1991 PRESIDENTIAL PREDICTION-PART 1

FORWARD

This hub is the first of a series based on an essay that I wrote in the fall of 1991 both making a prediction of the outcome of the 1992 Presidential election, and the economic situation in the United States at that time.

Chapter I The Beginning

As I take my pencil (yes pencil, I don’t own a word processor) in hand, and begin to write this essay I want to explain to you, the reader, exactly what I hope to accomplish by doing so. I want to make a politically neutral analysis of the present condition of the USA with particular emphasis on our economy.

This is a timely topic in the fall of 1991 as we Americans have experienced almost a year of economic hard times. Present unemployment rates stand at 6.8%, with inflation rates of 4.25%, and most Americans believe things will get worse before they get better (consumer confidence is 68.4%). Conventional economic wisdom would indicate that we are, indeed, in an economic situation that is unique in our history. Even though at this time well known national Democrats are running away from presidential consideration, I predict that George H. W. Bush will not be re-elected in 1992. Bush’s approval ratings have plummeted from a high of 89% following the successful Gulf war prosecution in March 1991 to a current level of just 53%. These diving ratings have been a direct result of the recession and his breaking of his “Read my lips” promise to not raise income taxes.

US Economics 101

During bad economic times of the past our Federal Government, and the Federal Reserve Board has employed two basic means to combat recessions.

Fiscal Policy

The government cuts taxes and/or increases spending and borrowing in order to both directly and indirectly increase consumption (demand) for goods and services. This increase in demand causes producers of goods and providers of services (employers) to both hire new employees and re-hire laid off employees to increase their production (supply) to accommodate the increase in demand.

The above description would be fiscal policy used to try to stimulate a faltering economy and would be an expansionary policy. The exact opposite of the above would be a contractionary policy used to help fight inflation.

Monetary Policy

The Federal Reserve Board (which is not a government entity) can increase the supply of money available by a combination of lowering bank reserve requirements, lowering interest rates, and increasing the money supply available by monitizing Government debt.

The above description would be used to stimulate a lagging economy and is described as an expansionary policy. The opposite of all the above actions would be used in an inflationary period and is called a contractionary policy.

Chapter II The National Debt

Having worked my entire career in industrial facilities I have heard a commonly used expression, ”When you’re up to your ass in alligators it’s hard to drain the swamp”.

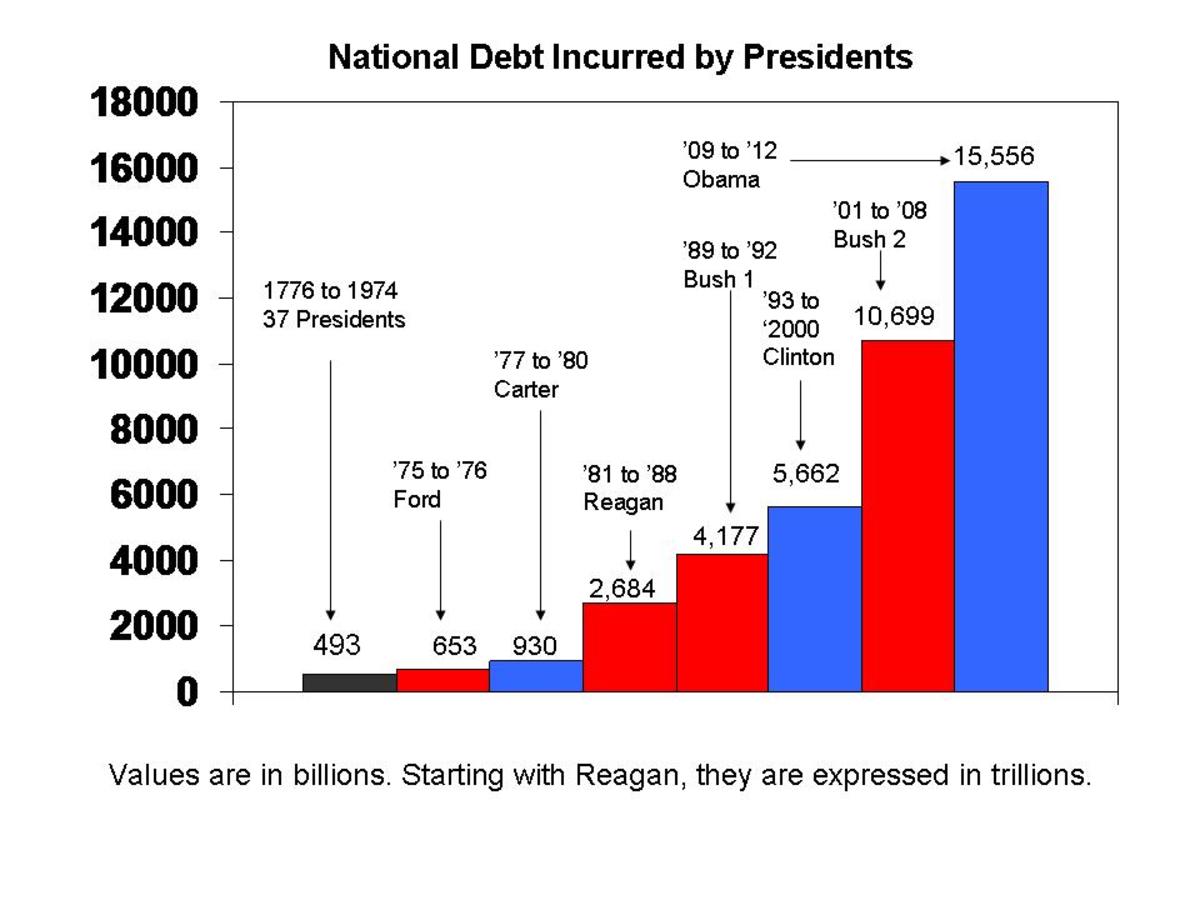

At this present time in 1991 the United States has a national debt of $4 trillion. When I earlier referred to a unique situation this amount of national debt is the exact reason that our current situation is unique.

Alligator #1 The National Debt

This $4 trillion national debt is REAL!!! It isn’t a bookkeeping trick it real money the US Government has borrowed. Our government has borrowed money from its own citizens, our financial institutions, and numerous other sources both foreign and domestic. If any of you own US Savings Bonds then you are one of the persons who lent the US Government money. Just as you expect to be able to cash your bonds at maturity (have your loan and interest repaid), I am confident each and every creditor of our government expects to have their loans plus interest repaid. I do not think I need to tell you the only source of revenue our government has. Just take a look in the mirror!!!!!!!!

There is a confounding problem with this debt situation or maybe I should say a compounding problem. Due to interest on our overwhelming national debt, the yearly compounding interest on that debt is at such a level we need to borrow more and more money just to maintain current government operations along with the interest on the national debt. The current interest is $320 billion.

Summary

- We have a huge national debt.

- Each year we pay a huge amount of money just in interest on the debt.

- Because the debt is huge the interest on the debt is huge so we must continue to borrow just to keep up with the interest.

- The national debt and interest on the debt are growing larger.

- Go back to Item 1.

I don’t know about you but the situation I’ve just related to you depresses me. What I’ve described is a formula for an economic MELT DOWN. The metaphorical use of an expression to describe a catastrophic event in a nuclear reactor is not an exaggeration of the possible economic consequences we are facing.

DEFINITIONS

FISCAL POLICY

http://en.wikipedia.org/wiki/Fiscal_policy

MONETARY POLICY

http://en.wikipedia.org/wiki/Monetary_policy

FRACTIONAL RESERVE BANKING