's easier than you think: No one is born with the ability to know how to manage their income, save or to invest their money. However, knowing how to process the capacity to secure your financial well-being is one quality everybody will need in life.

A person does not have to be a genius to know how to spend wisely, manage their paycheck, save money or investing it; they just need to know the fundamentals and how to create a saving account with a financial security plan to be prepared to gain and enjoy the benefits of managing their money. No matter how much money you bring home, it is hard to administer if you spend unwisely.

Disclaimer:

The information provided herein is stated to be truthful and consistent, in that any liability, in terms of inattention or otherwise, by any usage or abuse of any policies, processes, or directions contained within is the solitary and utter responsibility of the recipient reader. Under no circumstances will any legal responsibility or blame be held against the publisher for any reparation, damages, or monetary loss due to the information herein, either directly or indirectly.

The information herein is offered for informational purposes solely, and is universal as so. The presentation of the information is without contract or any type of guarantee assurance.

The trademarks that are used are without any consent, and the publication of the trademark is without permission or backing by the trademark owner. All trademarks and brands within this article are for clarifying purposes only and are the owned by the owners themselves, not affiliated with this document.

Do you know the total amount of money you spend and total income yearly?

How much you need to save each day to have $1000,000 at 65

Starting age

| 3 % Return

| 5 % Return

| 7% Return

|

|---|---|---|---|

20

| $29

| $16

| $9

|

25

| $35

| $21

| $12

|

30

| $44

| $29

| $18

|

35

| $56

| $39

| $27

|

40

| $74

| $55

| $40

|

45

| $100

| $80

| $63

|

50

| $145

| $123

| $103

|

55

| $235

| $211

| $189

|

you need to save each day in order to have $1 million saved by the time you're 65, assuming you start with zero dollars and receive a 12% annual return.

How to stop living paycheck to paycheck

© 2016 Pam Morris